The Litecoin Price is Crashing: Here’s Why

Litecoin developer Charlie Lee shocked many community members last month when he said “Litecoin does not need development right now.” Rather, he said, the coin needed users, liquidity, and merchant acceptance to succeed in the long term. However, the coin has struggled to achieve any of those aspirations, and the bitcoin price decline has weakened faith in the cryptocurrency industry as a whole. Consequently, investors have begun losing faith in altcoins, and in turn the litecoin price is bottoming out.

Litecoin developer Charlie Lee shocked many community members last month when he said “Litecoin does not need development right now.” Rather, he said, the coin needed users, liquidity, and merchant acceptance to succeed in the long term. However, the coin has struggled to achieve any of those aspirations, and the bitcoin price decline has weakened faith in the cryptocurrency industry as a whole. Consequently, investors have begun losing faith in altcoins, and in turn the litecoin price is bottoming out.

Also read: Litecoin and Dogecoin to Join Forces for Charity

Litecoin Price Tanking

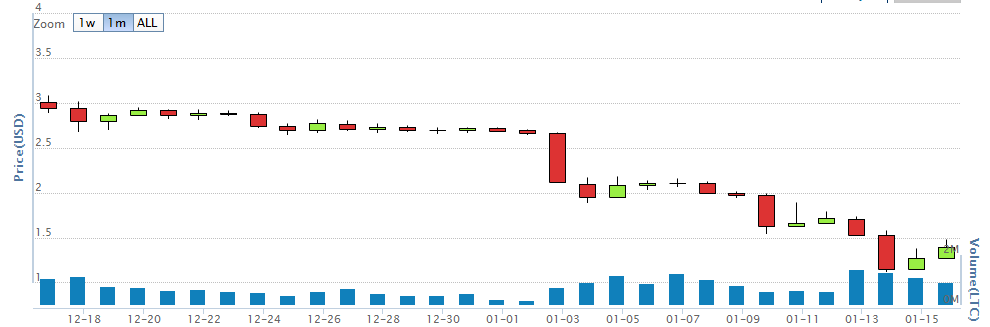

The litecoin price declined consistently throughout 2014 and has continued to fall during January. As recently as June, the litecoin price exceeded $10. During the past month, the litecoin price declined from $3 to $1.40–an alarming decline for one of the industry’s most prominent coins.

Litecoin Price Linked to Bitcoin Price

Connor Black, CEO of digital currency service Harborly, told CCN.com he believes the litecoin price decline is a by-product of the bitcoin price downtrend. Even though litecoin’s largest trading pair is USD, bitcoin’s vastly superior market cap (among cryptocurrencies) governs the direction of the litecoin price.

A major problem with the Litecoin price is the currency’s failure to distinguish itself as little more than the speculative younger brother of Bitcoin.

Looking at this last year you see that Bitcoin and Litecoin have had strong price correlations, with Litecoin usually trending further in either direction. When Bitcoin falls Litecoin plunges, and when Bitcoin rises Litecoin soars.

Indeed, altcoin market caps have (generally) evaporated at an even more alarming rate than bitcoin’s. However, Black believes litecoin can regain its swagger if the bitcoin price improves and the cryptocurrency community recognizes Litecoin’s benefits.

For Litecoin to get back on track, the digital currency community needs to recognize some of the big benefits Litecoin can offer. One benefit being that Litecoin transactions are about 4X faster than Bitcoin’s. This can be utilized with great success from casual spending to remittances, ensuring faster service time and less exposure to market volatility.

Disclosure: The author is not invested in Litecoin

Chart from OKCoin; other images from Litecoin and Shutterstock.