Goldman Sachs’ Election Forecast Is Ugly, But It May Prove Spot On

With the 2020 presidential election too close to call, Goldman Sachs is warning of prolonged volatility in the stock market. | Image: MANDEL NGAN / AFP

- Goldman Sachs sees the election contested for over a month after Election Day.

- There’s also about a 53% chance of tax hikes coming down the pike.

- Both events will create more uncertainty and volatility in markets for months to come.

Stocks continue to drop yet again, and Goldman Sachs is out with an election prediction that is rubbing salt in the wound. Noting that the polls are showing a Democratic sweep, and the prediction markets are betting on a closer 53% advantage to Democrats , a few issues are likely to keep markets swinging wildly for the foreseeable future.

Contested Election to Create Uncertainty

First, Goldman’s strategists have looked at the options market , where volatility related to the election is expected to cease around December 8, more than a full month after Election Day on November 3.

2016 Presidential candidate Hillary Clinton gave Biden the advice not to concede “under any circumstances ,” which could even include a scenario where Biden loses both the Electoral College and popular vote.

The Biden campaign has already announced it has legal teams in place ahead of a narrow election, including some key swing states that may hold the key to a victory in the electoral college.

In short, both sides expect a contested election. These delays in the election results will likely create uncertainty in the markets; however, such uncertainty may mean the stock market trades in a range until the outcome is decided.

That was the case in the 2000 election, when stocks sold off during the recount period , before rallying when an outcome started to become priced in.

With the odds tilted in favor of the Democratic Party, including a lead in taking a majority in the U.S. Senate based on the latest polling, once the election is decided, the next issue for markets is taxes.

Tax Hikes on the Horizon

Meanwhile, the forward-looking stock market would start pricing in the prospect of the Democrat Party’s tax plan. The Biden tax proposal seeks to increase the percentage of federal revenue from 17.8% of GDP to 18.9%, and as high as 19.3% by 2027 .

While the percentage change may sound small, it works out to be one of the largest potential tax hikes in history.

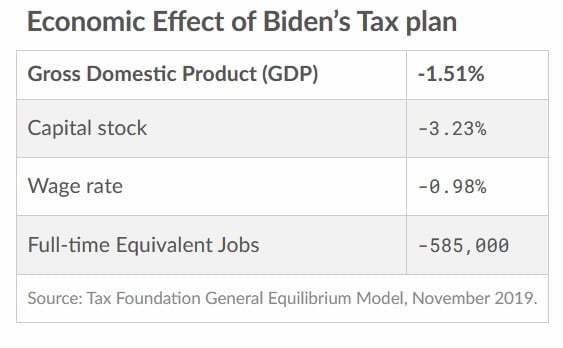

The tax hike is expected to hit GDP by 1.51%, and the higher tax burden will likely lower wages by 1% while costing over 580,000 jobs. With a job market still reeling from Covid-19, the job recovery under President Trump could be thwarted by new taxes before the employment market fully heals.

That’s just Biden’s baseline plan. With a Democratic sweep of the White House, Senate, and House of Representatives, the baseline plan may change. That’s especially true if Biden fails to make it through his first term as many voters suspect.

And that just includes base taxes. Adding in new healthcare laws and environmental laws like the Green New Deal , which Democrats could push through with simple majority votes, could add trillions more in taxes.

Goldman’s prediction, when all this is factored in, explains the recent market decline, and why it may continue.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.