SoftBank to Spearhead AI Chip Innovation with $100 Billion Project Izanagi: Nvidia Under Threat?

SoftBank founder Masayoshi Son plans a massive $100 billion chip venture called Project Izanagi to take on Nvidia in the AI chip market.

Key Takeaways

- SoftBank founder Masayoshi Son wants to launch a $100 billion chip venture to challenge Nvidia in artificial intelligence (AI) chips.

- The project, named after the Japanese god of creation, aims to develop chips for Artificial General Intelligence (AGI).

- Whether it can dethrone Nvidia’s dominance remains to be seen.

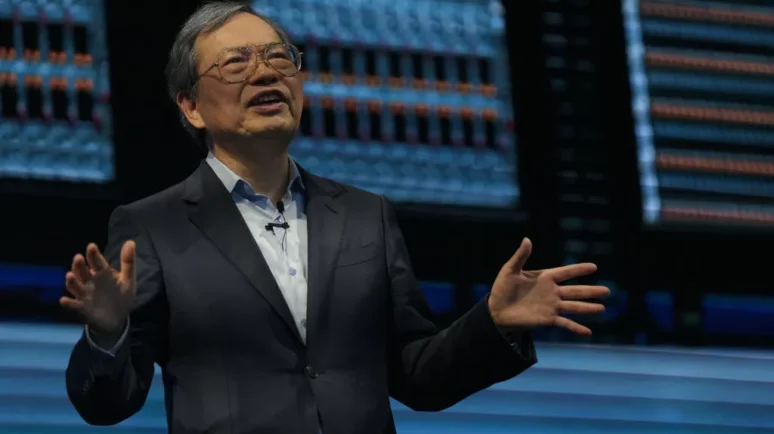

Masayoshi Son, founder of SoftBank Group Corp., is pursuing funding of up to $100 billion for a chip venture aimed at challenging Nvidia and supplying crucial semiconductors for artificial intelligence (AI) applications, sources familiar with the situation told Bloomberg.

But what’s Project Izanagi? Who will fund it? And is that enough to tackle Nvidia’s leadership in the chip sector?

Son Unveiled Project Izanagi

Dubbed Izanagi , the project represents billionaire Masayoshi Son’s latest venture as SoftBank shifts its focus away from startup investments. Son aims to establish a company that complements chip design unit Arm Holdings and propels him into the forefront of the AI chip sector, sources familiar with the matter revealed . Potential funding scenarios include $30 billion from SoftBank and up to $70 billion from Middle Eastern institutions.

If successful, the Izanagi chip project would rank among the largest investments in AI since the emergence of ChatGPT. It would also surpass Microsoft’s recent $10 billion investment in OpenAI.

Son named the project Izanagi, after the Japanese god of creation and life, incorporating the initials for artificial general intelligence (AGI). He foresees a future where machines surpass human intelligence, promoting safety, health, and happiness.

While details about funding and project specifics are still under consideration, Son is working to expand Arm’s presence in the AI market and investigating next-generation chip technologies. The project’s development and partnerships to challenge Nvidia’s dominance in high-end AI accelerators are yet to be determined.

Focusing Efforts On Arm

After facing challenges in startup investments, Son redirected his attention to Arm, aiming to build a powerhouse comparable to the Magnificent Seven stocks. SoftBank’s financial strength, with ¥6.2 trillion – equal to $41 billion – in cash and equivalents as of December 31, benefited from global equity market recovery. A windfall from T-Mobile US shares , nearly $8 billion, and a $50 billion surge in Arm’s market value in just one week further bolstered the company’s balance sheet.

While Son and OpenAI‘s Sam Altman explored collaboration in semiconductor manufacturing, Izanagi currently operates independently from Altman’s initiatives. Despite initial efforts to involve another company focused on foundational AI models in the chip venture, they declined to participate, according to sources.

Directly leading Project Izanagi, Son previously orchestrated the establishment of SoftBank’s Vision Fund , initially a $100 billion venture with Middle East backing, representing one of the world’s largest tech investment pools. However, over the past 18 months, investments from the fund have significantly decreased compared to previous levels.

SoftBank stock surged following reports that founder Masayoshi Son is exploring the creation of a $100 billion chip venture to supply AI-enabling semiconductors.

Shares in the Tokyo-based tech investor climbed by 3.2% after the news. In the meantime, Nvidia stock in New York didn’t trade on Monday, February 19, 2024, as markets are closed for President’s Day in the U.S..

Is Nvidia Leadership Under Threat?

Nvidia (NVDA) maintains a dominant position in the artificial intelligence (AI) graphics card market, boasting an estimated 92% market share, which has fueled its impressive growth of 230% over the past year.

However, the company faces potential challenges from several tech giants. This would prompt a closer examination of these threats and Nvidia‘s strategies to address them.

Nvidia is striving to ramp up the supply of its graphics cards through its foundry partners. Nevertheless, customers may grow impatient waiting for the availability of these chips.

In addition, Nvidia’s AI GPUs come with a hefty price tag. For instance, the H100 processor has a price between $30,000 and $40,000. Despite the high cost, investment banking firm Raymond James estimates Nvidia’s manufacturing cost for one H100 GPU to be just over $3,300. This highlights the significant pricing power the company wields in this market.

As competitors like SoftBank vie to challenge Nvidia’s chipmaking supremacy in AI, it’s clear that Nvidia will fiercely defend its position. Morgan Stanley forecasts that Application-Specific Integrated Circuits (ASICs) could seize 30% of the $182 billion AI chip market by 2027. This would offer a revenue opportunity of $55 billion. And Nvidia is well-positioned to uphold its leadership amidst this changing landscape.