Op-ed: Is Bitcoin Exchange Bitfinex in Trouble?

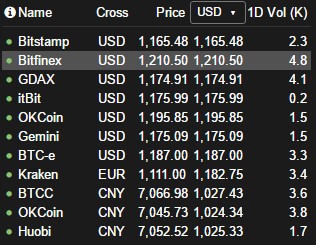

What exactly is bitcoin’s price? $1,174 as Coinbase is currently reporting, $1,211 as Bitfinex is saying or $1,028 as the Chinese exchanges are claiming?

Normally, the arbitrage opportunity created gives us an answer within a day or two, but in this case, there may not be such easy answer as, although free money is up for grabs – some $40 per coin between Bifinex and Coinbase, while there’s a massive $200 opportunity between western and Chinese exchanges – no one is taking it.

That suggests money can’t quite move. For Chinese exchanges, we know PBoC has forced them to halt withdrawals, allegedly temporarily, but until they do re-start normal operations we won’t quite know.

Since bitcoin can’t move in these exchanges, while fiat deposits and withdrawals continue as normal, traders have no option but to sell bitcoin and withdraw if they wish to move value out of OKcoin, creating a significant sell pressure and a $200 gap.

Red Flags

That’s fine and understandable, but, what’s happening at Bitfinex? Why is no one taking this free money? To answer this question, we have to ask quite a few new ones. Starting with enquiring who exactly is the CEO of Bitfinex, CTO, CFO, its other directors, employees, etc.

Their site doesn’t have an about us page, so we don’t quite know. This led to some confusion last year, but their site still doesn’t list any personnel. It does not list any license number either, even though the company handles hundreds of millions.

The lack of licensing led to some trouble last year as CFTC decided to fine them some $75,000 for “offering illegal off-exchange financed retail commodity transactions and failing to register as a futures commission merchant.”

It’s a small amount, but problems appear to have begun soon after. The exchange, for example, froze twice around June last year, leading to a price crash in bitcoin of around $100 each time. We don’t quite know why it really froze. We are still waiting for a report.

Thereafter, in August 2016, the exchange was hacked out of nearly 120,000 bitcoins, worth at the time around $60 million, now worth just above $140 million. The exchange recently announced customers had been reimbursed the hacked funds, but where all this money came from no one can really say.

Nor can anyone really say how the hack happened exactly. There was to be an audit, a report, with Drew Samsen, Applications Team Leader at Bitfinex, telling CCN.com back in January 2017:

“We know generally how it happened. It was the work of a profession[al] (or team) over several months who expertly covered his tracks. We have worked with 3rd parties to do memory analysis and have had security audits and are preparing a progress report soon.”

Now, some three months later, that soon sounds more like soon-ish as no such report appears in sight with those events apparently giving way to what may be a serious development. Wells Fargo, an intermediary bank, has stopped processing Bitfinex’s transfers, which may mean money can’t move.

Cut Off International Banking?

This may be a dangerous situation, similar to MT Gox’s predicament just a few months before it declared bankruptcy in 2014. Mark Karpeles, its CEO at the time, publicly commenting on the matter, states:

“A few years ago, MtGox had its international wires blocked by an intermediate bank. This caused a lot of additional costs as it was difficult to work around such blocks, and intermediate banks would also pressure our Japanese banks to close our accounts.”

After all these years and endless court cases, we still do not know what exactly happened at MT Gox, but the exchange was at the time very much in the eyes of regulators and enforcement agencies, which froze their dwolla funds, with banks then seemingly taking action.

Following CFTC’s fine, Bitfinex now appears to be courting regulator’s attention, with Wells Fargo’s action seemingly suggesting banks may be moving in. If that is indeed the case, then CFTC’s fine and Wells Fargo’s action are clearly a warning to other exchanges and gives them notice that they need to be regulated or America might cut you off from the international monetary system.

Unfortunately, that means the bitcoin trading space is once more moving towards becoming uncompetitive as there are hardly many options for margins trading. We may, therefore, see in action the critique of regulators that they are far too slow, erect barriers, considerably increase costs, and make markets uncompetitive.

Disclaimer: The views expressed in the article are those of the author and do not represent those of, nor should they be attributed to CCN.com.

Featured image from Shutterstock.