Bitcoin Price Outperforms Google, Microsoft, and Elon Musk’s Tesla

Bitcoin Vs Tech Giants | Image: Pete Linforth/Pixabay

Key Takeaways

- Bitcoin price has outperformed Tesla stocks in terms of investment value since early 2021.

- BTC prices rose over 63% against Tesla’s stock, while the crypto has done better than Google and Microsoft in the last year.

- Tesla remains one of the largest public holders of Bitcoin but has missed earnings expectations.

Bitcoin’s price rally has taken a pause but tech darling Tesla has also underwhelmed Wall Street with its first quarter results. The multi-year drop in Tesla revenue followed the ambitious announcement by the carmaker to roll out the next generation of affordable EVs. The development pulled Tesla’s stock price up but it is still unmatched to Bitcoin returns.

Meanwhile, Bitcoin has also outpaced Google and Microsoft in the last year.

Tesla Faces Financial Pullback But Bitcoin Stellar Investment

Tesla’s financial health has shown signs of strain in its first quarter report. The car maker’s first-quarter earnings for 2024 reported a 9% drop in sales and a 48% decline in year-on-year adjusted profit. In response, the Elon Musk-led company has said that a plan for more affordable models is in queue for 2024.

The company’s share price surged by at least 12% following the announcement. At the same time, Bitcoin price in the post-halving week has slowed down. On April 25, BTC was down around 5%. Despite this, the Bitcoin return against Tesla stocks is unmatched.

This means that Tesla is seeing a setback in its core automotive business while making significant strides as a Bitcoin investor. The company is currently the third-largest public holder of Bitcoin, with a total of 9,720 BTC, according to Bitcoin Treasuries. The investment has been a relatively bright spot as TSLA has a 35% YTD drop.

Since reporting its Bitcoin holdings in early 2021, Tesla benefitted from a Bitcoin price rise of around 64%. Tesla’s stock price has decreased by 43% in USD terms during the same period.

The relative performance against Bitcoin is even more telling, with Tesla’s stock price falling by 65% compared to Bitcoin.

Bitcoin’s Growth Over Time

Bitcoin’s performance, particularly in comparison to company returns, is notable.

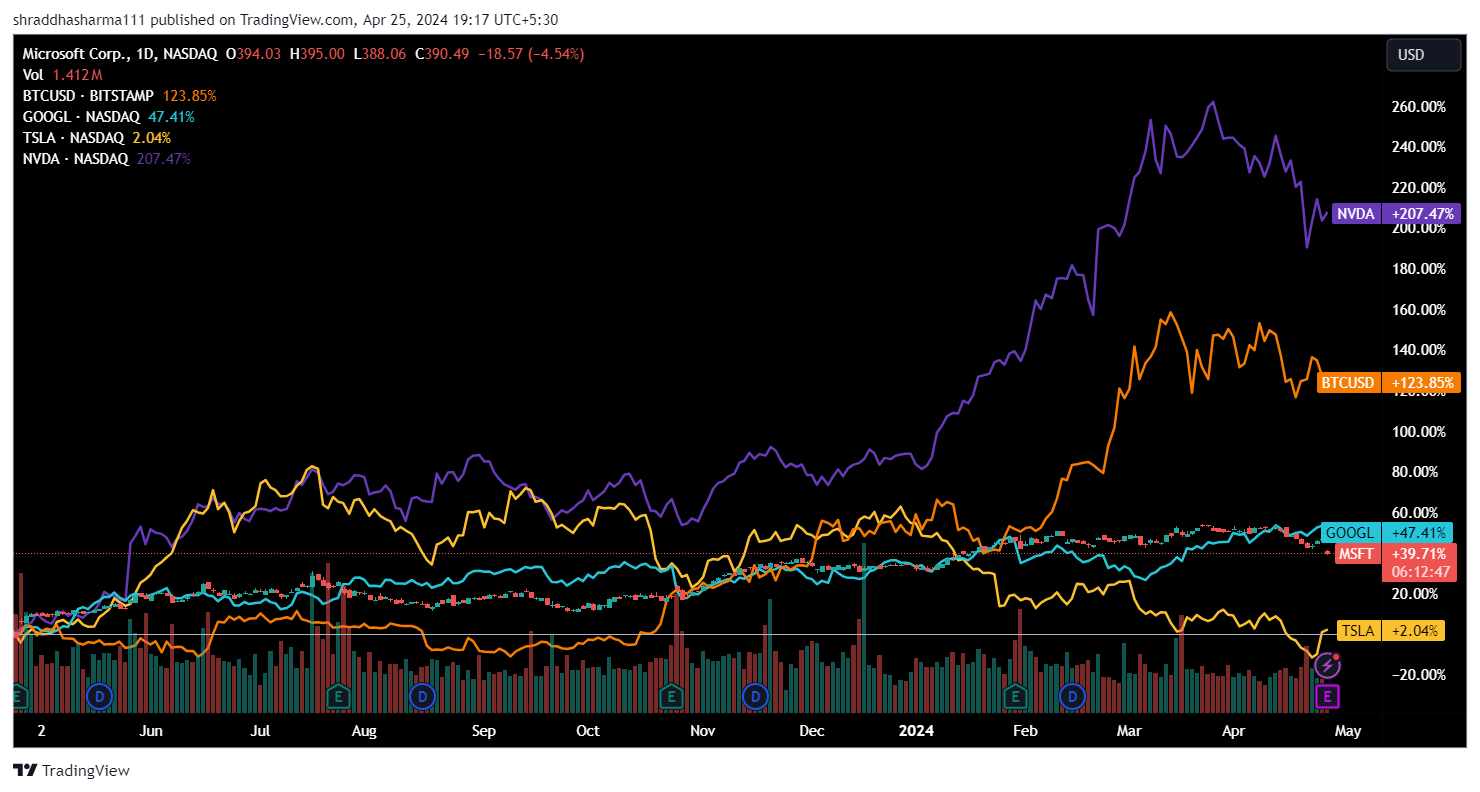

In one year, between Google, Microsoft, Tesla, and Nvidia, only the AI chipmaker has outperformed Bitcoin. In the category, Google registered a 47% gain while Bitcoin gained 124%. Microsoft gained close to 40% while Tesla’s gains were worst in the category at 2%.

Outside the tech universe, the stock of mining company Marathon Digital Holdings has underperformed to Bitcoin by at least 28% since 2021. Coinbase Global stocks against Bitcoin are down 68%.

Stocks of Canada-based Hut 8 Mining Corp are down 41% against Bitcoin. Meanwhile, Bitcoin is witnessing occasional volatility as April concludes.

Recently, CoinShares reported that Bitcoin experienced an outflow of $192m, indicating more investors withdrew their investments than added new funds. The report also underlined that the $18b trading volume of ETPs made up 28% of all Bitcoin trading volume. However, a month ago the percentage was 55%.

However, Bitcoin’s ability to outperform major corporate entities like Tesla highlights its potential as a diversifying asset in broader investment portfolios. Especially over a longer term on the sidelines of geopolitical tensions.

Can Corporates Outperform BTC?

The tale of Bitcoin versus Tesla is one of underlying strength over a longer period. While Tesla continues to innovate, it faces financial headwinds. Stocks of several crypto players like mining giants Marathon and Hut, along with Nasdaq-listed exchange Coinbase, have stayed behind Bitcoin in price returns.

Portfolio losses also partly subsided with investment in BTC for these companies. Therefore, Bitcoin’s rise in value does show its resilience as an alternative investment asset.