Bitfinex Market Freeze Sends Bitcoin Price Crashing

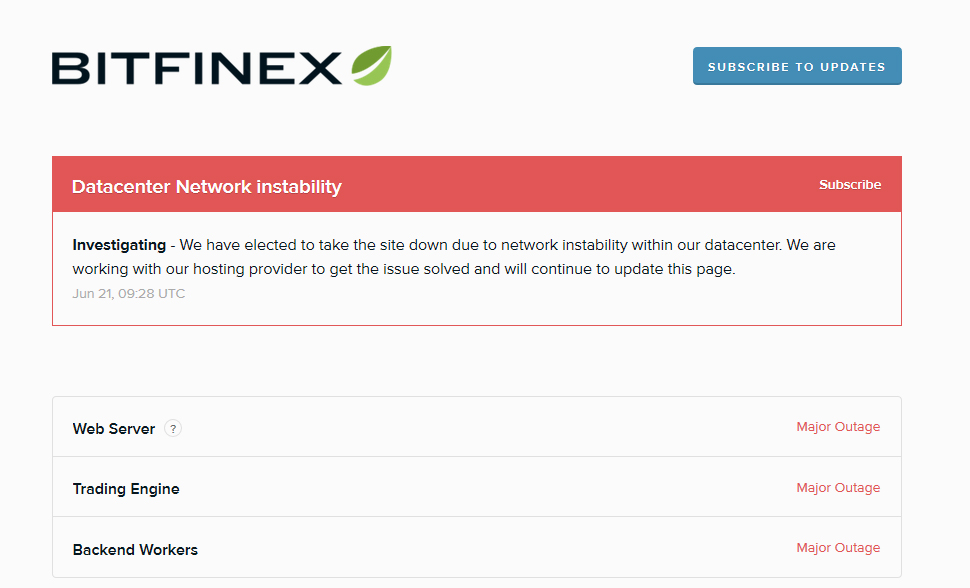

Bitfinex, one of the biggest bitcoin exchanges, went down for the second time within a day today at 10AM London time for four hours following “network issues” within Bitfinex’s datacentres according to Zane Tackett, Director of Community and Product Development.

The unexpected suspension of trading sent price crashing last night to $700 from almost $780. Bitcoin’s price continued to fall as low as $650 today before slightly recovering.

In responding to our question of whether this was a hack, bitfinex stated in a public tweet “No, not in any way.”

In response to our question on whether cold and hot wallets have been checked and whether everything is in order, Tackett stated:

“All funds are completely safe and have been from the beginning. If you ever want to check on your btc we have near-real time proof of reserves that you can use” after adding “we don’t have cold or hot wallets, we have customer segregated wallets, any user can verify their funds independently at any time.”

According to a bitfinex spokesman public statement:

“We believe that internal networking issues between our servers have been resolved, allowing us to reliably run the backend systems, including the trading engine. External connectivity issues remain, however, which may result intermittent unresponsiveness as our hosting provider continues to work on the problem.”

Responding to our questions, Tackett stated:

“Our hosting providers have been investigating and trying to solve the issues but it has not been an easy process.”

Although Bitfinex is now back up, Tackett stated that they were “[s]till working with our hosting providers to get everything back up and running 100%.”

It is not fully clear what exactly happened or what led to this devastating error that sent bitcoin’s price down by $80 in minutes last night. Undoubtedly a full update and investigation report from Bitfinex will follow with traders expected to now question why they should trust an exchange that went down for hours twice within one day, sending the market crashing and whipping out hundreds of millions in value.

Such questions as what precautions were taken, what errors were made and what lessons were learned will need to be answered to a highly satisfactory degree if the exchange is to retain any market share in its fierce competition with unregulated Chinese exchanges.

Standards in Bitcoin exchanges have considerably increased since the devastating bankruptcy of MT Gox which lost almost one billion dollars as valued at the time. There have been considerably less hacks and monetary losses, especially since last year, but as today’s events show, there are still signs of what may be considered amateurism and what may have been carelessness as the market continues to lack a professional exchange that offers margins or futures, partly due to the snail speed movement of regulators.

Regulators however have been quick to take punitive action with CFTC fining bitfinex $75,000, just days ago, “for offering illegal off-exchange financed retail commodity transactions and failing to register as a futures commission merchant.” Tackett stated that the latest outage had “[a]bsolutely nothing to do with the CFTC whatsoever. This had to do with a database migration we had been working through.”

Regulators share part of the blame for not offering the trading market any alternative, but part of what may be perceived as continued amateurism may be due to the bitcoin industry failing to set up an industry group which can lay down standards and guidelines to give the market any indication of trustworthiness or professionalism of exchanges, service providers, and all bitcoin companies that hold digital currency.

Featured image from Shutterstock.