Dow Fights to Hold 24,000, But Government Shutdown Puts Pinch on Airlines & Retailers

Sources close to President Donald Trump say that he likely won't feel pressure to end the government shutdown until the Dow and its fellow indices experience a sharp reversal. | Source: Shutterstock

Dow Jones Industrial Average futures traded down slightly in pre-market trading on Friday as the blue-chip index fought to hold above 24,000 and extend a five-day winning streak as the US government shutdown hit the three-week mark.

Dow Futures Dip Below 24,000

As of 8:36 am ET, Dow futures implied losses of 60 points or 0.25 percent, positioning the index for an opening-bell drop to 23,893. S&P 500 futures had declined by 0.32 percent ahead of the session open, while Nasdaq futures were down 0.43 percent.

All three indices had fought back from pre-market losses to close in the green on Thursday, notching the stock market’s fifth consecutive day of gains. The Dow rose 122.8 points or 0.51 percent to sneak across the 24,000 threshold to 24,001.92. The S&P 500 climbed 11.68 points or 0.45 percent to 2,596.64, and the Nasdaq added 28.99 points or 0.42 percent to close at 6,986.07.

Altogether, the stock market has seen its best 7-session start to a new year since 2006, which may or may not be comforting considering the ensuing events in 2007 and 2008. Indeed, as CCN.com reported, computer trading algorithms have already begun advising investors to short almost every asset class.

Government Shutdown Enters 21st Day

In any case, early indications are that the Dow and its fellow indices might not extend their daily winning streak to six, as investors are growing increasingly nervous about the impact that the ongoing government shutdown will have on the US economy.

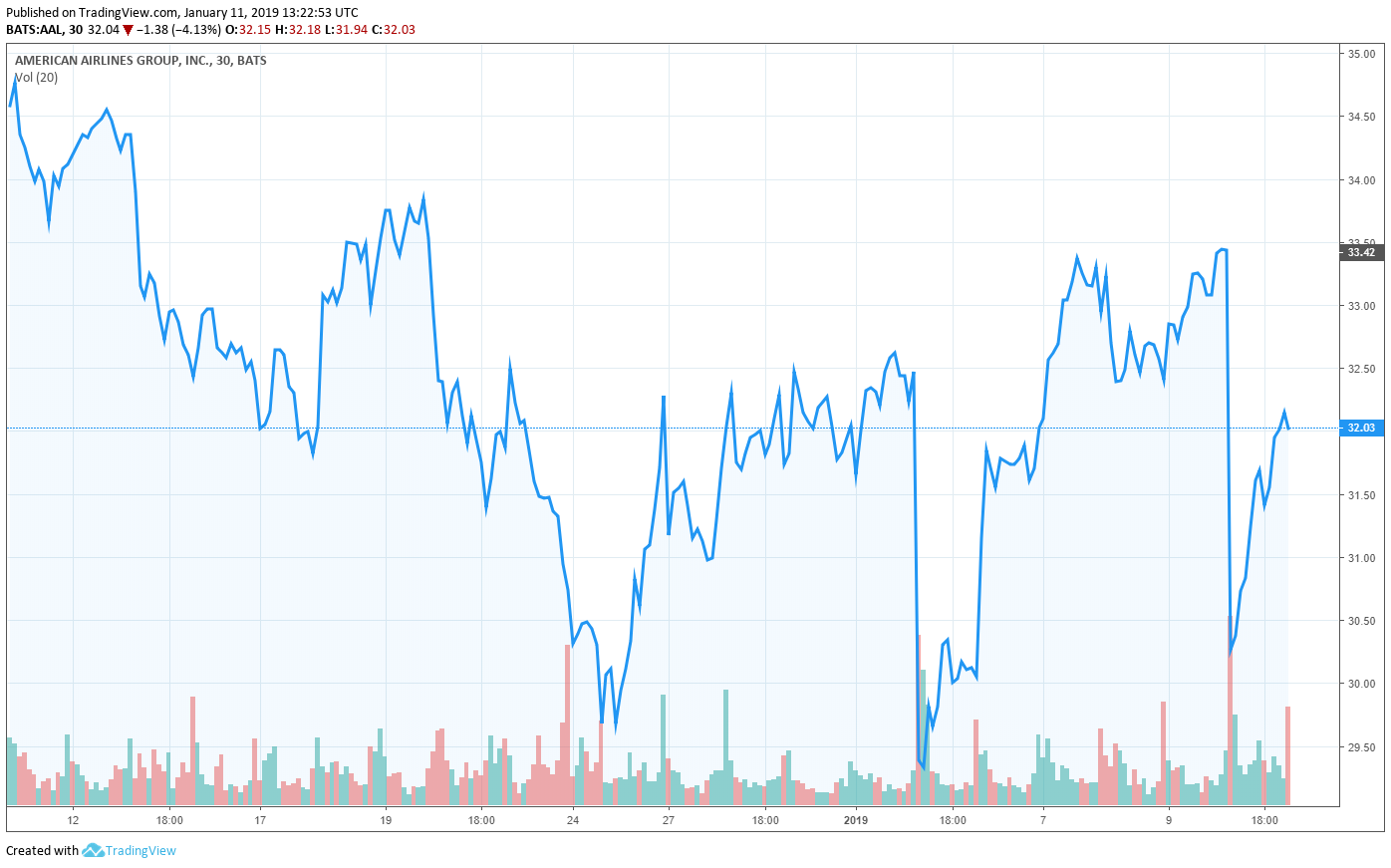

American Airlines Stands to Lose Revenue from Shutdown

The shutdown’s immediate impact was on the 800,000 federal employees who have been furloughed or forced to work without pay, and some workers will miss their first full paychecks today.

However, the longer the shutdown lingers, the more it will make its impact felt in the private sector as well, often in industries not normally associated with shutdown talk. Take the airline industry.

As analysts at Cowen noted , American Airlines, already struggling after weak revenue guidance, could its share price take further hits due to drastic reductions in government-related travel.

[T]he government shutdown will impact the industry’s corporate travel business the longer it lasts. American in particular has exposure to the government with its hub at Washington, DC Reagan National Airport. We believe government contractors are not traveling during this shutdown, and the longer it goes on, the greater the impact.

Analysts Warn IRS May Delay Refund Checks if Shutdown Lingers

Moreover, concerns continue to mount over the ability of the Internal Revenue Service (IRS) to process tax refunds with a reduced workforce. The agency has said that the shutdown will not force it to delay refund check processing, but analysts including Macquarie have warned that delays grow more likely as the shutdown extends deeper into filing season, which begins on Jan. 28.

Refund processing delays will take a bite out of retailers, who count on an uptick in consumer spending around tax time to bolster their bottom lines.

That could compound problems for retailers such as Macy’s and Kohl’s whose shares are already suffering after weaker-than-expected holiday sales numbers. Kohl’s shares declined 4.68 percent on Thursday, while Macy’s incurred a 17.66 percent sell-off.

Macquarie wrote:

Today is a primer in case tax refunds are delayed despite what the White House has to say about tax refund precedent when the government is shutdown. If the government remains shut down going into earnings — we may hear some conservative commentary about [quarter-to-date] comp trends from the retailers. Ultimately, the government will reopen and checks will be sent out but it may happen later in the first quarter of 2019.

Will Trump Declare National Emergency, End Shutdown?

Equally as worrisome is the fact that US President Donald Trump and congressional Democrats appear no closer to striking a deal to end the shutdown, with the president reportedly storming out of a meeting with Democratic leadership earlier in the week.

However, Trump said on Thursday that he would “probably” declare a national emergency to fund the border wall’s construction if Congress does not allocate spending to the project. This would undoubtedly thrust the administration into a prolonged court battle, but it would also provide Trump cover to sign a spending bill that funded the government without earmarking funds for a wall on the US-Mexico border.

Oil Futures Eye Longest-Ever Winning Streak

The stock market isn’t the only asset class that has assembled an impressive rally to start 2019. Oil futures are pointing to gains for the tenth consecutive day, which — if held through the day’s close — would mark the commodity’s longest winning streak since oil futures contracts were introduced in June 1988.

A variety of factors have contributed to oil’s early-year rally, including improvements in US-China trade relations and the Federal Reserve’s recent assurances that it will take a patient approach to tightening its balance sheet.

“The macro drivers of prices has been the more dovish Federal Reserve and better news coming out of the US-China trade dispute,” Stephen Innes, head of trading for Asia Pacific at futures brokerage Oanda , said in an interview with Business Insider . “The market is reading between the lines that any deal would boost China’s economy and really improve demand.”

Concurrently, the crude supply has begun to diminish now that OPEC has implemented production cuts and US sanctions have led to reduced oil exports from Iran.

Abhishek Kumar, senior energy analyst at Interfax Energy in London, stated in remarks quoted by Reuters that the uptick in oil prices could become a “near-term trend” for the market.

Featured Image from Shutterstock. Price Charts from TradingView .