Former Goldman Sachs Analyst Warns Turbulence Ahead for S&P 500

The S&P 500 Index risks a much larger correction if it holds below this critical level, analyst warns. | Image: AP Photo/Charles Rex Arbogast

To say that the S&P 500 (SPX) is having a rough few days would be an understatement. The index is down by 2.7% this week.

Sure, the SPX has weathered selloffs that are much worse before but this time appears to be different. Multiple economic indicators are flailing reversal signals. On top of that, market analysts are persistently seeing red flags.

One of those analysts is a former Goldman Sachs employee. He marked a critical level for the index. According to him, we should expect a bloodbath if the S&P 500 moves below this area.

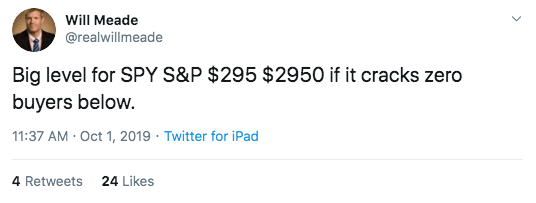

Will Meade: Zero Buyers Below 2,950

In technical analysis, there are price areas that can make or break a market. A move above or below a particular price level can determine the trend of an asset.

For the S&P 500, it appears that that number is 2,950. Will Meade, a former Goldman Sachs analyst and now the founder of a $1.4 billion hedge fund, took to Twitter to warn his followers that the SPX is likely to experience a waterfall event. He tweeted that if 2,950 is taken out, there will be “zero buyers below.”

It looks like Mr. Meade’s call is playing out as expected. The SPX opened with a huge gap down Wednesday at 2,924.8. It plunged all the way down to 2,874.9 before bulls lifted the index to a close of 2,887.6.

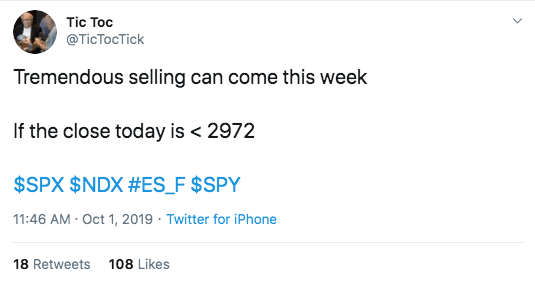

The wick below yesterday’s candle appears to be a brief pause in selling rather than a bullish insurrection. That’s because other widely-followed analysts expect more blood. For instance, SPX Trader Tic Toc sees more selling this week:

Sven Henrich, founder of NorthmanTrader , is also bearish on the S&P 500. The trader tweeted an image of the index breaking down from a rising wedge pattern .

Based on Mr. Henrich’s expanding top pattern, it appears that the S&P 500 is en route to support of 2,150. That’s a massive drop of over 25% from current levels.

Other Analysts More Upbeat About the Year-End Prospects of the S&P 500

While it seems that there’s blood on the streets and the technical analysts are writing off the index, a few fundamental analysts are not yet giving on the SPX.

Parker Evans, president and chief investment strategist at Successful Portfolios LLC, sees the SPX regaining the 2,950 support. He told CCN.com,

I see the S&P 500 finishing 2019 at 2950, in line with the mean target close of strategist tracked by Bloomberg. A 2950 close would represent a valuation of 18x year-end 2019 earnings of $164. That’s an earnings yield of 5.56% which compares favorably to the current 10-year US Treasury of 1.65%.

Clem Chambers, CEO of ADVFN and Online Blockchain plc , has a more optimistic view. He said,

The S&P 500 will end the year at 2966.

Whether the SPX will stabilize or not in the coming weeks is anyone’s guess. One thing is for certain though, volatility has arrived.