‘Riot Blockchain’: Biotech Company Stock Surges After Crypto Rebrand

Biotech company Bioptix Inc. (NASDAQ: BIOP) saw its stock surge following the announcement that it would rebrand as Riot Blockchain and shift its focus to cryptocurrency and blockchain-based investments.

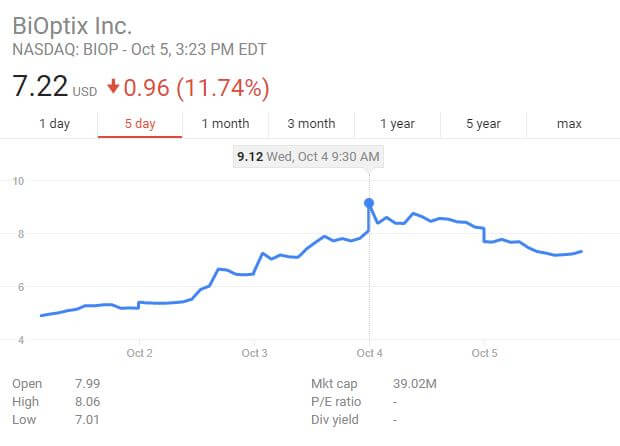

Shares of Bioptix — a company that previously manufactured diagnostic machinery for the biotechnical industry — had traded between $4 and $4.50 for the majority of the previous month, but they soared above $9 on Wednesday immediately following the announcement that the Colorado firm would make the leap into the burgeoning cryptocurrency industry.

“When I got on the board, they had made an acquisition that we decided as a board did not make sense, so we closed that down and then decided to change our focus,” Bioptix CEO Michael Beeghley told Bloomberg in a phone interview. “We looked at the sector and said, ‘How can we participate in this, and how can our shareholders participate in this very exciting industry that’s like the beginning of the internet?”

Consequently, Bioptix is completely shuttering its operations and liquidating its biotech patents as it transitions into Riot Blockchain. The first foray the revamped firm will make into the industry is a multi-million dollar investment in Coinsquare, a Canadian cryptocurrency exchange that currently ranks 82nd in total trading volume ($351,000 in the past day, according to CoinMarketCap).

Bitcoin-Linked Firms Face Regulatory Scrutiny

As Bloomberg notes, stock for cryptocurrency-linked firms is a hot commodity. MGT Capital and Overstock each experienced significant share price increases following announcements increasing their involvement in the crypto space.

But as a recent Wall Street Journal article points out, the majority of blockchain projects serve to increase a company’s “cool factor” rather than to meet use cases that current technology cannot. Consequently, the vast majority of projects fail to reach actual implementation.

Moreover, the U.S. Securities and Exchange Commission (SEC) has expressed concern that some smaller firms are associating themselves with blockchain projects — including initial coin offerings (ICOs) — to artificially pump their share prices. Over the past several months, the agency has suspended securities trading for multiple over-the-counter firms related to their purported involvement with crypto investments, including First Bitcoin Capital and Bitcoin Crypto Currency Exchange Corporation. As the SEC increases its oversight of ICOs and blockchain projects, it its likely more suspensions will follow.

Featured image from Shutterstock.