This Tesla Chart Reveals Investors’ FOMO Into Outrageous Stock Run

The 'Cybertruck' (pictured) was Tesla's last major reveal from late 2019 but few expected the stock's meteoric rise since the turn of the year. | Source: Shutterstock.com

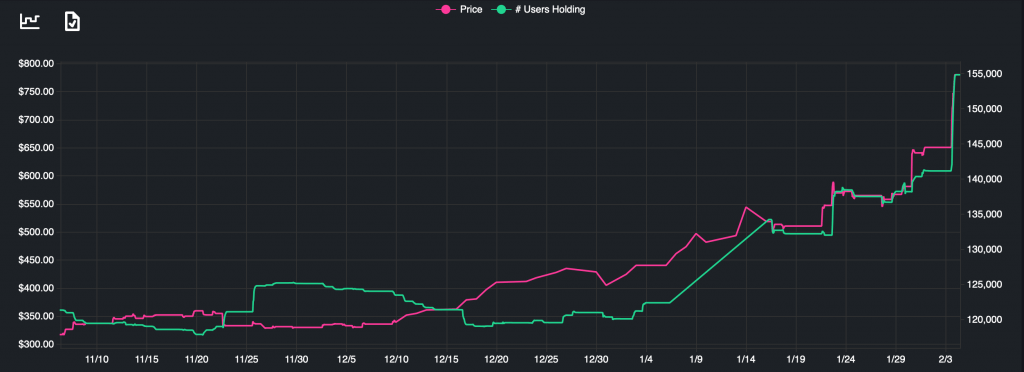

- At least 13,686 people FOMO’d into Tesla stock in the last three days using the Robin Hood trading app.

- The stock jumped 20% in a day on Monday and is rising again in premarket trading.

- Elon Musk’s company is now the second-largest automaker on the planet after a 280% run-up in share price.

Tesla [NASDAQ: TSLA] stock is unstoppable right now. It jumped 20% in a day on Monday and it’s already up 11% in pre-market trading Tuesday. The stock is in pure euphoria mode and that means retail investors are getting FOMO!

We can see the action play out in real time on trading app Robin Hood. According to data tracker Robin Track, at least 13,686 of the app’s users FOMO’d into Tesla stock in the last three days. Roughly 12,000 bought in after hitting $700

The actual number of buyers on Robin Hood is likely even higher. The stat above tracks the total net number of users holding Tesla stock. We can assume a large number sold the run-up and cashed out.

Tesla stock run triggers FOMO

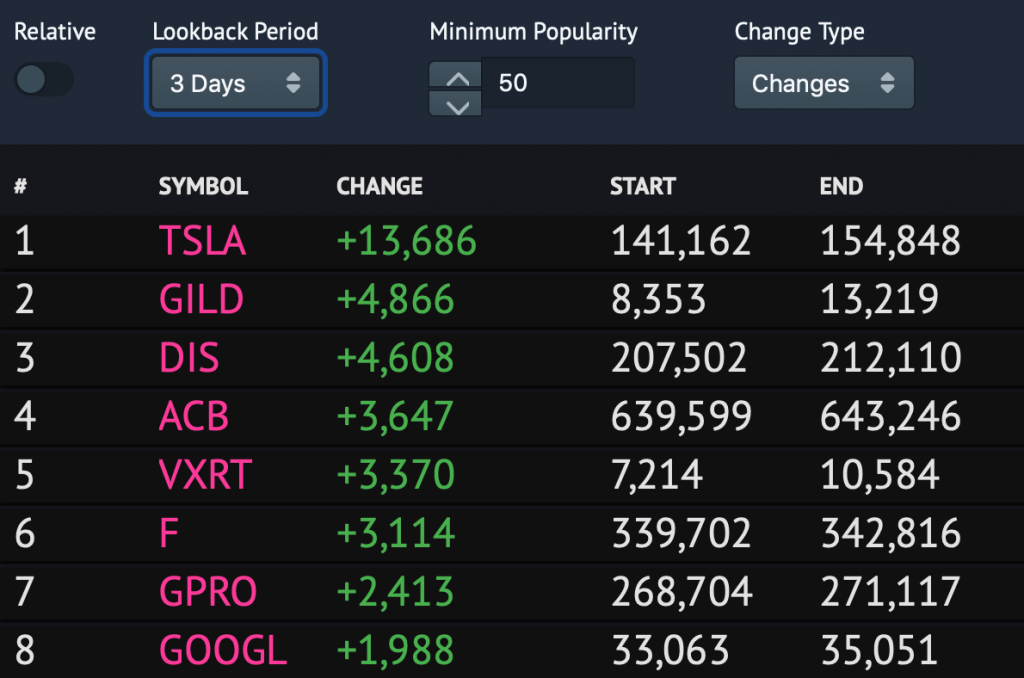

The stock quickly hit the number one spot on Robin Hood’s ‘popularity changes’ leaderboard, racking up 13,686 new stock holders.

Tesla bears were quick to chalk this move up to irrational FOMO. Analyst and Tesla parma-bear Craig Irwin told CNBC last week:

What we have is fervent enthusiasm for the stock and the fear of missing out. That’s really what’s driving this – Craig Irwin, Tesla analyst

The case for $7,000 TSLA stock

On the flip side, you’ve got Tesla parma-bulls who believe the stock will go to $7,000. Ark Invest issued guidance last week with a ‘conservative’ price target of $7,000 by 2024. Their best-case scenario is $15,000.

If Ark is right, this isn’t just FOMO. It’s the start of a mega-trend for Tesla stock. Based on the share price, Tesla is now the second-largest automaker on the planet , overtaking Volkswagen yesterday [Bloomberg]. Only Toyota remains ahead of Elon Musk’s electric car company.

One thing’s for sure. Tesla’ 280% stock run since October has wiped out short-sellers. Shorts have already lost almost $6 billion betting against the stock [Market Watch]. Yet 25 million Tesla shares are still held short [Nasdaq].

If this is the biggest short-squeeze in history, then the rally might not be over yet.