Is Bitcoin’s Printing Press Propping up the Crypto Market?

Is Bitcoin-related inflation doing the heavy lifting in propping up the crypto market? | Source: Shutterstock

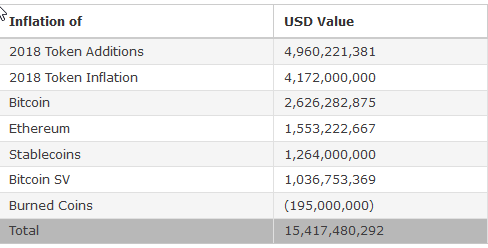

By CCN.com: The total market capitalization of the cryptocurrency market is currently over $120 billion. However, studies show that billions of dollars worth of this market cap is from built-in inflation. Over the course of 2018, $15 billion in new tokens entered the supply, buttressing the overall market valuation even as prices plunged.

Bitcoin Inflation Adds Over $5 Million Per Day

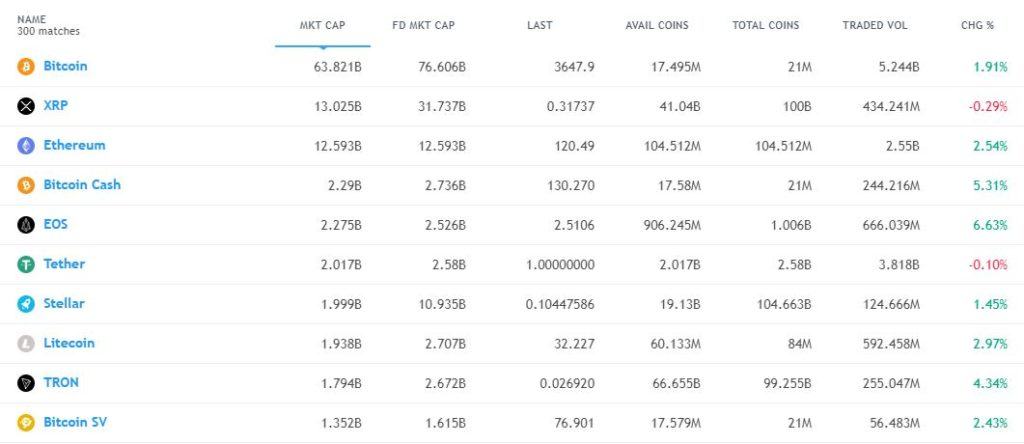

An average of once every 10 minutes, 12.5 new bitcoins are added to the market. If we just call the base price $3,000, that’s $37,500. The actual amount added to the market capitalization is actually significantly higher at present, but for the sake of argument, we’ll use an easy round number. It comes to a total of $5.4 million every single day in new coins. These new coins are also miner rewards, which means that their odds of winding up on the markets are high. Miners have slim margins even when markets are doing well (because more miners participate).

Bitcoin SV and Bitcoin Cash don’t always hit the 10-minute block target (neither Bitcoin nor any Bitcoin fork does, either), but for the sake of argument, we’ll say they do. That’s another 1,800 coins per day each, worth a combined total of another $360,000 at current prices. From this, we can extract that the three Bitcoin variants add a minimum of $5.7 million to the market capitalization every day. Every 175 or so days, that’s $1 billion, even if the markets were frozen and no trading was conducted.

Market Capitalization May Not Be the Best Metric

These figures are all in the middle of a bear market, where per-coin prices are low. The figures get much more extreme during bull runs. Ethereum and all of its tokens contribute to the inflationary effect as well. According to a new report in Diar , Ethereum itself added $1.5 billion via inflation. The whole of the market averaged around 35% in overall increases thanks to new tokens entering the market.

What does stand out even more as a sore thumb in the midst of a bubble burst was the $5Bn in value that cryptocurrency traders have appreciated in new tokens that did not exist at the start of the bear market – coins that, for all intents and purposes, remain to be no more than additional noise in an overcrowded decentralized promise-land. […] When all is said and done, new supply that came onto the blockchains during 2018 accounted for almost the whole market valuation that stood at the start of 2017.

Inflation is Not a Sign of Growth

The market capitalization figure is merely the price of tokens times the number of them. It doesn’t account for buy orders, which might paint a very different picture for the cryptosphere. If a central bank adds $1 billion new dollars to the economy, has the value of the fiat gone up or down? Is this actually any different in cryptocurrency?

The question of liquidity, even for Bitcoin, arises. Is there really money out there to buy all of the coins at anything like current prices? Trades happen on a micro basis. Portions of a coin or a small block of coins trade to infinity. Coins that enter a given market might trade hundreds or thousands of times before the same value exits. This creates the all-important metric of trading volume, which some exchanges fake.

But that’s a discussion for another time.

Featured Image from Shutterstock