Nvidia Stock Surged on Earnings News: Market Cap Rivals Amazon, Google – Apple and Microsoft Next?

Nvidia Competes With Strong Q4 | Source: Jean Louis Tosque/Pixabay

Key Takeaways

- Nvidia’s shares clocked double-digit gains after reporting a 265% increase in quarterly revenues.

- The company projects $24 billion in revenue for the current period, surpassing analyst expectations.

- AI-driven growth being a key factor, eyes are now on competitors like Alphabet, Amazon, Apple, and Microsoft.

The release of Nvidia’s fourth-quarter earnings for 2023 injected a wave of optimism into the financial markets. This was seen by the significant rise in its stock prices during early trading sessions. Now, the world’s most valuable chip-maker not only reported a staggering 265% increase in quarterly revenues but also projected sales figures that far exceed analyst predictions.

This surge is attributed to the global spending spree on artificial intelligence (AI), positioning Nvidia to potentially rival tech giants like Microsoft in market capitalization while being the 4th largest.

Nvidia’s AI-Driven Success

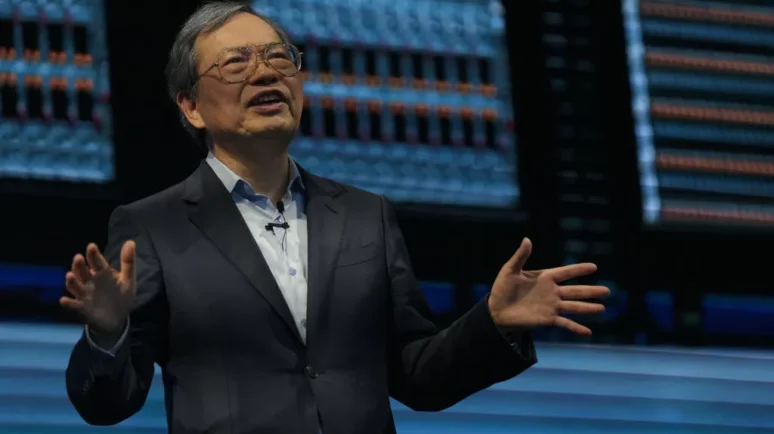

The cornerstone of Nvidia’s success is in the AI revolution. The company’s revenue for the quarter was about $24 billion, more than Wall Street estimated. CEO Jensen Huang remarked , “Accelerated computing and generative AI have hit the tipping point.”

Huang pointed to an AI demand surge worldwide.

OpenAI’s ChatGPT has now put AI in the mainstream. Chip-makers like Nvidia are driving on its momentum. As per CoinGecko, Artificial Intelligence (AI) tokens have reached a market cap of over $17 Billion at the time of writing.

In response to Nvidia’s stellar performance, CNBC reported that stocks of supplier TSMC, server company Super Micro Computer, and equipment manufacturer ASML booked gains.

JPMorgan’s trading desk had reportedly anticipated a potential negative stock reaction even if Nvidia’s shares beat estimates. NVDA stabilized during trading hours and even showed slight weakness. However, the company shares are showing the strongest period in February fueled by its dominance in the AI computing boom.

“Our Data Center platform is powered by increasingly diverse drivers — demand for data processing, training, and inference from large cloud-service providers and GPU-specialized ones, as well as from enterprise software and consumer internet companies,”Huang noted.

Data Center business reported a strong $18.4b in sales.

Where are the Competitors?

Nvidia competitors reported Q4 earnings in January and February. Alphabet’s earnings pulled the company’s stock prices down as its advertising revenue failed to meet the expectations of analysts, despite an overall increase in revenue.

Amazon managed to keep the investors happy with its fourth-quarter results exceeding forecasts, leading to a rise in its stock value during after-hours.

Meanwhile, Apple reported strong sales figures, primarily driven by its iPhone segment, surpassing revenue and earnings predictions for the quarter. However, a less optimistic sales outlook resulted in a decline in its stock value post-earnings announcement.

In the quarter, Microsoft concentrated on the booming sector. CEO Satya Nadella highlighted a strategic shift during its January earnings call, focusing on the integration and scaling of artificial intelligence technology across its products. It included Microsoft Copilot, Azure AI, and the widely used GitHub Copilot, marking a focus on AI development.

Hours after the NVDA result, Google, Apple, and Amazon stocks are recording gains, but Microsoft remained mute at press time.

Tech Sector’s Consolidated Boom

Nvidia’s latest earnings report places it as a strong company, but Microsoft, Apple, and even Amazon have built a larger and diversified revenue stream. But NVDA will pull up suppliers and chip industry as a market.

Its position in AI does challenge industry titans, but Nvidia’s market cap growth depends on expansion in AI capabilities. But it will remain in the forefront of the technology sector, considering the large consolidation in the stock market.