The U.S. Dollar is Facing Its Highest Shorts in 3 Years – And Here’s Why

Hedge funds are watching from their biggest position as short-sellers. | Source: Shutterstock.com

- The net volume of shorts on the U.S. dollar has hit its highest level in nearly three years, with more traders shorting the dollar than going long on it.

- The market now seems to be gearing up for a dollar crash, while economists and fund investors have been predicting a crash for several months.

- The ongoing coronavirus pandemic, as well as the continued need for massive spending, will make a crash more likely.

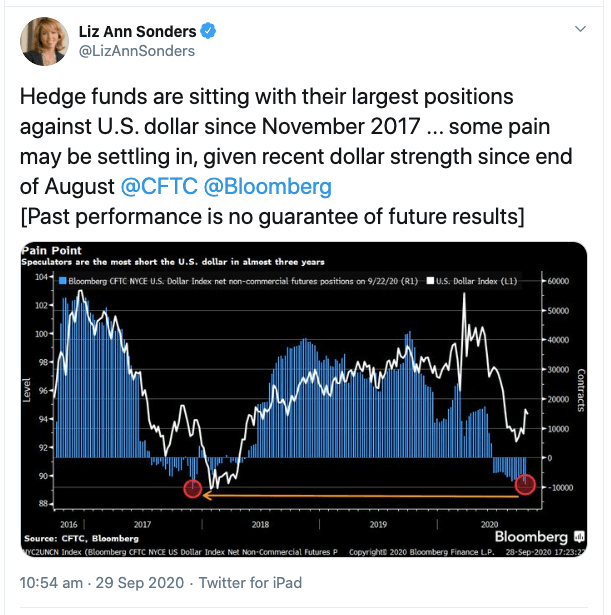

The U.S. dollar is facing its highest volume of short positions in three years, according to new data. Compiled by the CFTC and Bloomberg, the data reveals that short volumes have grown to almost ten thousand contracts in less than four months.

Further data gathered by the CFTC also shows that more asset managers and funds have short positions in the dollar than long positions. Combined with recent warnings about a U.S. dollar crash, they suggest the tide may be turning for the dollar from bad to worse.

U.S. Dollar Attracts Short Sellers

The U.S. dollar has long been the world’s reserve currency. Part of this status means that traders have turned to it as a safe haven during periods of economic stress. This no longer seems to be the case, with short-sellers now turning to it in order to make a killing from its decline.

The chart above shows futures positions on the dollar going from net long in June to net short from July onwards. As of the end of September, net short positions on the U.S. dollar equal almost 10,000 open contracts. This is the highest level since November 2017, when net short contracts passed 10,000.

What this means is that more traders and speculators are shorting the dollar than going long on it. A majority of the market believes that the dollar is going to fall further, and perhaps fall hard.

This is backed up by further data collected by the CFTC , which shows that more asset managers and institutions — as well as more leveraged funds — are shorting than going long on the dollar.

Market Increasingly Losing Faith

This surge in short selling has come amid a weakening of the U.S. dollar. The Federal Reserve and the U.S. federal government have both created an unprecedented amount of money to keep the economy moving during a global pandemic and recession. This has had the unfortunate side-effect of depreciating the dollar against most major currencies.

With the coronavirus pandemic still likely to continue until 2021, the U.S. dollar is likely only to get weaker. A second stimulus package from Congress is highly likely, while the Federal Reserve has begun expanding its balance sheet over the past couple of months .

This all means more U.S. dollars will enter circulation, decreasing the currency’s spending power at a time of reduced supply.

A growing chorus of analysts, investors, and economists are predicting steeper declines in the U.S. dollar’s value as a result of all this. Ray Dalio warned earlier in September that the dollar’s status as a reserve currency is under serious jeopardy. Yale economist Stephen Roach predicted more recently that the U.S. dollar is set for a big crash by 2021. Roach suggested that this process would be brought about by a rising current account deficit and a declining net-national savings rate.

Self-Fulfilling Prophecy

These are only a few of the prominent figures predicting a big fall for the U.S. dollar. It seems that the market is increasingly listening to such pessimists, given that the volume of shorts on the dollar has grown to its highest level in three years.

And as with so many things in economics, a widespread belief in a U.S. dollar crash may end up being a self-fulfilling prophecy.