Runes Hype Over? Bitcoin Mining Profits Collapse as Enforcement Actions, Difficulty Levels Surge

Bitcoin Profitability Takes a Hit After Halving | Image: Zhang Xinjun CostfotoFuture Publishing via Getty Images

Key Takeaways

- The hype surrounding Runes and its impact on Bitcoin mining profits might be fading.

- Electricity demands and operational costs for mining Bitcoin have increased post-halving.

- The overall difficulty in mining Bitcoin has seen a rise over the past year.

In the buildup to the 2024 Bitcoin halving event, discussions were rife about the potential impact on Bitcoin miners. After Runes minting created some hype, difficulty levels, and costs are keeping profitability low.

Soaring Costs in Bitcoin Mining, Runes Hyped Up

The Bitcoin halving seemed profitable for miners at first. Later, however, it turned out that the increased profits were, at least in part, due to the influence of Runes minting. Runes is a classic example of high anticipation and abrupt descent. The platform, founded by Casey Rodarmor, who is also behind the Ordinals project, helps people generate fungible tokens directly on the Bitcoin blockchain. The hype around Runes peaked when its launched coincided with the fourth Bitcoin halving.

The excitement over Runes led to a massive surge in network transactions as users rushed to mint these new tokens. This minting frenzy contributed to Bitcoin miners earning a record-breaking $107.7 million in a single day. Interestingly, over 75% of this revenue was derived not from the block rewards but from network transaction fees, on the back of a high volume of activity spurred by Runes.

Despite the impressive start, the enthusiasm for Runes has quickly cooled off. And lower transaction volume is evident in the miner profits.

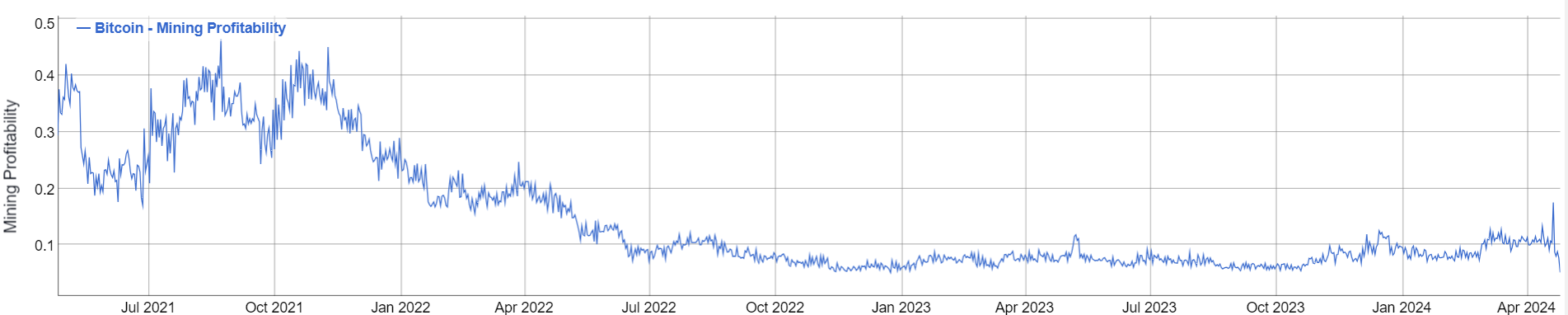

A Change to Mining Profits

Bitcoin mining profitability is shifting, influenced by increasing costs and regulatory challenges. According to the S&P Global Commodity Insights Bitcoin Energy Consumption Index, the energy required to mine a single Bitcoin has doubled, yet total daily energy consumption has remained stable after April 19.

The report finds that the surge in energy requirement per Bitcoin has effectively doubled the break-even point for miners, making mining less profitable overnight.

While the price of Bitcoin has remained stable, there has been no significant impact on electricity prices. But the increased energy per Bitcoin has heightened the financial burden on miners. Kjetil Pettersen, CEO of KryptoVault, explains that the profitability of mining halved immediately after the halving. He suggests that a potential increase in Bitcoin’s price or a drop in the global hash rate could eventually stabilize profitability.

The Challenge of Increased Difficulty

The difficulty of mining Bitcoin is a critical factor. It adjusts based on the total computational power in the network to maintain an average block generation time of 10 minutes.

According to yCharts , the Bitcoin Average Difficulty has risen to a current level of 88.10T on April 25, 2024. This marks an 80.87% increase from 2023. The difficulty level indicates another challenge for miners, further squeezing their profits.

Meanwhile, recent enforcement actions could increase the compliance cost. The United States Securities and Exchange Commission (SEC) recently took legal action against Texas-based Geosyn Mining, LLC, and its co-founders for an unregistered and fraudulent securities offering. In a separate release, the FBI issued warnings about the use of unregistered cryptocurrency money-transmitting services that do not comply with federal anti-money laundering regulations.

Therefore, there is a necessity for cryptocurrency operations to keep up with legal standards. Particularly in terms of registration and compliance. Compliance costs can pile up for miners in the foreseeable future.

At the time of writing , mining profitability stands at $0.0513 per day for 1 THash/s as the price has not lifted to its previous highs.

Can Miners Sustain Profits?

Bitcoin mining is undergoing significant changes after the 2024 halving coupled with recent enforcement actions. The post-halving increase in operational costs, combined with a rise in mining difficulty could pressure profitability for miners.

While the early days post-halving seemed profitable, the ongoing developments suggest a slightly tougher road ahead for those dependent on mining for income. However, a sustained price rise could help keep the profits stable.