Caroline Ellison May Also Face Jail Time Despite Helping Put Sam Bankman-Fried Behind Bars

Caroline Ellison was the prosecution’s star witness but her sentencing is still onknown. | Credit: Michael M. Santiago/Getty Images

Key Takeaways

- Caroline Ellison played a pivotal role as the prosecution’s key witness in the case against Sam Bankman-Fried.

- Ellison admitted guilt in December 2022 and is still awaiting her sentencing.

- SBF’s ex-girlfriend was among the first individuals Bankman-Fried enlisted as he ventured into the cryptocurrency sector.

In the sentencing of FTX founder Sam Bankman-Fried to 25 years in prison on Thursday, Judge Lewis Kaplan highlighted the impactful testimony of Caroline Ellison.

Ellison was not only an early member of Bankman-Fried’s cryptocurrency venture but also an ex-girlfriend.

Ex-Girlfriend’s Testimony Key in FTX Founder’s Conviction, Judge Says

During the hearing in downtown Manhattan, Kaplan emphasized Ellison’s assertion about Bankman-Fried’s awareness of his wrongdoing, stating :

“I keep coming back to Ms. Ellison’s testimony that he knew it was wrong. He knew it was criminal.”

Ellison emerged as a crucial witness for the Department of Justice in its case against Bankman-Fried, following her agreement to a plea deal in December 2022, which occurred a month after FTX declared bankruptcy.

In her significant role during the criminal trial later that year, Ellison provided the prosecution and jury with vital evidence including text messages, documents, and confidential recordings. This evidence was instrumental in securing a guilty verdict against Bankman-Fried on all seven charges filed against him.

Following the sentencing on Thursday, Manhattan U.S. Attorney Damian Williams issued a statement condemning Sam Bankman-Fried’s actions, stating that his “deliberate and ongoing lies showed a stark disrespect for his customers’ trust and a flagrant disregard for the law, all to clandestinely funnel his customers’ funds into expanding his own power and influence.”

Ellison, who led FTX’s affiliate hedge fund, Alameda Research, confessed to two counts of wire fraud, two counts of conspiracy to commit wire fraud, as well as conspiracies to commit commodities fraud, securities fraud, and money laundering.

Although Ellison is subject to sentencing guidelines similar to those of Bankman-Fried, her cooperation with the authorities as a witness is expected to significantly reduce her sentence, highlighting the benefits of her pivotal testimony in the case.

From Wall Street to Crypto: Ellison’s Rise and Fall with FTX Founder

In 2017, Caroline Ellison made a significant career move from her trading position at Jane Street, where Sam Bankman-Fried also started his financial career, to join the early stages of Alameda Research. This decision was driven by Bankman-Fried, a fellow Stanford graduate, who persuaded her to leave Wall Street and come aboard at Alameda’s initial Bay Area setup.

Ellison’s relationship with Bankman-Fried was multifaceted, marked by periods of romantic involvement and cohabitation. Her path closely followed Bankman-Fried’s, moving from California to Hong Kong, and eventually to the Bahamas, mirroring the shifting base of operations for his cryptocurrency ventures.

Author Michael Lewis captures Ellison’s role and experiences within Bankman-Fried’s business empire in his book “Going Infinite,” which narrates the swift rise and fall of Bankman-Fried. In 2021, Ellison was elevated to CEO of Alameda, a position for which, Lewis notes, there were mutual reservations about her fit, reflecting on the challenges and intricacies of her ascent within the cryptocurrency domain.

Lewis wrote:

“Caroline sensed that, even as Sam promoted her to CEO of Alameda Research, he disapproved of her job performance — and she shared his opinion.”

He also shared a piece from one of the memos that Ellison had sent Bankman-Fried:

“It feels like I’m doing a much worse job managing Alameda than you would if you were working on it full-time.”

From Amphetamine Tweets to Witness Tampering Drama

In April 2021, Caroline Ellison, then CEO of Alameda Research, sparked controversy with a tweet mentioning “regular amphetamine use.” The tweet went on to describe the significant effort it took for her to get motivated for basic activities.

Despite her leadership role, court documents reveal Ellison’s compensation lagged behind other FTX executives. While the exchange distributed $3.2 billion amongst its founders and senior employees, Ellison received only $6 million . In comparison, the head of engineering, Nishad Singh, received $587 million, co-founder Gary Wang got $246 million, and Sam Bankman-Fried took home a staggering $2.2 billion.

Ellison’s private diary entries , disclosed by Bankman-Fried to The New York Times , became the subject of a report published last July, well ahead of the trial. This revelation not only intensified scrutiny around the case but also led to Bankman-Fried’s re-incarceration. Judge Kaplan revoked his bail, citing the dissemination of these entries as an act of alleged witness tampering, highlighting the ongoing legal and personal drama surrounding the collapse of FTX and its affiliated entities.

Frustrated CEO’s Testimony Against Ex-Boyfriend

In a document dated February 2022, Ellison wrote :

“I have been feeling pretty unhappy and overwhelmed with my job. … At the end of the day I can’t wait to go home and turn off my phone and have a drink and get away from it all. It doesn’t really feel like there’s an end in sight.”

Ellison delivered a key testimony against Bankman-Fried by claiming she followed Bankman-Fried’s instructions, including misusing FTX customer funds to prop up Alameda during a cryptocurrency slump. The sheer size of these transactions, exceeding FTX’s profits, led her to suspect wrongdoing. One example involved a massive $1 billion transfer from FTX to repurchase equity from Binance.

Ellison also expressed frustration with Alameda’s leadership, criticizing both Bankman-Fried and co-CEO Sam Trabucco. Her testimony revealed a strained relationship with Bankman-Fried. She avoided eye contact and their communication dwindled to messages despite living together, highlighting the tension between them.

Encrypted Messages Seal Bankman-Fried’s Fate

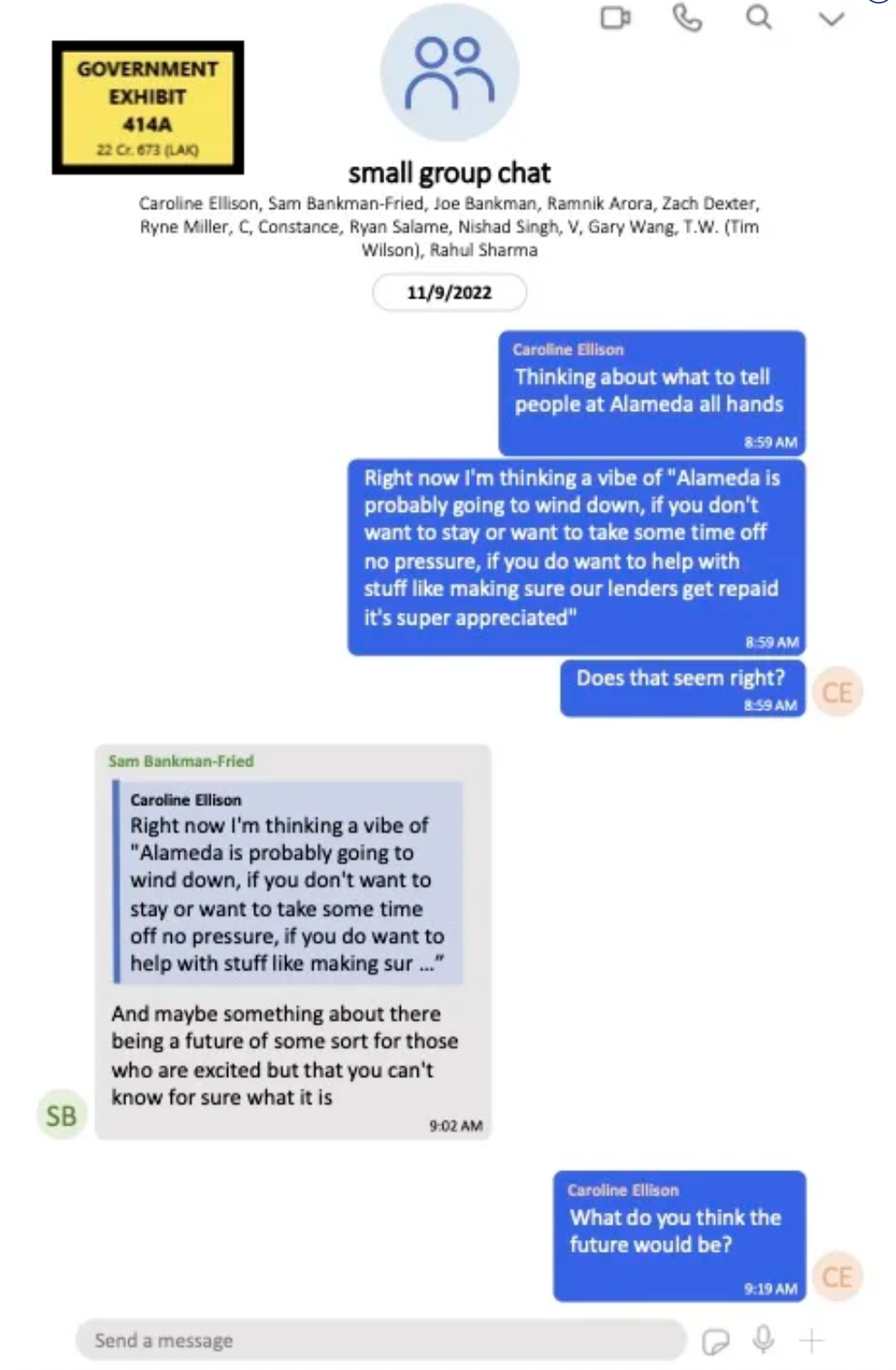

Among the vast array of evidence presented at the trial, a collection of messages from the encrypted app Signal proved to be particularly damaging for Bankman-Fried. The prosecution showcased a series of Signal messages between Bankman-Fried, Ellison, Wang, and other senior executives. In a notable exchange from November 8, 2022, Ellison reached out to Bankman-Fried and other key figures, seeking assistance with managing public perception and communications.

On that day, FTX halted all customer withdrawals.

The next day, Ellison sought advice from her colleagues on conducting an all-hands meeting for Alameda’s approximately 30 employees. She intended to inform them that Alameda was likely to cease operations, reassuring them there was no obligation to remain but any assistance in ensuring lenders were repaid would be greatly valued.

Bankman-Fried advised her to convey a message of a potential future for those who remained enthusiastic about staying on.

Ellison ultimately revealed much more during the staff meeting, the details of which were made public to the jury through a secret recording played during the trial.

At the meeting, Ellison explained that Alameda had taken out significant loans to finance its investments. She mentioned that as cryptocurrency values declined, FTX found itself lacking customer funds. This led to users beginning to withdraw their investments, at which point it became clear they could not sustain operations.

When a staff member inquired about whose decision it was to cover Alameda’s loan deficits with FTX customer funds, Ellison responded uncertainly with, “Um, Sam, I guess,” accompanied by a giggle. She further noted that, to her knowledge, FTX had historically permitted Alameda to borrow from user funds.

Ellison’s testimony against her former boyfriend was incriminating, offering jurors a glimpse into the personal dynamics behind the cryptocurrency empire and placing the majority of the blame on Bankman-Fried. This approach seemed effective, as evidenced by Bankman-Fried’s motionless posture, looking down at his hands in his lap, upon hearing the guilty verdict. Ellison’s sentencing, however, is pending.