Trump Overrules Dr. Fauci’s Warning. Brace for Stock Market FOMO.

Trump has called Dr. Fauci's remarks on reopening schools and the economy as 'not acceptable', underlining the president's impatience to regain a strong economy. | Source: REUTERS/Kevin Lamarque

- President Donald Trump is pushing for the U.S. economy to reopen, dismissing Dr. Anthony Fauci’s comments.

- The stock market is seeing peak fear as some cities tout prolonged restrictions until a “cure” is found.

- Fund managers say heightened levels of fear will mark a stock market bottom.

Fund managers suggest the U.S. stock market is poised to surge higher in the near-term, as investors portray a peak level of fear. President Donald Trump’s firm dismissal of Dr. Anthony Fauci’s concerns may fuel confidence among institutional investors.

During a Senate testimony held on May 13 , Fauci suggested the reopening of the U.S. economy can have dire consequences. As countries across Europe and Asia start to ease lockdown measures, scientists are increasingly expressing concerns toward a second wave of infections.

Trump dismissed Dr. Fauci’s remarks by politicizing the matter to state:

Look, he wants to play all sides of the equation…I was surprised by his answer, actually. To me it’s not an acceptable answer, especially when it comes to schools.

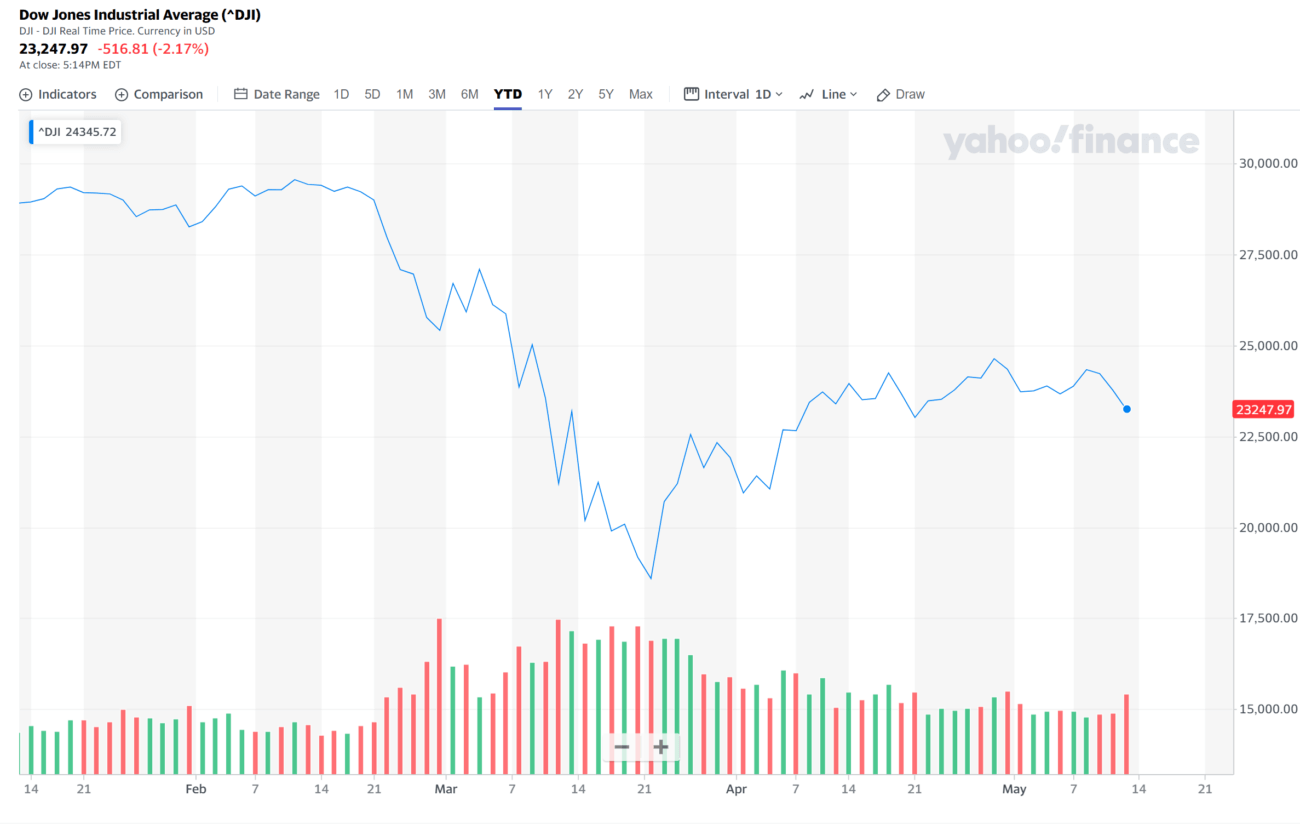

The U.S. stock market fell by 2.17%, and the Dow Jones Industrial Average (DJIA) fell by more than 1,200 points since the last week of April.

LA Won’t Open Until It Finds a Cure

The global economy is already projected to see a slump in the aftermath of the coronavirus pandemic.

Unavoidable disruptions in supply chains, a slowdown in manufacturing, and declining consumer spending can contribute to a stock market downturn, especially for retail and travel-related stocks.

But, the concern of investors towards a near-term pullback in the stock market intensified following the comments of Fauci and the controversial decision of Los Angeles.

On May 14, Los Angeles mayor Eric Garcetti said the city’s “Safer at Home” order will be extended beyond May 15.

He said :

Our Safer at Home order will remain in place beyond May 15. Depending on public health conditions, we will continue to adjust the order to safely allow more businesses to operate and more people to get back to work.

Garcetti’s statement on Good Morning America caused outrage in California when he said the city will not completely open until a cure for coronavirus is found.

The problem with that is, a cure for any coronavirus was never found in human history, and it remains unclear when a cure will be produced in the next 12 to 18 months.

Garcetti said :

We’ve never been fully closed, we will never be fully open until we have a cure.

If restrictions in the economy are prolonged to the latter half of 2020, even the Federal Reserve’s highly aggressive policies will struggle to maintain the momentum of the stock market.

A Stock Market Disaster is in the Works if Economy Doesn’t Reopen

Dave Portnoy, the famed founder of Barstool Sports who now runs a popular day-trading show called Davey Day Trader Global (DDTG), had harsh words to say about the questionable decision to remain some states closed until June.

Portnoy pointed out that the initial objective of the U.S. government in handling the coronavirus pandemic was to flatten the curve.

As the curve started to flatten, the goal post shifted. Now, some cities like LA are showing reluctance to open their economies until a cure is found.

He said :

We’re staying inside until there is a cure? When did that become a thing? Who said we’re getting a cure? so we’re just done as humans? There is risk! we’re Americans, you have to take risk.

Retail investors started to turn pessimistic based on the change in the stance of some regional governments within the U.S. According to Leuthold Group’s Jim Paulsen, the heightened level of fear will be the trigger that leads to a stock market recovery.