Morgan Stanley Fears Trade War Recession in 2020 as Stock Market Burns

An escalating trade war could spell economic doom with recession in 2020, warns a Morgan Stanley analyst.

By CCN.com: Morgan Stanley’s chief economist expects a global recession in three quarters if the trade war escalates, CNBC reported Sunday . In May Donald Trump hiked tariffs on Chinese imports from 10% to 25%. The move sent equities into a tailspin, wiping out $1 trillion from global stock markets on the next day of trading.

The U.S. also threatened to expand the 25% tariff to include $300 billion more Chinese goods. Morgan Stanley’s chief economist, Chetan Ahya, warned of the dire consequences in a research note Sunday. He said it would put the world “in a recession in three quarters.”

Ahya wrote:

“Investors are generally of the view that the trade dispute could drag on for longer, but they appear to be overlooking its potential impact on the global macro outlook.”

Speaking on Bloomberg Surveillance, he outlined what that potential impact would be:

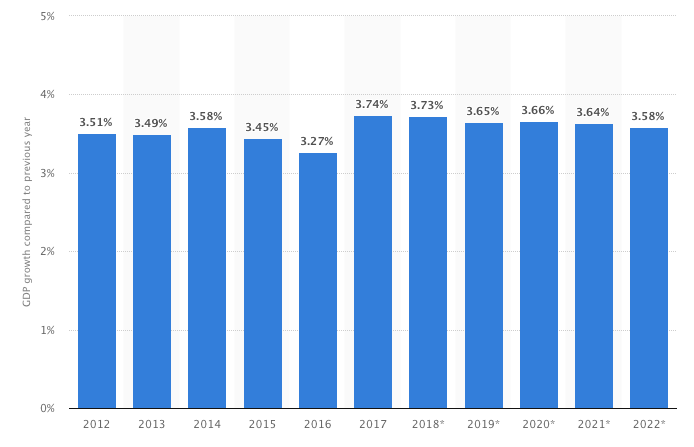

“We think you will probably in that scenario see a recession in the U.S., see a recession in global economy –– which is basically that the global economy will reach below 2.5% year on year growth by 2020.”

Stock Market Facing Massive Downside Risk

A trade war recession appears likely to hit equities first. The stock market is already slogging through a record six week losing streak. That’s the longest streak of week over week losses for the Dow in eight years . Just the uncertainty over the possibility of a trade war escalation has been enough to keep the stock market down.

While investors are selling off stocks, they’re piling up global macro hedges. U.S. Treasury bonds and even cryptocurrencies are on a bull run. That makes the trade war a possible factor in the bitcoin price pump this spring as institutional investors hedge their portfolios with “digital assets.”

“It’s The Economy, Stupid.”

President Donald Trump’s closest advisors and political allies understand that his reelection prospects hinge on a strong economy.

If Chetan Ahya’s analysis is correct and the White House levies tariffs on all Chinese imports, the ensuing recession would give Donald Trump’s crowded field of Democratic challengers some heavy campaign ammo to fight with in 2020.

When President George H. W. Bush ran for reelection in 1992, politicos thought he was all but assured of victory. The Gulf War to liberate Kuwait was one of the most popular and militarily successful actions in recent U.S. history. So much so that many big names in the Democratic Party declined to challenge Bush. That opened up an opportunity for a little known governor from Arkansas to make a bid for the Oval Office.

But a mild 8-month recession that spanned 1990 and 1991 –– with job numbers remaining sluggish through 1992 –– stood in the way of Bush’s reelection bid. Gov. Bill Clinton’s campaign manager, James Carville, sounded the death knell for Bush’s reelection when he coined the memorable slogan: “It’s the economy, stupid.”