FTX’s Cash Reserves Soar as It Teeters on Customer Payouts

FTX is liquidating cryptocurrency assets to generate funds for customer reimbursement. | Credit: Jonathan Raa/NurPhoto via Getty Images

Key Takeaways

- FTX is selling off its crypto assets and accumulating cash to reimburse customers who lost funds during its bankruptcy.

- The company’s cash reserves have largely increased.

- FTX does not expect to be able to fully reimburse all of its customers.

As part of its bankruptcy proceedings, FTX is actively liquidating its crypto assets and accumulating cash in efforts to reimburse clients whose funds were immobilized following the platform’s downfall in 2022.

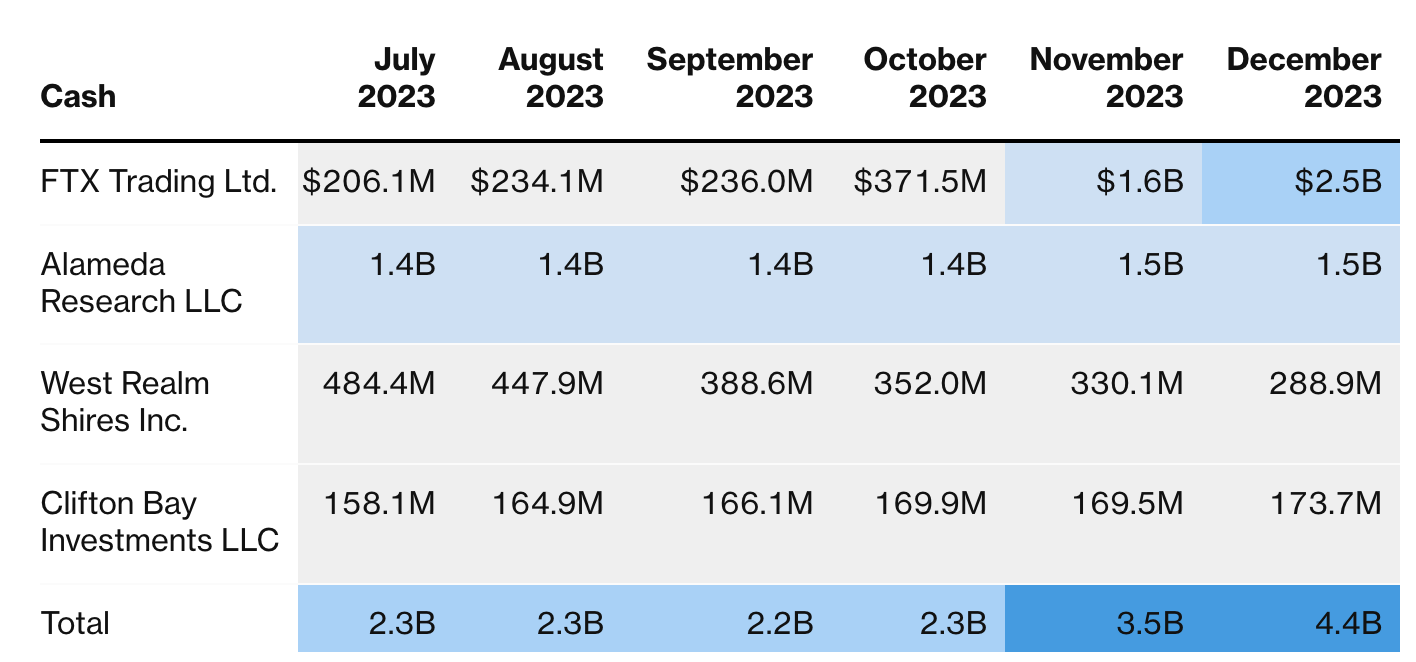

The company’s four principal subsidiaries, including FTX Trading Ltd. and Alameda Research LLC, have significantly increased the firm’s cash reserves.

FTX did not immediately respond to a request for comment.

Boosting Cash Reserves through Asset Sales and Strategic Trading

According to reports from Chapter 11 monthly operations, these reserves escalated to $4.4 billion at the close of 2023, up from approximately $2.3 billion in late October. It’s noteworthy that the total cash holdings across all of FTX’s affiliates are expected to be even greater.

FTX disclosed in a recent court document that it has garnered $1.8 billion by December 8, predominantly through the liquidation of a portion of the company’s digital assets. In addition, FTX is actively engaging in Bitcoin derivative trading as a strategy to mitigate exposure to the cryptocurrency while also seeking to amplify yield from its digital assets. The firm is also evaluating potential pathways to possibly reinstate its exchange operations.

This move to augment FTX’s cash reserves has paralleled an increase in the value of customer accounts. Since the unraveling of FTX in November 2022, bankruptcy advisors have diligently worked to recover assets, reaching agreements aimed at benefiting holders of smaller accounts on the platform. Furthermore, FTX has initiated significant legal actions against former affiliates of Sam Bankman-Fried and certain crypto entities such as Bybit Fintech Ltd., which extracted funds from FTX prior to its Chapter 11 filing.

Claims See Increased Trading Value, Full Repayment Unlikely

According to investment firm and bankruptcy claims broker Cherokee Acquisition, customer claims exceeding $1 million against FTX were trading at approximately 73 cents on the dollar as of Friday, marking a substantial increase from about 38 cents in October. Cherokee Acquisition noted that actual trading values vary based on the specifics of each claim among other variables.

Despite this uptick in claim values, FTX has indicated that it does not anticipate customers will receive full reimbursement. Moreover, customers of FTX.com are projected to absorb a larger share of the financial losses. A considerable number of FTX customers are contesting a proposal from the company which seeks to fix the value of their digital assets at the point of the company’s bankruptcy filing.

This move would exclude them from benefiting from the significant rally and recovery of Bitcoin and other tokens over the past year.

The ongoing case is registered as FTX Trading Ltd., 22-11068, in the US Bankruptcy Court for the District of Delaware.