Ethereum ETF on the Table Even if It’s a Security: BlackRock Boss

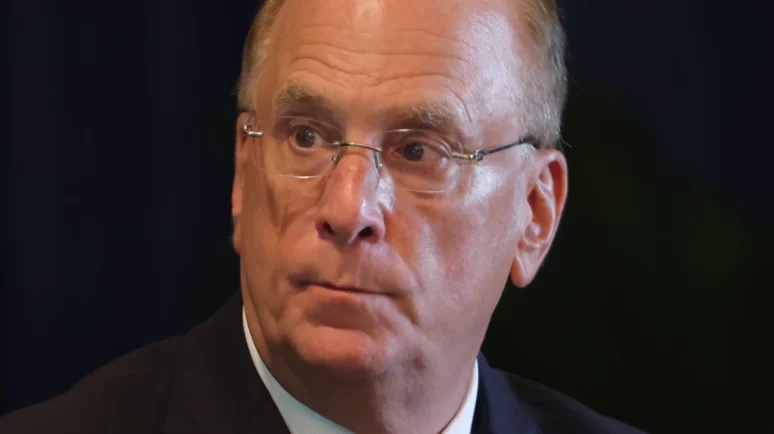

BlackRock's Fink is bullish on crypto, especially Bitcoin. | Credit: John Lamparski/Getty Images

Key Takeaways

- Larry Fink is optimistic about the future of cryptocurrencies, especially Bitcoin.

- While BlackRock has expressed interest in an Ether ETF, the SEC’s scrutiny of Ether as a security creates uncertainty.

- The potential classification of Ether as a security highlights the evolving regulatory landscape surrounding cryptos.

BlackRock’s CEO Larry Fink is undeterred by the possibility of the U.S. Securities and Exchange Commission (SEC) classifying Ethereum’s Ether as a security.

He suggested that the creation of an Ether-based Exchange Traded Fund (ETF) remains feasible, despite the increased regulatory measures that would accompany such a designation for the world’s second-largest cryptocurrency.

BlackRock CEO Bullish on Ethereum ETF Despite Security Concerns

In a recent interview , Fink addressed the potential of listing an Exchange-Traded Fund (ETF) that includes Ethereum’s ETH, even amid speculation about its classification as a security by the United States Securities and Exchange Commission.

Fink expressed optimism, stating : “I think so.”

This follows BlackRock’s introduction of a Bitcoin ETF earlier in the year, marking a significant move into the crypto space by the world’s largest asset manager.

Ethereum ETF Faces Uncertainty as SEC Scrutinizes Classification

The SEC is scrutinizing Ethereum to determine if it should be classified as a security.

This regulatory uncertainty has sparked debate over the feasibility of an Ethereum ETF in the US. However, Larry Fink’s optimism stands out amid this backdrop. Despite the regulatory ambiguity, eight potential issuers, including BlackRock, have moved forward with SEC filings for a spot Ethereum ETF.

The industry awaits the SEC’s decision in May, though skepticism remains about approval, independent of the SEC’s classification of ether. This ongoing situation reflects the complex and evolving regulatory landscape surrounding cryptocurrencies in the U.S.

BlackRock Bets Big on Crypto: Bitcoin ETF Booms, Ether on Watch

BlackRock has significantly expanded its footprint in the cryptocurrency market. It has not only proposed a spot Ethereum ETF but has also became one of 11 issuers of spot Bitcoin ETFs.

The firm’s iShares Bitcoin Fund (IBIT) has seen remarkable success, amassing over $15 billion in assets within just two and a half months of its launch. Larry Fink heralded IBIT as the “fastest growing ETF in the history of ETFs” during an interview.

Fink commented :

“Look, I’m very bullish on the long-term viability of Bitcoin. We’re creating now a market that has more liquidity, more transparency, and I’m pleasantly surprised, and I would never have predicted that before.”

On the topic of whether BlackRock plans to introduce an Ethereum-based fund following its Bitcoin ETF’s success, Fink’s response was non-committal, stating: “We’ll see.”

This suggests that, while BlackRock is closely monitoring the evolving regulatory landscape and market demand for cryptocurrency investment products, any decisions regarding the launch of an Ethereum fund remain under consideration and dependent on a variety of factors, including SEC rulings and market readiness.