ICO Exit Scams after Listing Ryan Gosling as Graphic Designer

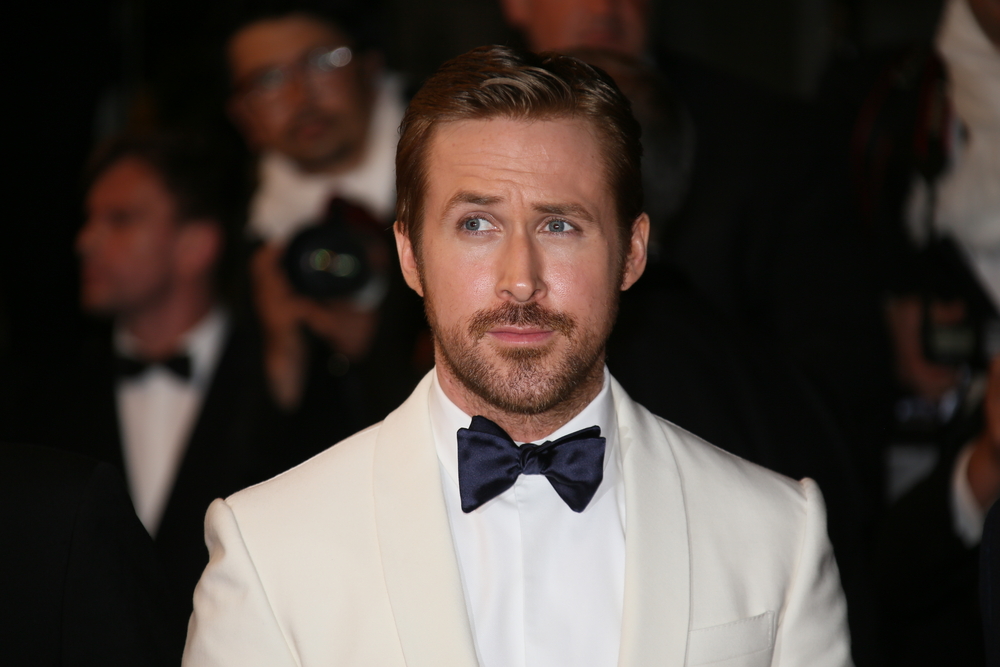

Another initial coin offering (ICO) has been outed as an apparent scam after it listed actor Ryan Gosling as the project’s graphic designer.

ICO Exit Scams after Listing Ryan Gosling as Graphic Designer

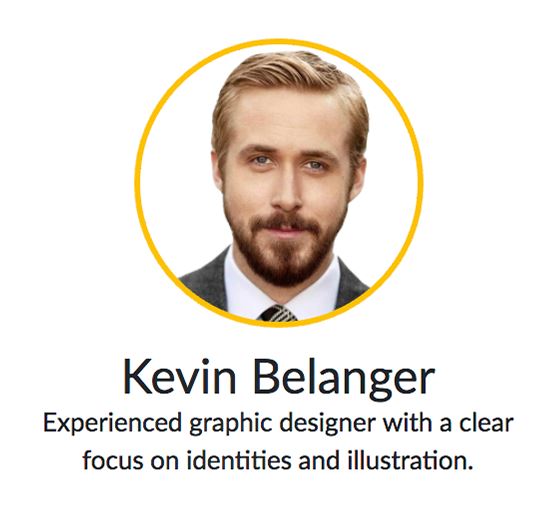

Several days ago, Twitter user @CryptoShillNye was perusing through ICOs when he came across something unusual on the website for Miroskii, a blockchain banking startup that claimed to have raised more than $833,000 from 389 contributors. The project’s graphic designer, “Kevin Belanger,” bears more than a passing resemblance to actor Ryan Gosling.

Now it’s possible that Mr. Belanger simply missed his calling in life as a Ryan Gosling body double/impersonator. However, developer Claus Wahlers did a bit more digging into Miroskii’s team and found — unsurprisingly — that the remaining members are apparently fake as well. Most of the images are stock photos, while several were lifted straight from social media users’ public profiles.

This discovery quickly made the rounds on social media. Likely realizing that the jig was up, the actual person or group behind the Miroskii ICO took the website offline, closed the project’s social media accounts, and made off with their $833,000 worth of ill-gotten proceeds — assuming those self-reported figures are accurate.

Red Flags Abound

However, an archived version of the ICO’s website reveals several other red flags that investors should have noticed.

First, Miroskii — which describes itself as a “Bank without any Bankers” — claimed that “Visa, Master Card [sic], Maestro Card, American express [sic] and many more” card issuers had signed on to issue Miroskii-branded cards. While cryptocurrency-funded debit cards do exist, they are currently only offered by a few companies, and it would not make sense that a startup would ink deals with three different card issuers. Moreover, this claim has been used to promote several other ICO scams, including PlexCoin.

Second, the website indicated that Miroskii Coin (MRC) was in the process “to get regulated under the EUROPEAN [sic] Union.” While it may be true that Miroskii’s “decentralized bank” would have been subject to EU regulations governing financial institutions, the project’s creator clearly meant to intimate that the company would receive a banking license — a highly unlikely scenario.

Third, Miroskii claimed that MRC had already been “tested, approved and accepted by most of the industry giants who has [sic] already started using the MRC in their closed B2B sector.” While perhaps technically true that MRC had been accepted by all of the companies that had started using the coin — i.e. zero companies — that is clearly not what the author meant to convey. Were MRC really being used by “industry giants,” why had this not been reported in the mainstream press?

Finally, the project creators were too lazy to even write a whitepaper, as a link on the ICO’s website simply reads “whitepaper coming soon.” If an ICO truly was in the process of applying for a banking license, had been pilot-tested by B2B industry giants, and had reached agreements to issue branded debit cards, one imagines that the project’s developers would have found time to compose a whitepaper — or at least plagiarize one.

Featured image from Shutterstock.