Max Keiser Sets $28,000 Bitcoin Price Target as Market Falters

Bitcoin maximalist Max Keiser set an exuberant $28,000 bitcoin price target, citing an escalating hash rate and Game Theory. | Source: Shutterstock (i), Keiser Report/YouTube (ii). Image Edited by CCN.com.

By CCN.com: As the bitcoin price sputters this weekend, crypto bulls are stepping in to pump the market up.

Bitcoin permabull Max Keiser set an exuberant $28,000 bitcoin price target, citing its escalating hash rate and Game Theory.

The bitcoin maximalist is the host of the Keiser Report, a financial program broadcast on RT (formerly Russia Today).

Keiser: Game Theory points to higher price

On Twitter, Keiser reasoned that per the “protocol’s hard-coded Game Theory, hash precedes bitcoin.”

Keiser interprets that to mean that a $28,000 bitcoin price target is now in play. So is a bull run around the corner? Who knows?

The Bitcoin network’s hash rate has been gradually increasing since January 2019. It has been moving in tandem with mining difficulty, as CCN.com’s sister publication Hacked noted.

Bitcoin mining difficulty and the network’s hash rate tumbled in November and December 2018 during the Crypto Winter.

When mining difficulty spikes, it means miners are deploying more hash power into the network. This relationship largely correlates to bitcoin’s price and miners’ optimism about the market’s outlook.

Keiser: Bitcoin price is not everything

Max Keiser followed up with another tweet in French. In that post, Keiser noted that (according to CCN.com’s translation) “bitcoin is driven by a whole new school of economic theory corresponding to a new asset class.”

Despite hyping a $28,000 price target, Keiser underscored that “its price is one of the less important attributes in relation to its hash rate.”

Crypto bull stirs FOMO

Fellow bitcoin bull Raoul Pal tried to stir FOMO by urging investors to buy now while BTC’s price is deflated.

Pal, a retired hedge fund manager, excitedly tweeted that “if you don’t have any bitcoin, then this looks like the last time to board the rocket ship.”

He then posted a bitcoin price chart that he claims points to a near-term rally.

Skeptics: Bitcoin is ‘fundamentally flawed’

Meanwhile, skeptics predicted in May and June that the bitcoin rally at the time would end. Why? Because they say bitcoin is “fundamentally flawed.”

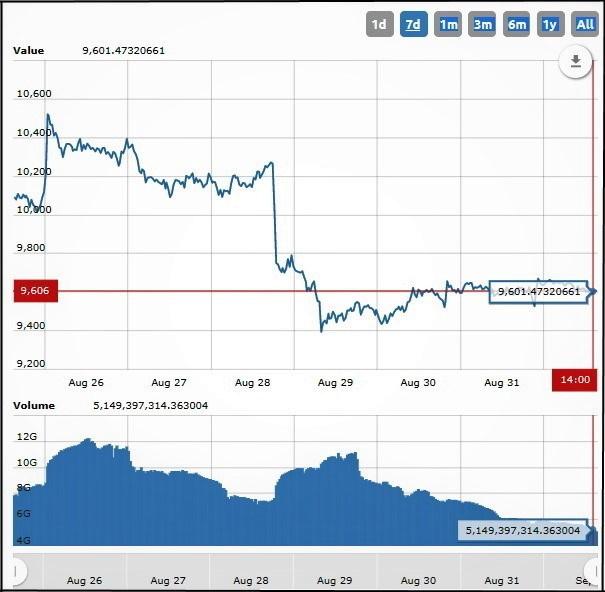

In early-July, bitcoin topped $12,400. Today, it’s hovering at $9,600.

As CCN.com reported, the Motley Fool’s Sean Williams attributed the June bull run to several factors that are unrelated to its fundamentals:

- Bitcoin halving in 2020.

- Potential SEC approval of a bitcoin ETF.

- Contact buzz surrounding Facebook’s Libra crypto launch.

According to Williams, a major catalyst that was driving bitcoin prices up in May and June is the forthcoming May 2020 halving.

That’s when BTC block rewards will be slashed in half. The halving is expected to buoy the price of nearly every cryptocurrency since most altcoins derive their USD value from BTC.

Blockchain expert Garrick Hileman, a research associate at the London School of Economics, explained the halving to CNBC in June (video below).

Critic: Bitcoin’s volatility is a huge handicap

However, Motley Fool’s Sean Williams insists that bitcoin is a flawed investment because he says:

- Bitcoin is not really “scarce.”

- Bitcoin has no utility in the real world.

- Stocks are better investment vehicles than crypto will ever be.

“One of the more common arguments from bitcoin bulls as to why it’s worth so much is its perceived scarcity,” Williams explained. “But there’s a catch…There’s no hard cap on the number of tokens that are in circulation. Rather, it’s computer code and community consensus that determine this cap. Although it’s unlikely that consensus would be reached to increase the 21 million token cap, the possibility of this happening is not 0%.”

In contrast, Williams says a physical store of value like gold is a truly finite asset. The gold that’s currently in existence is all the gold that will ever be on Earth. “That’s in stark contrast to bitcoin, which could have its token cap adjusted based on community consensus,” Williams notes.

Click here for a real-time bitcoin price chart.