Tesla Stock Speeds Toward Brink as Analyst Warns of ‘Outright Disaster’

Beleagured Tesla is raising billions in new capital, and Elon Musk's paltry stock buy exposes a lack of faith in his cratering company. | Source: REUTERS / Lucy Nicholson

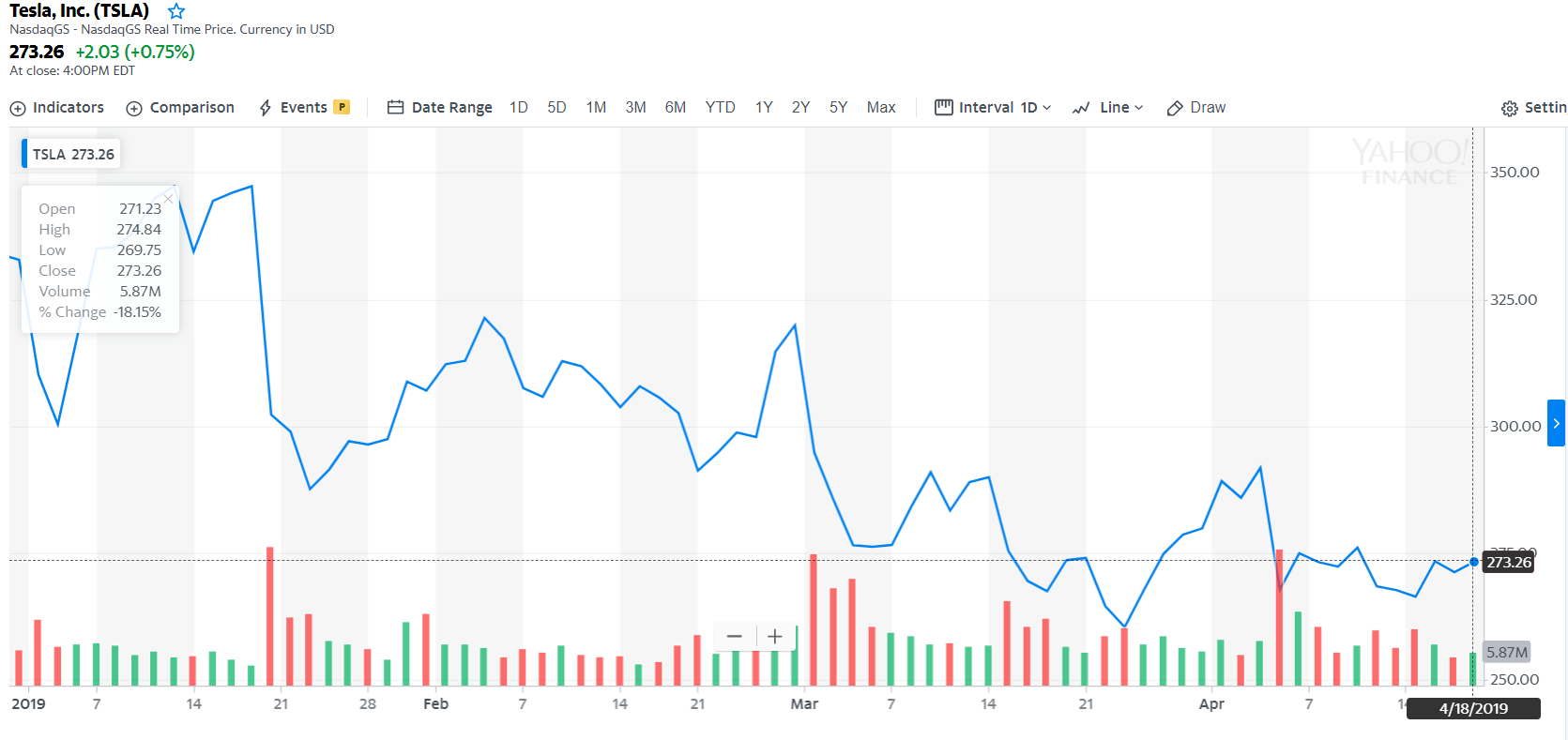

By CCN.com: Tesla stock has been taken to the cleaners this year. Elon Musk’s stand-off with the SEC, terrible Q1 delivery numbers, and an abandoned Gigafactory expansion plan have tested the mettle of even the most bullish investors.

But with the electric vehicle giant scheduled to report earnings next week, one analyst warns that TSLA shares could take an even more bearish turn.

Tesla Stock: Elon Musk Groupies Should Brace for Impact

The electric vehicle specialist will release its first-quarter results on April 24. The company already warned investors to expect a steep decline in deliveries that would also miss Wall Street’s expectations.

The Elon Musk-led firm produced 77,100 vehicles in the first quarter of 2019. The Model 3 accounted for 62,950 units. Tesla’s Q1 deliveries came in at 63,000 units, an impressive increase of 110% over the prior-year period.

However, deliveries fell 31% quarter-over-quarter as Tesla ran into “Logistics Hell” and had to ask for volunteers to help deliver vehicles. Critics alleged that was not a professional approach for a company looking to disrupt the automotive market.

According to CFRA analyst Garrett Nelson, TSLA shareholders should brace for an “outright disaster ” when the company reports earnings on Wednesday:

“Our suspicion is that Q1 EPS could be an outright disaster, given that Tesla guided for a loss with an entire month left in the quarter, and its inherently high degree of operating leverage.”

The cheaper Model 3 and the phase-out of the federal EV tax credit could wreak havoc on the company’s bottom line. In fact, a price cut intended to compensate for the reduced tax credit could impact Tesla’s quarterly revenue to the tune of $180 million, as reported by CNN.

Elon Musk Hopes to Dazzle Investors Ahead of Potentially-Ugly Earnings

Wall Street will keep a close eye on what Elon Musk has to say about the company’s ability to meet its delivery guidance for this year. But even if he fails to provide a palatable answer to that question, Musk has lined up another catalyst that could save the stock price from crashing in case the earnings report fails to impress.

Tesla scheduled its investor day for April 22, and the company is expected to provide a closer look at its self-driving technology. The company claims that its full self-driving (FSD) computer is already in production. Tesla also says that it can deploy autonomous driving capabilities through over-the-air software updates.

Elon Musk recently boasted that Tesla can bring a fully self-driving vehicle to the market sooner than many analysts expect. He also claimed that his company is “vastly ahead” of the others in the race to develop self-driving cars.

Elon Musk’s gloating, no doubt, will be music for Tesla fanboys, but the reality could be more complicated as the safety record of Tesla cars is far from impeccable.

Next week will be crucial for Tesla. How Elon Musk manages these critical tests could determine whether the EV darling is on the fast-track to becoming the “next Amazon” or will instead ferry investors toward “outright disaster.”