The Dow Will Recover – But Not Before Trump Loses to Bernie Sanders

More than any other president before him, Donald Trump has hitched his cart to the fickle winds of Wall Street. | Source: Brendan Smialowski / AFP

- Jeremy Siegel says that the stock market will recover from its recent crash, but only after a “one-year shock.”

- That recovery may not come soon enough to save Donald Trump’s reelection chances.

- The next time the Dow sets an all-time high, will the credit go to Bernie Sanders?

As the stock market recoils from its worst crash since the financial crisis, Wharton School finance professor Jeremy Siegel has some good news and bad news for President Donald Trump. The Dow Jones Industrial Average (DJIA) will recover… but not until he loses the 2020 election to Bernie Sanders.

OK, Siegel didn’t quite go that far. But it’s hard to deny that that’s the upshot from his latest stock market forecast.

Here’s When the Dow Jones Will Finally Recover

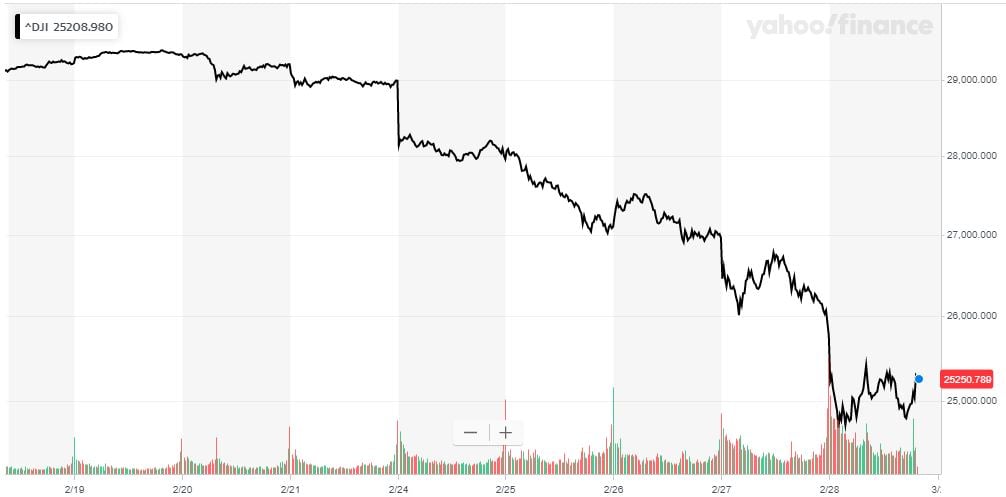

After five straight days of brutal sell pressure, the Dow Jones has nosedived from record highs into a technical correction. The longest bull run of the past century is teetering dangerously close to plunging into bear market territory.

Speaking on CNBC , Siegel said that investors with long-term outlooks don’t need to worry about their retirement portfolios. The stock market will recover within the next several years – long before most retirement-minded investors deposit that final paycheck.

“I see this as a very severe one-year shock, and then a bounce back that could be extremely rigorous,” Siegel said.

That’s great news for younger investors, but it’s unlikely to be much comfort to President Trump, who has a much more pressing target date in mind: November 3.

That’s when voters will cast their ballots in the next U.S. presidential election. And if current trends continue, they’ll be filling in the bubble next to “Bernie Sanders.”

Why Bernie Sanders Will Get Credit for the Stock Market Recovery

Sanders is the odds-on favorite to win the Democratic nomination , and his chances of winning the presidency are rising too.

While the stock market was booming, Wall Street didn’t consider him a real threat to Trump. But the “coronavirus sell-off” has forced analysts to sit up and take notice.

Just this week, Goldman Sachs predicted that coronavirus-related economic headwinds could darken sentiment and hand the Democrats the 2020 election.

“If the coronavirus epidemic materially affects US economic growth it may increase the likelihood of Democratic victory in the 2020 election,” analysts led by Ben Snider wrote in a Feb. 26 report.

Trump and his advisors recognize this, which is why they have already executed an abrupt U-turn in how they talk about the stock market and economy.

Trump is blaming the stock market crash on the Democratic presidential candidates, while White House economic advisor Larry Kudlow is complaining that the government can’t control the economy.

But those new marching orders are unlikely to bear much fruit.

Lady Fortune Turns Against Trump at the Worst Possible Time

More than any other president before him, Donald Trump has hitched his cart to the fickle winds of Wall Street . And for more than three years, that strategy worked.

But now, on the cusp of an election, Lady Fortune’s wheel has turned against his campaign’s most compelling plank.

That wheel will eventually turn again.

But when it does, and the stock market finally begins the “rigorous” recovery Siegel expects, it looks like the credit will go to President Bernie Sanders.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.