Ocasio-Cortez Could Land Banking Post, How Will Stock Market Respond?

The co-founder of Greenpeace took issue with Alexandria Ocasio-Cortez's Green New Deal | Source: Shutterstock

Rep. Alexandria Ocasio-Cortez is the youngest woman ever to serve in Congress. She now looks set to make waves by joining the House Financial Services Committee, which oversees the Wall Street regulatory regime.

Peeling Back Trump’s Years of Deregulation

Reports indicate the Democratic congresswoman has a strong chance of the appointment and could be an ally to Financial Services Committee Chair Maxine Waters. Rep. Waters shook the markets with her promise that:

Come January, in this committee the days of this committee weakening regulations and putting our economy once again at risk of another financial crisis will come to an end.

Ocasio-Cortez, who leans to the left of the Democratic mainstream and identifies as a democratic socialist, vowed to take on New York’s corporate interests and has reportedly hoped for a position to allow her to put her stamp on financial sector policy.

US President Trump has been targeting the financial reforms put in place after the financial crisis ten years ago. His hostile stance towards Jerome Powell and the US Federal Reserve is just one example of where Trump puts pressure even on departments outside of his control.

With the new Democratic-led House of Representatives, Trump’s pressure on regulation could be lifted, as he will find that Democrats oppose the bulk of his policies.

The Democrats, led by an influential combination of Waters and Ocasio-Cortez, could push back against Trump’s fast growth policies. However, leading the House Financial Services Committee to push policies of regulation could threaten business confidence and investment.

The stock market is already reacting to trade talks, interest rate hikes, and a potential recession.

A Belief in Modern Monetary Theory (MMT)

Though conservatives worry about Ocasio-Cortez’s views on a range of issues, she believes in Modern Monetary Theory (MMT) , which holds that federal deficits aren’t all that bad. With US debt at sustained highs, Wall Street worries that the debt could lead to higher inflation.

MMT leans towards low interest rates but also towards raising taxes to cool an economy and control inflation.

However, it’s how deep into MMT Ocasio-Cortez sits that could be important. She also proposes raising the tax rate on incomes over $10 million to 70%. If that doesn’t make Wall Street tremble a little, nothing will.

Are the Markets Already Worrying About the Financial Committee?

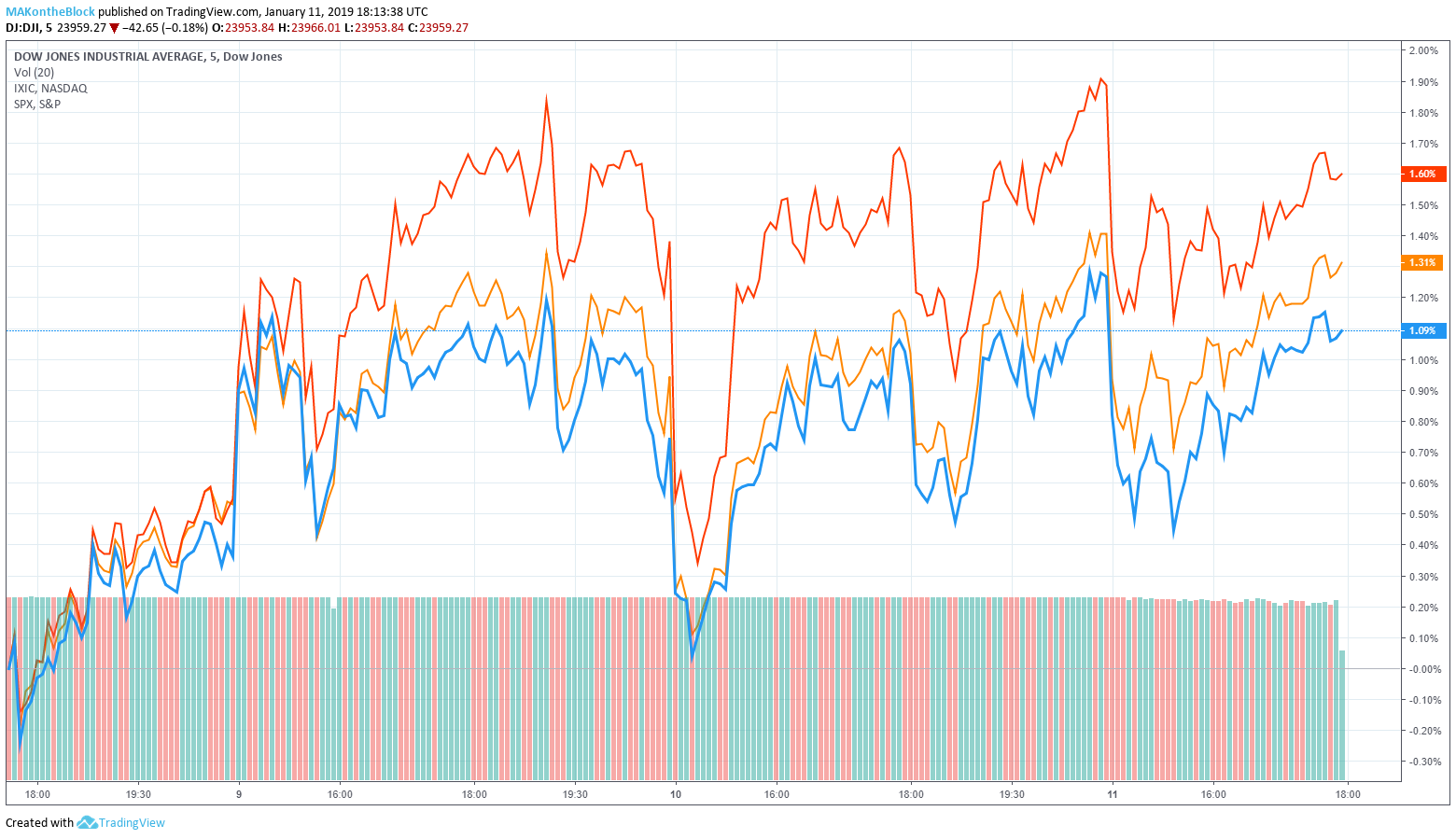

If Waters manages to roil the markets, the news of an ally in Ocasio-Cortez may also be doing so. Since the news broke trading has shivered somewhat, and the Dow Jones Industrial Average, the Nasdaq, and the S&P 500 are all down for the day, albeit less than 1%. The markets have a bit of Friday trading left to recover, but can they take a five-day upturn into a sixth?

As the government shutdown looks set to continue and more corporates find themselves under pressure and revising sales forecasts down, it’s a tough call. Morgan Stanley says the stock markets are “vulnerable” right now.

Featured Image from Shutterstock. Price Charts from TradingView .