Overstock Shares Surge 30% After $500 Million ICO Announcement

Shares of online retailer Overstock (OSTK) surged 30% this week after chief executive Patrick Byrne revealed key details about the initial coin offering (ICO) for one of Overstock’s portfolio companies — an ICO that he says can raise as much as $500 million.

As CCN.com has reported, Overstock subsidiary tZERO has formed a joint venture with two other companies to establish the first regulated U.S. trading platform for ICO tokens. Because Overstock has a license to operate an alternative trading system (ATS), the exchange will be able to list tokens that fall subject to federal securities regulations.

Byrne later revealed that tZERO would hold an ICO to fund the development of the platform, and he announced key details about the ICO at this week’s Money 20/20 conference in Las Vegas. Most importantly, he stated that the tZERO token will function as a security, meaning that it will entitle investors to a percentage of the company’s profits. He has boasted that the ICO will raise up to $500 million, a mark that would shatter the $257 million crowdsale record currently held by Filecoin.

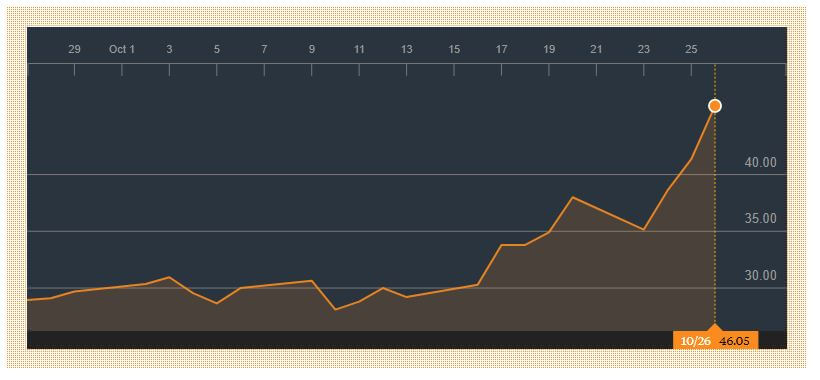

The announcement sent the price of Overstock shares through the roof. Since October 20, OSTK shares have surged from about $35 to a high of $46 for a 7-day increase of more than 30%. In the past year, Overstock shares have nearly tripled in value, and analysts attribute this rally primarily to the company’s involvement in the blockchain space through Medici Ventures, its blockchain investment subsidiary.

Despite this dramatic rise, Overstock may still offer investors significant upside potential. Bloomberg reports that equity analyst Tome Forte raised his mid-term Overstock share price target to $57 following the ICO announcement. “We are encouraged by the announcement and the direction tZERO is taking its business,” Forte reportedly wrote in a note to clients this week.

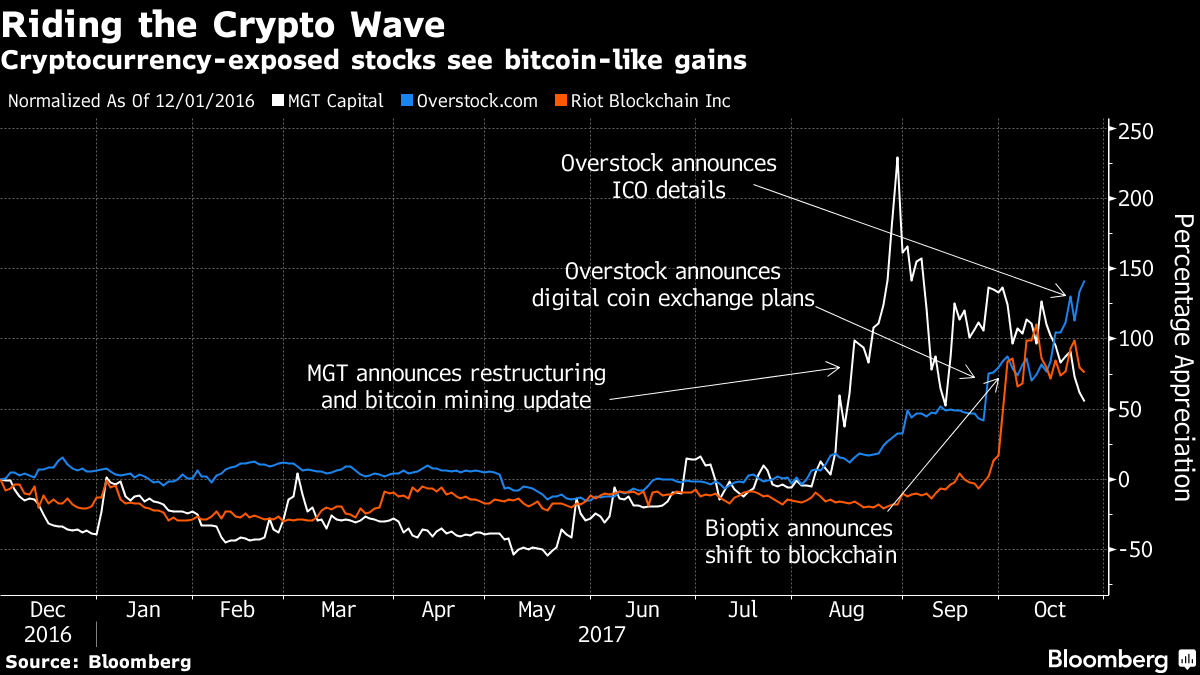

Overstock is not the only company to profit from its engagement — or perceived engagement — with blockchain. MGT Capital shares soared after it restructured and began investing in a cryptocurrency mining operation, and a biotechnology company doubled its share price after rebranding as “Riot Blockchain” and announcing that it would begin investing in crypto startups.

However, investor hype around blockchain technology has begun to concern regulators. The U.S. Securities and Exchange Commission (SEC) has warned investors that companies — particularly ones whose shares are traded over-the-counter (OTC) — may associate themselves with blockchain technology to cause the price of their shares to increase artificially. Consequently, the SEC has issued several temporary trading suspensions to OTC blockchain firms during the past few months.

Featured image from Shutterstock.