Tesla Stock Careens Toward 12-Month Low – No Relief in Sight?

| Source: FP PHOTO / ROBYN BECK

By CCN.com: Tesla stock continued its downward lurch, falling 3.5 percent on Monday. The Easter holiday gave investors no apparent good feelings toward the automotive stock, as it continues to suffer from chaotic boardroom intrigue.

Elon Musk’s Antics Shaking Everyone’s Confidence

Recently, Tesla investors sued the board of directors over their failure to rein in itinerant CEO Elon Musk, who has had continued run-ins with regulatory agencies.

Musk has also had his security clearances – crucial for someone working in aeronautics – under review over his public usage of marijuan a. The bad boy billionaire is shaking the confidence of investors and analysts, who once believed the unicorn electric car company would present a real challenge to traditional automakers.

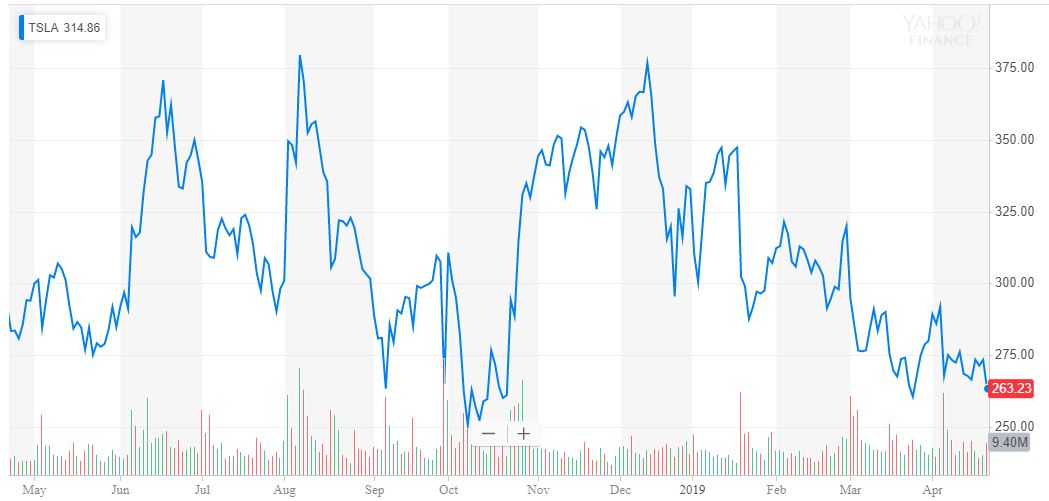

Tesla stock dropped from close to $270 to around $263 by press time. The stock’s 12-month low is in sight at right about $250. If it reaches that point, there’s no telling what will happen, as more and more investors might decide to cut their losses or take profits from long-term positions.

The market action is an essential reminder that the people who make up a company are every bit as important as its profitability and product, especially in an era where every prominent person is under a microscope. The crypto world saw a painful reminder of this recently when Bitcoin SV was delisted from several exchanges in direct retaliation for the courtroom antics of nChain chief scientist Craig S. Wright.

What Will Tesla Do About Its Founder Problem?

For his part, Musk has continued to rile the SEC and others. Musk was recently told by a federal judge, in essence, to grow up. But Musk isn’t backing down, and investor concern doesn’t bother him any. Last year he was removed as chair of the Tesla board but retained his position as CEO. The SpaceX founder has spent the intervening months without anything resembling a filter when it comes to Twitter, reminding one of a certain billionaire currently occupying the White House.

Musk recently addressed his Twitter activity – via Twitter:

He’s changed his biography there to read “meme necromancer,” and his profile image is something from a cartoon.

Some investors remain long on Tesla, betting that the company’s recent changes in sales strategy and historical chart data will push the price higher, combined with positive earnings calls .

The price is at the bottom of a very well respected channel which if it breaks will be a massive short, but we see a great long opportunity.

While Tesla probably isn’t going away anytime soon, major automakers continue to press into their business. Ford is aggressively moving into electric vehicles as well as e-scooters, and they’re seeing some traction as a result. Tesla’s superior electric car models will soon have a litany of competitors in the form of industry heavyweights who are prepared to manufacture at scale and without delay, likely at lower price points. Tesla’s road to mainstream adoption may be as long as cryptocurrency’s, and the company’s competitors have a century of successful relationships to build on.

The only question at this point is whether continued downward pressure on TSLA will lead to more drastic censuring of Elon Musk, or if a rebound will lead investors to rally behind the eccentric leader.