Tether Under Threat? USDT Could Be Usurped as Top Stablecoin if US Bill Passes Says S&P

Tether to Become Illegal in US? | Fathromi Ramdlon/Pixabay

Key Takeaways

- A bipartisan stablecoin bill aims to create a comprehensive regulatory but it could challenge Tether’s dominance.

- The Lummis-Gillibrand Payment Stablecoin Act could boost the market, says S&P Global.

- Since Tether is not based in the US, another stablecoin could threaten its dominance

- How do changes in reserve requirements and redemption mandates affect top stablecoins?

The Bipartisan Lummis-Gillibrand Payment Stablecoin Act.has been introduced. The legislation has the potential to reshape the stablecoin market. However, according to S&P Global, the framework could undermine Tether’s (USDT) position while favoring adoption.

Since Tether is not based in the US, it is possible another, American-based, stablecoin could remove USDT from its position as the number one stablecoin.

How Does Stablecoin Bill Threaten Tether?

Republican Senator Cynthia Lummis and Democratic Senator Kirsten Gillibrand have proposed stablecoin regulations in the latest bipartisan bill. A new report by S&P Global believes that the bill will boost adoption but could negatively affect Tether.

The key proposals of the Lummis-Gillibrand Payment Stablecoin Act, which was introduced on April 17, promise investor confidence. It seeks to establish a legislative foundation around the issuance threshold,transitional provisions, stringent reserve requirements, and disclosure norms while banning algorithmic stablecoins.

S&P has commented that the bill could limit Tether in the US because it is issued by a non-US entity. The bill’s strict rules aim to gain endorsement from crypto skeptics in the Senate and make it an unpermitted payment stablecoin under the bill’s terms.

S&P notes that US entities would not be allowed to hold or engage in transactions using Tether. The restriction could lead to a decrease in Tether’s demand in the US market while boosting the demand for stablecoins issued within the US

However, the report also pointed out that most of Tether’s transaction activity occurs outside the US, particularly in emerging markets. Retail users and remittances largely drive Tether’s use in these regions.

Tether Diversifies Operations

The US Treasury recently named Tether in a list of Russian tools used to circumvent sanctions. This comes as Tether remains the top stablecoin by volume with the figure surpassing $110 billion.

A fall is expected while the proposed US regulation might potentially impact its usage within the region. However, its global dominance may be less affected due to its strong presence in other parts of the world.

However, Tether has planned its business diversification after the potential restrictions were laid down in the bill. Its new framework comprises of data, finance, power, and education and moves away from core revenue from USDT.

As per the recent press release, Tether Data will focus on the strategic development and investment in emerging technologies such as artificial intelligence and peer-to-peer platforms. Tether Finance would leverage blockchain technology to democratize financial services.

Tether Power will reportedly venture into sustainable Bitcoin mining, and Tether Edu will impart digital skills and education.

Impact on the Stablecoin Market

S&P finds that the clarity provided by the bill could drive more banks and financial institutions to enter the stablecoin market, offering them a competitive edge. Meanwhile, non-banks have a $10b threshold.

The bill also proposes changes in how digital asset custodians report their holdings, shifting away from the SEC’s previous requirement to treat digital assets as on-balance-sheet items.

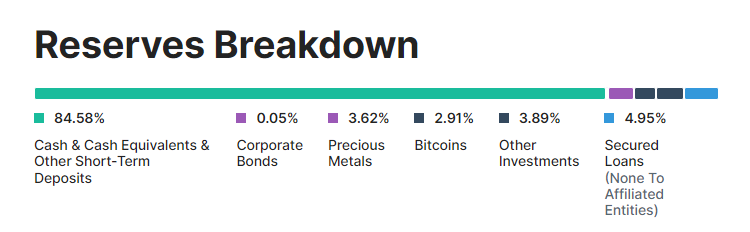

S&P outlined specific reserve requirements for stablecoins. These include:

- Segregating assets to distinguish company funds from customer deposits.

- Making sure all issued stablecoins are fully redeemable.

- Restricting reserve assets to highly liquid and low-risk options.

Notably, the permitted reserve assets comprise

- Cash.

- Bank deposits, Short-term Treasury Bills with maturities of no more than 90 days.

- Repurchase agreements that mature within seven days.

- Deposits held at the Federal Reserve.

While this is expected to bring stability, stablecoins that are backed by Bitcoin will also have to relocate their funds.

What is Next for Stablecoins?

If passed, the Lummis-Gillibrand Payment Stablecoin Act will alter the US stablecoin market. But it will have to satisfy skeptic Senators as well.

While the act aims to integrate stablecoins more deeply into the financial system, it also puts transparency in line with other regulatory standards.

But this could mean a diminished role for Tether in the US while opening up new opportunities for other stablecoins backed by financial institutions.