The Graph Price Prediction 2024: Will New dApps Boost GRT?

What's next for The Graph?

Key Takeaways

- The Graph’s switch to the Arbitrum protocol has given the GRT token a boost.

- The platform is designed to help people access blockchain data and make charts based on it.

- Can GRT maintain its recent momentum?

- One Graph price prediction says it can reach $1.13 in 2025.

The Graph, a blockchain platform that helps people create their graphs, had a pretty busy few months in 2023.

The platform got back in the headlines after the news that the system was to move from Ethereum (ETH) to the Arbitrum (ARB) protocol.

The crypto’s investors should be mindful of the disastrous time it had in 2022, when it lost more than 90% of its value. Now, new dApps may boost the price.

The Graph did not immediately respond to a request for comment.

But what is The Graph (GRT)? How does The Graph work? Let’s see what we can find out, and also take a look at some of The Graph Price Predictions that were being made as of April 22, 2024.

The Graph Price Prediction

Let’s examine some of the Graph price predictions being made on April 22, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $0.835276 | $1.13 | $2.63 |

| Prediction #2 | $0.65 | $0.76 | $2.22 |

| Prediction #3 | $0.4193 | $0.6434 | $4.04 |

First, CoinCodex had a short-term Graph price prediction that said it would drop to $0.372690 by April 27 before climbing to $0.947633 by May 21. The site’s technical analysis was bullish, with 23 indicators sending signals and five making bearish ones.

The Graph Price Prediction for 2024

Bitnation said GRT would be worth $0.835276 in 2023. DigitalCoinPrice was less optimistic, saying it would reach $0.65 by December. PricePrediction.net was more cautious, suggesting it would trade at $0.4193 by the end of this year.

The Graph Price Prediction for 2025

DigitalCoinPrice argued The Graph would reach $0.76 in 2025, but PricePrediction.net thought GRT would only get to $0.6434. Bitnation was, however, more upbeat, forecasting the token to reach $1.13 next year.

The Graph Price Prediction for 2030

Moving on to a more long-term Graph price prediction, PricePrediction.net thought the token could hit $4.04 that year, while DigitalCoinPrice said it would reach $2.22. Bitnation had a GRT price prediction for $2.63 at the start of the next decade.

Google Gemini AI Price Prediction for The Graph (as of April 22)

Google’s Gemini AI platform gave the following price prediction for The Graph on April 22. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligent price predictions are predicated on past performances and are in no way entirely accurate.

Short Term (Next three months)

- Expected price: $0.42

- Factors to Consider:

- Overall Cryptocurrency Market Sentiment: The broader market sentiment can significantly impact individual token prices. If the overall market trend is bullish, GRT could see a price increase. Conversely, a bearish market could lead to a price decrease.

- The Graph’s Development and Adoption: Positive news about The Graph’s development, such as new partnerships or integrations, could boost its price. Conversely, negative news could have the opposite effect.

- Regulations: Regulatory changes in the cryptocurrency space could also impact GRT’s price.

Medium Term (Next six months)

- Expected price: $0.40

- Factors to Consider:

- Overall cryptocurrency market sentiment: The price of The Graph is likely to be influenced by the broader trends in the cryptocurrency market.

- Adoption and development of The Graph: Increased adoption by developers and projects, as well as further development of the platform, could positively impact the price.

- Regulatory landscape: Changes in regulations could affect the demand and accessibility of The Graph, impacting its price.

- Unforeseen events: Unexpected events, such as hacks or major economic changes, could significantly impact the price of The Graph.

Long Term (Next five years)

- Expected price: $2.00

- Factors to Consider:

- Overall crypto market sentiment: If the general sentiment towards cryptocurrencies remains positive, it could boost the price of GRT.

- Adoption and usage of The Graph: Increased adoption and usage of The Graph’s technology could lead to higher demand for GRT tokens, potentially driving up the price.

- Regulations: Regulatory changes could impact the crypto market in unpredictable ways, affecting the price of GRT.

- Competition: The Graph faces competition from other blockchain indexing projects, which could affect its market share and price.

Recent Updates from The Graph

The Graph said in mid-March that “40+ leading blockchains and L2s are now supported on The Graph Network.”

“That means that thanks to new tech enhancements such as the upgrade Indexer, devs across + chains can use subgraphs on the network more easily than ever, including Arbitrum, Avax, Celo, Fantom Foundation, Gnosis Chain, Optimism, Polygon, and newly-enabled chains Base, NEAR Protocol, Scroll, zkSync, and more.”

GRT Price History

Let’s now take a look at some of The Graph’s price history . While past performance should never be taken as an indicator of future results, knowing what the token has done can help give us some very useful context when it comes to either making or interpreting a Graph price prediction.

When GRT first came onto the open market in late 2020, it was worth about $0.12. It shot up as crypto entered a bullish phase and it reached an all-time high of $2.88 on February 21 2021. It then entered a gradual decline, falling below the dollar in late May and closing the year at $0.6446.

In 2022, GRT suffered as the market went through a series of crashes. It fell below $0.50 in the middle of January. Although March and April saw something of a resurgence, the token suffered throughout the rest of the year and it closed it at $0.055375, an annual loss of more than 90%.

The Graph in 2023 and 2024

In 2023, links between The Graph and artificial intelligence-related tokens such as SingularityNET (AGIX) saw it shoot up, peaking at $0.2284 on February 7. After this, it was downhill, with a low coming on June 10. In the wake of Crypto.com announcing the suspension of its US institutional operations, it was worth $0.09046.

Since then, the price has gone up, boosted by the completion of the Arbitrum switch and, on July 3, it reached a high of $0.1431.

In the months after that, GRT dropped somewhat. By October 19, it was worth just $0.07678. Since then, a growing market has seen it rise and, on November 7, 2023, it was worth about $0.137. It then ended 2023 at $0.1783 and reached $0.2885 on February 22, 2024. It’s worth $0.2945 on April 22, 2024.

At that time, there were 9.48 billion GRT in circulation, out of a total supply of 10.80 billion. This gave the token a market cap of $2.79 billion, making it the 41st largest crypto by that measurement.

The Graph Price Analysis

GRT reached a yearly high of $0.50 on March 10, coming from a low of $0.14 in January. This was a continuation of a larger rise. Once it finished, we saw a significant downturn.

On April 13, GRT fell to $0.20, decreasing by 58%, dippingits February 2023 peak. The daily chart Relative Strength Index (RSI) signaled it was oversold conditions and a recovery followed.

GRT reached $0.30 on April 22. It now faces strong resistance at the horizontal zone above. If it breaks out, it could signal a more significant starting uptrend that could make a new yearly high above $0.80.

But if the price gets rejected, another downturn would look more likely in which case we would be looking for a target below its April 13 low of $0.20

Advantages and Disadvantages of The Graph

Blockchain analytics company Messari recently released its quarterly report on The Graph . It outlined some key advantages and disadvantages of the blockchain.

It found that, in the second quarter of 2023, The Graph had

- Made $22,400 in usage fees, down from $63,900 year-on-year and from $46,600 quarter-on-quarter.

- Had revenue from index rewards of a little over $9 million, down year-on-year from $17.2 million and from $9.1 million quarter-on-quarter.

- 1,322 published subgraphs, up from 392 year-on-year and 1,082 quarter-on-quarter.

Advantages of The Graph

Messari said that The Graph

- Worked on its move to Arbitrum well.

- Helped remove barriers to Web3 for developers.

- Should see the number of subgraphs continue to grow.

Disadvantages of The Graph

Messari also said that The Graph had

- Seen a substantial fall in revenue across the quarter.

- A high entry fee for people who wanted to operate nodes on the network.

- A decline in active indexers.

Is The Graph a Good Investment?

It is hard to say. No one is suggesting GRT is an unregistered security right now, which is a good thing for the token. Its links to the now-fashionable artificial intelligence sector could well put it at the forefront of investors’ minds. Its recent move to the Arbitrum protocol should, at least in theory, make it quicker.

Something else worth pointing out, though, is that The Graph does not make it easy for someone who is not a computing expert to get to grips with.

The site’s technical documentation is filled with jargon, even by the standards of whitepapers. It would not be a huge surprise for an investor to decide to put their money where they can actually understand the system’s purpose.

As ever with crypto, you will need to make sure you do your own research before deciding whether or not to invest in GRT.

Will The Graph go up or down?

No one can really tell right now. While The Graph crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in The Graph?

Before you decide whether or not to invest in The Graph, you will have to do your own research, not only on GRT, but on other, related, coins and tokens such as SingularityNet or Ocean Protocol (OCEAN). You will also need to make sure that you never invest more money than you can afford to lose.

Who are the Founders of The Graph?

Computer engineers and crypto entrepreneurs Yaniv Tal , Brandon Ramirez and Jannis Pohlmann founded The Graph in 2018. Ramirez is currently CEO of Edge & Node. Tal has degrees from the University of Southern California and Westminster University. Pohlmann is CTO at Edge & Node.

Who Owns the Most The Graph (GRT) Coins?

On April 22, 2024, a wallet held 27.63% of the supply of GRT.

Richest GRT Wallet Addresses

As of April 22, 2024, the five wallets with the most GRT were

- 0x36aff7001294dae4c2ed4fdefc478a00de77f090. This wallet held 2,762,834,018 GRT, or 27.63% of the supply.

- 0x32ec7a59549b9f114c9d7d8b21891d91ae7f2ca1. This wallet held 1,033,333,333 GRT, or 10.33% of the supply.

- 0xf977814e90da44bfa03b6295a0616a897441acec. This wallet held 530,000,000 GRT, or 5.30% of the supply.

- 0x823fd1a44a37a4be35c3b0c8b11463cc4f27396c. This wallet held 437,848,556 GRT, or 4.38% of the supply.

- 0xf55041e37e12cd407ad00ce2910b8269b01263b9. This wallet also held 379,630,772 GRT, or 3.80% of the supply.

Fact Box

| Supply and Distribution | Figures |

|---|---|

| Total supply | 10,796,713,909 |

| Circulating supply (as of April 22, 2024) | 9,482,506,383 (94% of total supply) |

| Holder distribution | Top 10 holders owned 53% of total supply, as of April 22, 2024. |

From the Whitepaper

In its technical documentation, or whitepaper, The Graph says that it is built to help people answer any queries they might have about any system based on Ethereum.

It says: “The Graph is a decentralized protocol for indexing and querying blockchain data. The Graph makes it possible to query data that is difficult to query directly.”

It goes on to say: “The Graph learns what and how to index Ethereum data based on subgraph descriptions, known as the subgraph manifest. The subgraph description defines the smart contracts of interest for a subgraph, the events in those contracts to pay attention to, and how to map event data to data that The Graph will store in its database.”

The Graph (GRT) Explained

If someone wants to make the most of blockchain technology, it is helpful if they can access the data that is stored on the system. Unfortunately, many systems are designed in a way that makes it tricky, if not impossible, to find the information that should be out there.

The Graph is built to allow people to create their own data charts, based on information that the system takes and indexes.

The Graph, was based on the Ethereum (ETH) blockchain before being taken up a level to stand on Arbitrum. It is supported by its eponymous token, which goes by the ticker handle GRT.

How The Graph Works

The Graph uses a piece of technology called an application programming interface (API). This software allows people to take the data that the platform has indexed and create small subgraphs, which are then collected to form larger graphs.

A lot of the subgraphs on the system were created by The Graph’s users. This helps the platform to be decentralized and also, theoretically, quicker than relying on the traditional method of using specialized servers. This new way of doing things should also, according to The Graph’s technical documentation, save “engineering and hardware resources”.

There are three types of users on The Graph. Indexers store data from the platform’s subgraphs. They are responsible for operating the computers, or nodes, that help run the network. In order to do that, they stake GRT. Delegators delegate an amount of GRT to Indexers. Curators list the data that they consider worth indexing.

People who create the subgraphs are rewarded with GRT. The token can also be bought, sold, and traded on exchanges.

Because GRT is based on Ethereum, it is a token, rather than a coin. You might see references to such things as a Graph coin price prediction but these are not entirely correct.

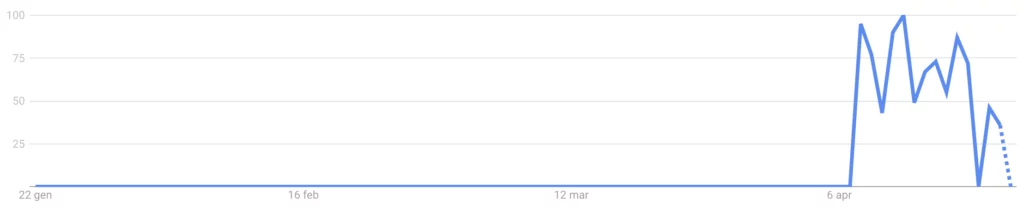

The Graph Attention Tracker

Here is a chart for the The Graph Google search volume for the past 90 days. This represents how many times the term “The Graph GRT” has been Googled over the previous 90 days.

FAQs

Will The Graph reach $1?

It could do, but PricePrediction.net and DigitalCoinPrice say it will happen in 2029 while Bitnation says it will reach the dollar in 2025.

It is important to remember that GRT has not traded above the dollar since November 2021.

What is The Graph used for?

People who create subgraphs on The Graph blockchain data platform are rewarded with the GRT crypto. GRT can also be bought, sold, and traded on exchanges.

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.