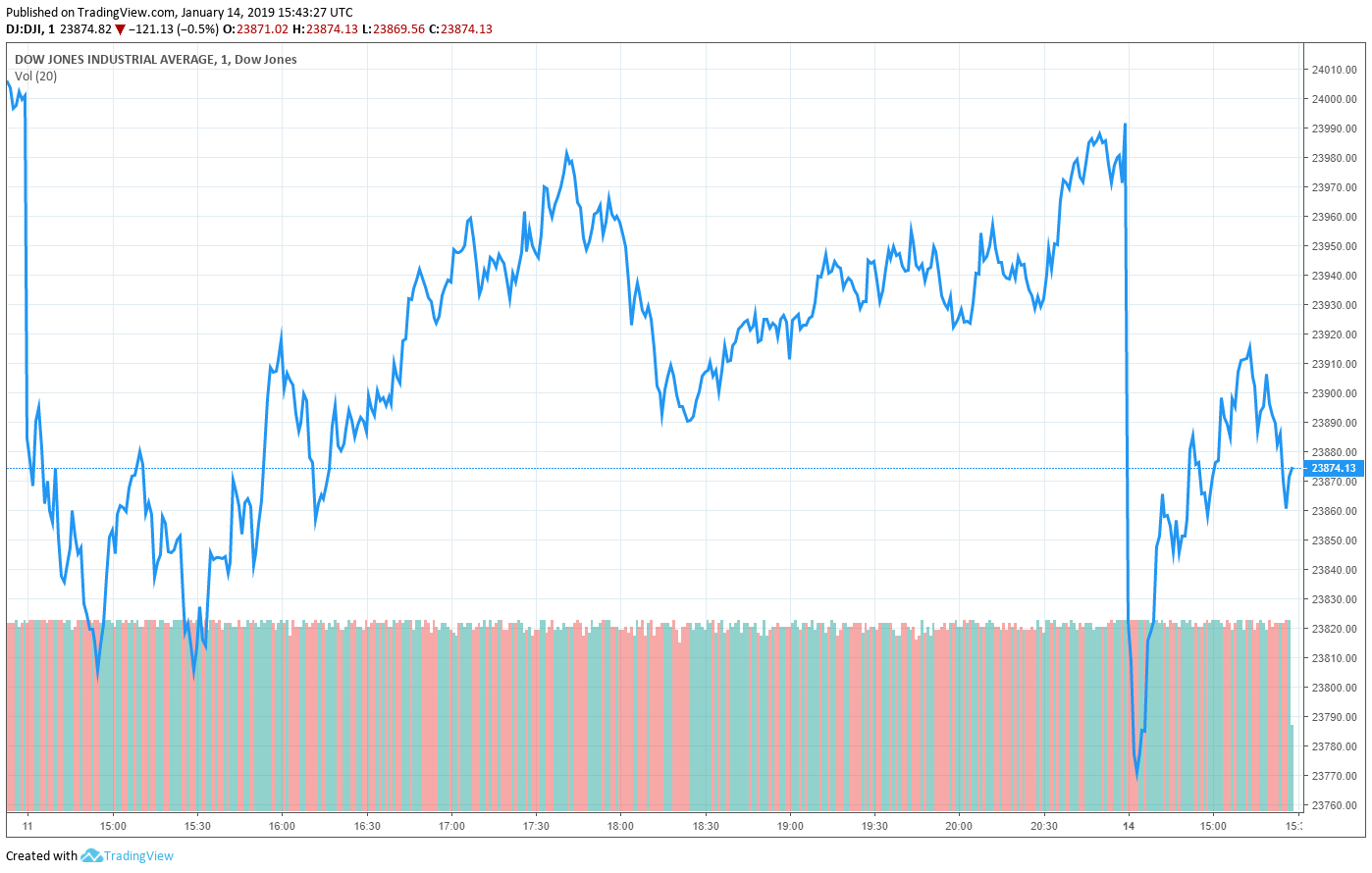

Poised for a Comeback? Dow Jones Pares Losses after President Trump Predicts New Trade Deal with China

President Donald Trump has suggested that the U.S. is close to striking a deal with China to end the trade war. | Source: AP Photo/Andy Wong, File

U.S. stocks pared losses Monday morning after President Donald Trump predicted the United States would soon reach a comprehensive trade deal with China.

Stocks Bounce Off Lows

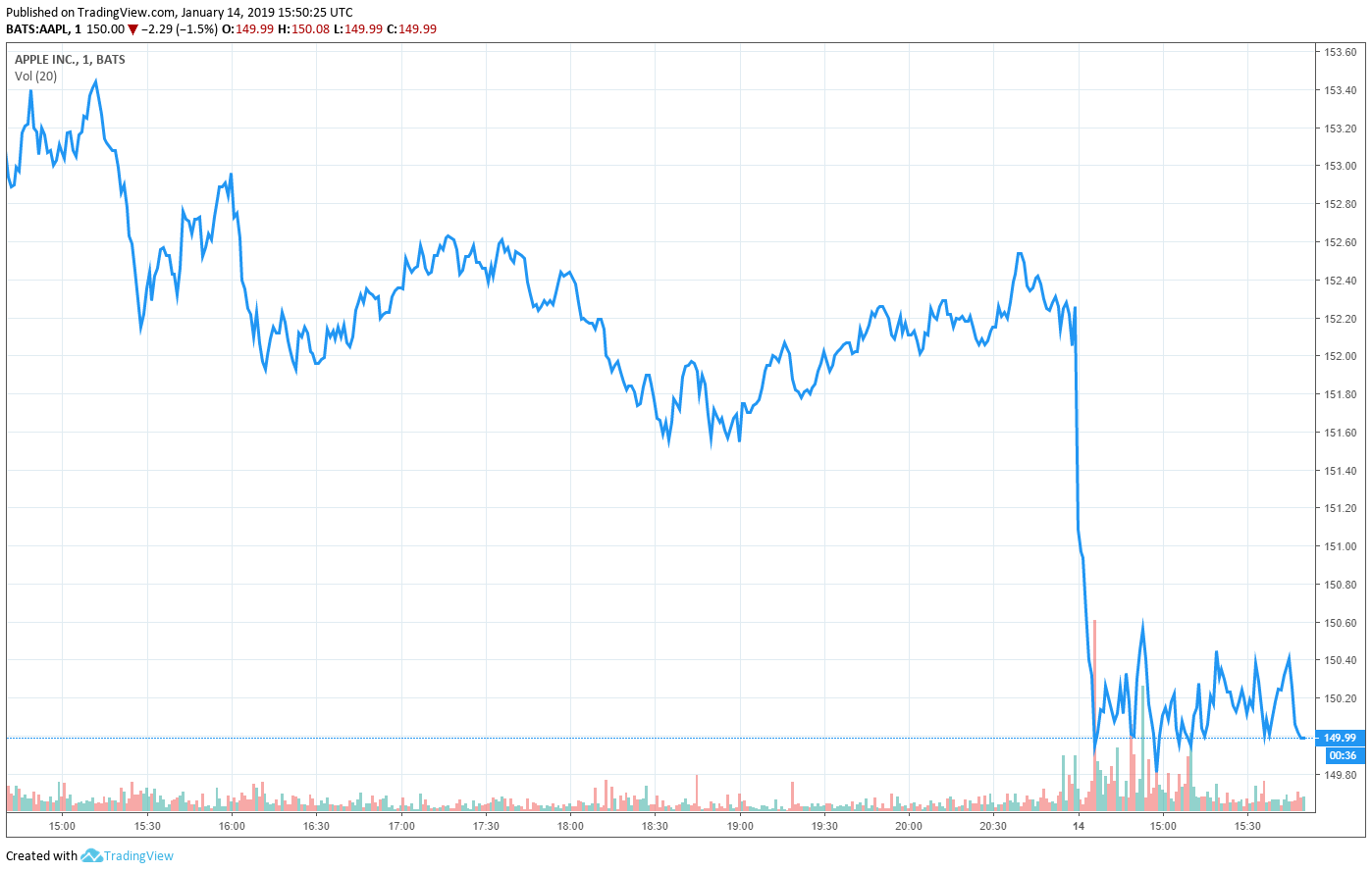

The Dow Jones Industrial Average fell by as much as 230 points Monday morning, an extension of a volatile pre-market session for Dow futures. At the time of writing, the blue-chip index had pared its loss down to 91 points, or 0.3%, to 23,904.60. Apple Inc. (AAPL) was the worst performing stock, having declined 1.4%.

The broad S&P 500 Index was down 0.6% at 2,581.79. It was down by as much as 1% earlier. Most major sectors were trading lower, led by a sharp drop in utilities and technology shares.

A weak tech sector weighed on the Nasdaq Composite Index, which fell 0.8% to 6,914.74.

Trade Deal Coming?

President Trump told reporters on Monday that a new trade deal with China was likely. According to Reuters , the president cited Beijing’s desire to continue negotiating as a strong signal that a deal will eventually be reached. No further details or timelines were provided.

“We’re doing very well with China,” Trump told reporters at the White House, according to Reuters. “I think that we are going to be able to do a deal with China.”

Talks between the world’s two largest economies went longer than expected last week, with delegates making notable progress on key issues related to U.S. farm and energy commodities and increased access to Chinese markets. It was the first face-to-face meeting since President Trump and China’s Xi Jinping agreed in early December to halt the trade war for 90 days.

The U.S.-China trade war forced the International Monetary Fund (IMF) to slash its forecast on global growth. It also put investors on high alert for possible disruptions in global trade flows. Those fears exacerbated a disastrous fourth quarter for Wall Street and global stocks.

Washington and Beijing have until March to iron out a new trade agreement – that is, unless they agree to extend the 90-day truce. Talks are expected to intensify later this month as China grapples with a cooling domestic economy and the Trump administration contends with growing political pressures at home.

China’s exports in December experienced their worst drop in two years, government data showed Monday. International shipments plunge 4.4% annually, confounding expectations for a 3% gain. Imports also fell 7.6% annually versus expectations of a 5% gain.

Featured image courtesy of AP Photo/Andy Wong. Chart via TradingView.