DOGE Day Approaches — Analyzing Dogecoin Price Behavior in Lead-Up to April 20

How Will DOGE Price React to DOGE Day? | Credit: Getty Images

Key Takeaways

- There are only five days left until DOGE Day on April 20.

- Dogecoin’s price has corrected since March 28.

- Will DOGE Day cause a noticeable movement in the DOGE price?

DOGE Day is the informal holiday created by Dogecoin enthusiasts that falls on April 20. To emphasize the lighthearted nature of the memecoin, the community chose to honor the 420 meme by choosing April 20 as the date.

The DOGE price already bounced over 25% since its April 14 lows. Will the anticipation surrounding DOGE Day reinforce this upward trend and lead to the retracement of the entire correction?

Movement in Previous DOGE Days

A look at the four previous DOGE Days shows that there is no visible pattern of price movement in the days leading up to and around April 20.

In 2020 and 2023 (green), the DOGE price created small bullish weekly candlesticks, while in 2021 and 2022 (red) it created small bearish candlesticks.

Furthermore, the price was in a long-term uptrend in 2020 and 2021, while it was in a downtrend in 2022 and 2023.

Finally, incorporating the RSI does not tie up anything together. The RSI has been below 50, above 50 and in overbought territory throughout the previous ocassions.

As a result, the weekly time frame shows that there is no discernible DOGE price pattern that creates leading up to or following DOGE Day.

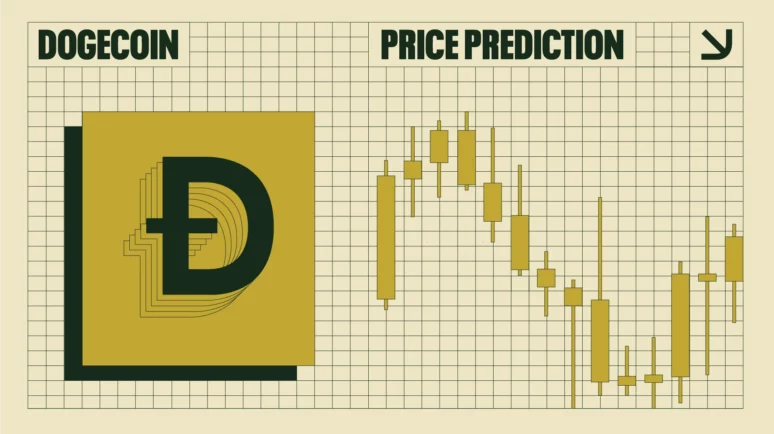

DOGE Price Prediction: Is the Correction Over?

The daily time frame wave count shows that DOGE has completed a five-wave upward movement starting in August 2023. Then, it completed an A-B-C corrective structure, reaching and bouncing at the 0.5 Fib retracement support level (green icon).

The bounce also reclaimed the $0.148 horizontal support area. The previous time this happened (green circle), it led to an 86% increase and a new yearly high.

While the depth of the decrease aligns with a completed correction, its length does not. The previous upward movement lasted for 224 days, while the correction has only lasted 16.

So, it is possible that the decrease is only the first portion of a larger correction. The middling RSI at the 50 level aligns with this outlook.

Even if this is the case, DOGE price will likely increase by another 25% and reach the $0.200 resistance area. The reaction to it will determine whether the entire correction is complete, or another drop is expected.

On the other hand, closing below the $0.145 horizontal area will mean the trend is still bearish. If that happens, DOGE can fall to the next support at $0.11.

Short-Term Bounce Likely

Due to the reclaim of the minor support at $0.145, it is likely the DOGE price has reached a local bottom. While the long-term trend is uncertain, a short-term bounce toward $0.200 is the most likely scenario based on the wave count and price action. A daily close below $0.145 will invalidate this positive scenario and could lead to a deeper retracement.