Spark Protocol Airdrop is Coming From MakerDAO — Here’s How to Be a Part

Spark Protocol token airdrop has been proposed

- Rune Christensen, the creator of MakerDAO, announced an airdrop of the Spark Protocol governance token

- Two billion Spark (SPK) tokens will be distributed over a ten-year period

Rune Christensen, the creator of stablecoin issuer MakerDAO, proposed an idea to develop a new governance token for the Spark lending protocol and distribute them as incentives to users, or a “pre-farming airdrop.”

The proposal describes the distribution of two billion Spark (SPK) tokens over 10 years as a strategy to encourage continuing use of Spark Protocol. Its goal is to encourage long-term involvement with the platform.

MakerDAO created the Spark Protocol , a lending protocol that offers DeFi loans by obtaining liquidity straight from Maker. It accepts collateral in the form of ether, staked ether, and dai.

Spark is anticipated to eventually become a subDAO, which would be a significant development for MakerDAO’s long-term strategy.

A subDAO will be a separate, autonomous, decentralized entity within MakerDAO. Many subDAOs, including Spark, are predicted to be developed as part of the endgame strategy; each will be governed by its own tokens.

Encouraging Usage

With a variety of assets serving as collateral, the SubDAO tokens will be distributed to Spark borrowers in proportion to the amounts and terms of borrowing.

“We want to bootstrap a community of users and DAO participants that are aligned with the mission and potential of SparkDAO,” stated Christensen.

According to Christensen, the Enhanced Dai Savings Rate, which offers a 5% income on Dai deposits (down from an 8% rate previously), is meant to encourage Spark’s active usage.

If the EDSR proposal to raise stability fees to 5% is approved, the SPK performing airdrop aims to incentivize users and borrow-arbors to continue using Spark Protocol.

Christensen said that in order to increase Spark Protocol’s Lindy impact and market trust, the company wants to make sure that a significant amount of funds are deposited into it. Due to this, even borrow-arbitrage is problematic.

“We want to establish a user base and DAO members who share SparkDAO’s vision and potential;” he stated.

SPK Pre-Farming Airdrop – How To Take Part

Pre-farming Airdrop will function as follows:

- At Phase 2 Launch, when SubDAO tokens and SubDAO farming go live, the Support Facilitators will determine backward which users borrowed from Spark Protocol, starting from the moment the EDSR anti-borrow-arbitrage change increases the borrowing rate to 5%.

- Based on how much and how long each borrower borrowed, a fixed number of SPK tokens—which will be specified in the Support Scope in the upcoming amendment proposal—would be distributed proportionally to Spark Protocol borrowers who used volatile assets as collateral; this effectively functions as farming, but the tokens are distributed in large quantities as an airdrop at the conclusion.

- All different kinds of users, accounts, contracts, multisigs, etc. would have access to this. Users just need to borrow from Spark Protocol, as usual, to qualify for the airdrop; no other actions are required.

The SparkDAO Workforce Bonus Pool would be used to fund these SPK tokens. The goal would be that it should just represent a low single-digit percent yield per year, not be a massive amount of free money. The majority of the SPK token distribution should still benefit NewStable farmers through regular tokenomics. I will take some time to calculate various scenarios before proposing an actual number of tokens.

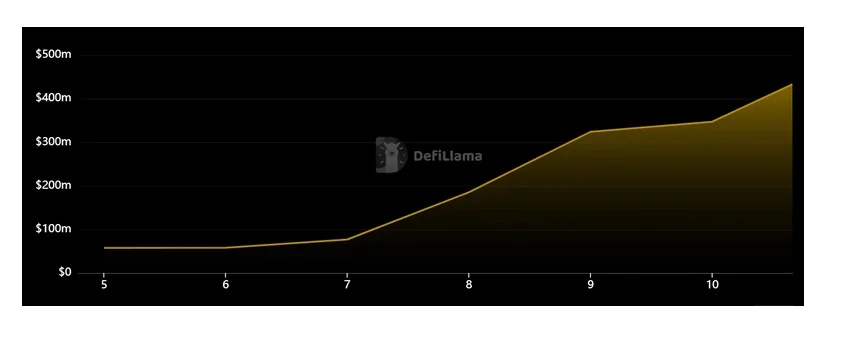

This week, the EDSR on Spark rose to 8% , prompting huge capital inflows as consumers took advantage of borrowing arbitrage opportunities. Dai was borrowed by users at cheaper interest rates and used in EDSR for higher yields. Later on, Christensen predicted that the rate would drop to 5% as Dai deposits quickly exceeded the predetermined threshold for deposits.