Nasdaq FOMO Meets Crypto: This Bitcoin ‘IPO’ Could Break the Stock Market

What impact will a Coinbase IPO have on the stock market - or bitcoin, for that matter? | Image: Useacoin/shutterstock.com

- Cryptocurrency exchange Coinbase is gearing up for a public listing.

- Bitcoin fear of missing out (FOMO) is set to collide with a tech bubble on Wall Street.

- Sorry Tesla, did the stock market just find its new cult favorite?

Coinbase, the $8 billion bitcoin exchange, is planning an IPO to become a publicly-listed company . As rampant speculation sweeps the investing world, Is there a more devastating FOMO combination than the world of cryptocurrency diving headlong into a frothy tech bubble?

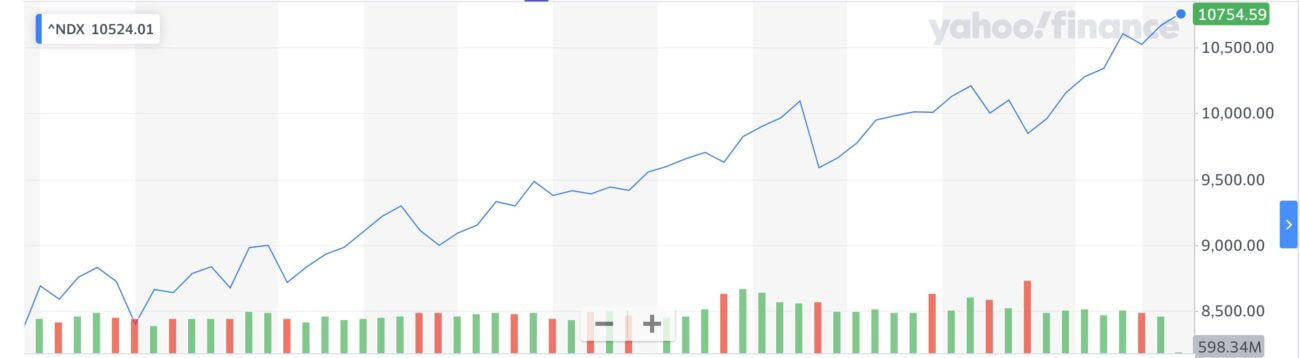

Nasdaq Tech Bubble, Meet Bitcoin

Bitcoin’s massive rally in 2017 is probably one of the most famous speculative bubbles in recent memory. After a stock market crash earlier this year, the latest FOMO craze has been buying beaten-up equities, with a particular penchant for bankruptcy. As those companies have struggled recently, the tech sector has forged ahead.

Companies like Nikola (the EV company that has yet to sell a car) have seen enormous gains, while established giants like Amazon and Apple are trading at record highs despite record unemployment claims in the United States.

Enter Coinbase.

As the largest and most recognizable cryptocurrency exchange, it has found the right time to IPO.

Coinbase Eyeing Draftkings’ Incredible Public Success

When trading legends like billionaire Paul Tudor Jones have purchased bitcoin as an inflation hedge, how hard is it to imagine that more pension funds want a coin or two? Especially with almost every major central bank printing money like there’s no tomorrow .

Given bitcoin’s limited liquidity, the prospect of higher transaction volume would be great news for Coinbase. Bitcoin is an easy proposition to sell, and so is Coinbase. That’s why the FOMO could get crazy.

Existing demand is likely why Coinbase is not going through a traditional IPO. Instead, the exchange is diving straight into the market via a direct listing.

Why give up a bigger slice of the deal when the product sells itself? If you have the cash flow, a direct listing makes sense. A quick exit (no oppressive stock lockups) and a faster listing are also benefits.

Coinbase will undoubtedly have seen how successful Draftkings’ public move was.

A crypto stock could benefit from similar demand for speculation in a fledgling industry. At the same time, Coinbase gets some much needed (and cheap) marketing exposure.

Long-Term Value For Shareholders, Or Insider Cash-Out?

Nasdaq and Coinbase are a FOMO match made in heaven. Publicly-traded exposure to the crypto business is still a rare commodity, and Wall Street wants anything with a decent growth story.

Behind the scenes, is there another explanation for the rush to IPO? It could be that indicators are starting to suggest that the economic sugar rush has peaked and its cash-out time for insiders.

In the meantime, let’s see how crazy things can get for Coinbase’s stock.

Armchair investors, get your popcorn ready.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds an investment position in bitcoin.