Former Goldman Sachs Analyst: ‘The 1% is Dumping Stocks’

With smart money exiting U.S. stocks, don't assume the bull market will last indefinitely. | Image: Shutterstock

The S&P 500 (SPX) is trading close to all-time highs. The Dow Jones Industrial Average (DJI) is in the same boat as it is a few points away from a new record. The market is climbing despite global instabilities such as the U.S.-China trade war and the attack on Saudi Arabian oil producer Aramco.

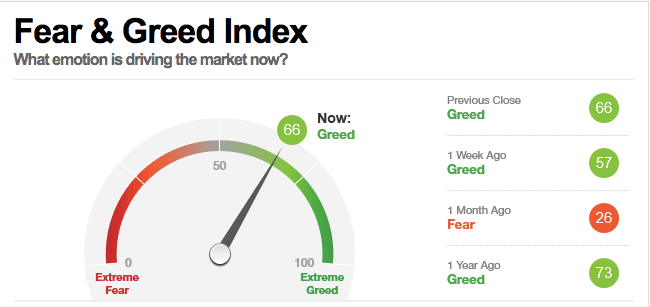

It appears that investors are euphoric. CNN’s Fear and Greed Index supports this assumption.

Under such conditions, it pays to consider the contrarian stance. We did some digging and discovered that a former Goldman Sachs analyst is making an interesting claim.

Will Meade on Stocks: ‘Money Always Finds a Home’

As a technical analyst, buying the top or the resistance is almost never a smart decision. You’d be better off waiting for a strong breakout and only buying after it’s validated instead of buying at the resistance and hoping for one.

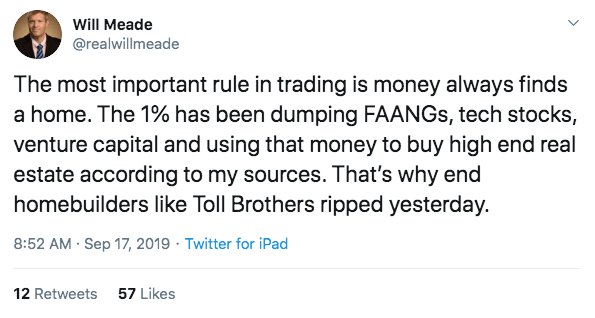

It appears that we won’t be seeing a strong breakout anytime soon. Will Meade , a former Goldman Sachs analyst, took to Twitter to share what his sources told him. In his tweet, he wrote,

The 1% has been dumping FAANGs, tech stocks, venture capital, and using that money to buy high end real estate according to my sources.

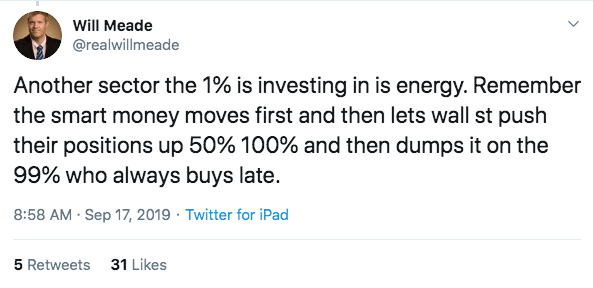

In another tweet, the former Goldman Sachs employee revealed the inner workings of the elite:

The revelations of Mr. Meade came one month after media outlets reported that Warren Buffett is sitting on a large cash position to the tune of $122 billion. According to Markets Insider, the Oracle of Omaha sold more stock in June than he bought the quarter prior.

It appears that Will Meade’s sources are correct. The one percent is exiting the stock markets at the expense of retail investors.

Financial Analyst: It Is Now a ‘Sold-to-You’ Market

At LaDuc Trading , Samantha LaDuc leads the analysis, education, and trading services; she’s also CIO for LaDuc Capital LLC. She spoke to CCN.com about the long-term prospects of the stock market and said,

When global money supply diverged from market price, beginning of July, it became a ‘Sold-to-You’ market in my eyes.

This is another indication that the smart money is no longer pushing the market up. Therefore, with the global money supply drying up, it looks like the smart move is to take a contrarian stance.