Fed’s Neel Kashkari Goes Greenspan on Bank Self-Regulation

The Federal Reserve's most renowned dove wants banks to halt dividend payments out of the goodness of their hearts. You're going to have to go further than that, Neel. | Image: REUTERS/Shannon Stapleton/File Photo

- Neel Kashkari’s plan for increasing loan-loss reserves suggests banks stop dividends out of the goodness of their hearts.

- Banks are boosting loan-loss provisions while openly counting on bailout money.

- I recommend we stop bailing out banks and make them fend for themselves.

Federal Reserve Bank of Minneapolis President Neel Kashkari suggested in the Financial Times how banks could raise their own capital to prepare for the coronacrisis:

The most patriotic thing they could do today would be to stop paying dividends and raise equity capital, to ensure that they can endure a deep economic downturn.

They could … if they wanted to be patriotic. We all know banks operate fundamentally based on patriotism and good will … as, apparently, does Kashkari in his banking oversight position. He’d rather appeal to good will than use his voting position on the Fed to enforce preparation for the worst.

The Neel Kashkari Kash&Karry Loan Loss Plan

Kashkari’s oversight by gentle persuasion sounds like plain old CYA. When he’s eventually asked why the Fed didn’t get ahead of the curve on loan losses gone viral, he can respond, “Well, I asked banks to stop paying dividends and raise capital instead.”

More like suggested. As a sitting member on the central bank’s Federal Open Market Committee (FOMC) , which regulates the nation’s money supply, Kashkari could press harder with the FOMC and the Fed’s Board of Governors to broaden loan-loss provisions with a simple rule:

There will be no bailouts available in 2020 or 2021 for any bank continuing dividends or stock buybacks or paying bonuses too executives.

It might be good to implement that before banks carry cash in a crisis out of the Fed’s bailout window.

Current Bank Loan-Loss Provisions

Some banks have halted buybacks already, and some have also started to increase loan-loss provisions in anticipation of a deluge of defaulting loans during the current global economic shutdown.

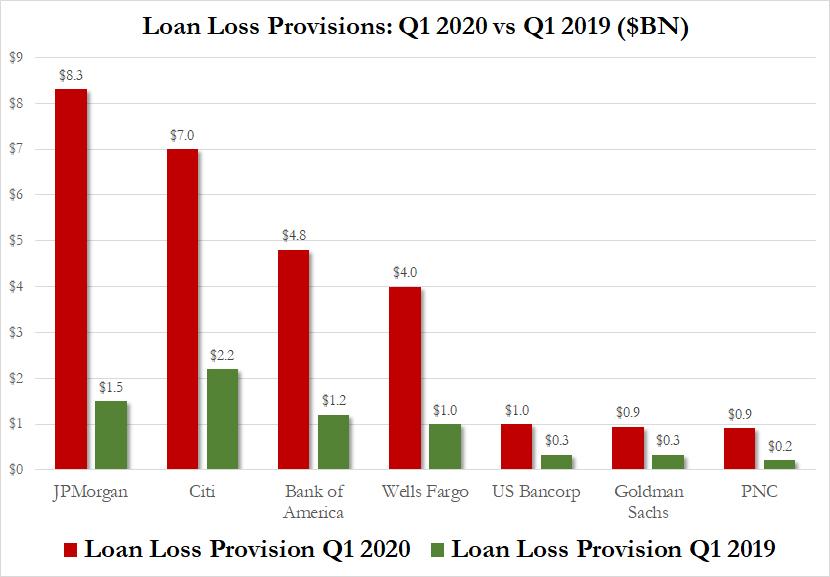

This has been the big earnings story of the quarter for banks. Pulling down their quarterly earnings to create these provisions damaged stock valuations for most. JPMorgan provided the most for potential loan losses at about 5.5 times their normal set-aside.

Many banks and analysts have predicted U.S. GDP could plunge in the next quarter anywhere from 15-20% on the conservative side. That would be the largest decline in post-war history.

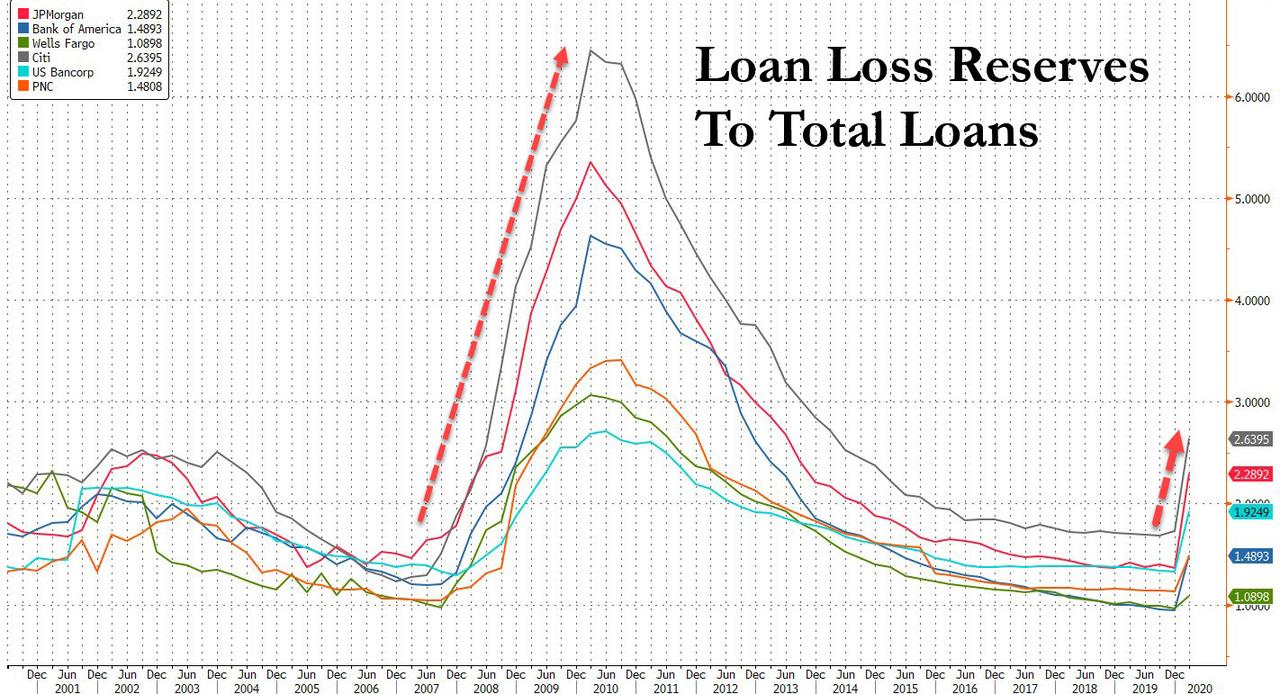

Since that anticipates a recession much deeper but possibly not as long as the Great Financial Crisis (GFC), a comparison to the provisions made during the GFC can bring perspective to current loss reserves:

Neel Kashkari, himself, said we should prepare for the coronacrisis to last eighteen months . Clearly, then, we are only a fraction of the way to setting aside enough for loan losses compared to where banks went during the GFC.

Though JPMorgan plans to continue aggregating its increase for loan losses in each of the quarters ahead, JPM stated they’re banking on government bailouts this time, too, just as during the GFC.

Better Than Bailing Out Banks

Experience has taught us that the imprudent choices bankers made as they fattened their shareholders with dividends and share buybacks for years will fall on tax payers to backstop their unpreparedness.

So, maybe Kashkari could push things harder than just an appeal to the phantom of bank patriotism. The institutions that broke the nation’s financial spine in 2008 with their known profligacy didn’t seem all that patriotic to me.

Before banks socialize their losses again, it’s time to demand more oversight from Neel Kashkari and his federation of banking buddies. It’s time to inform Congress and the Fed that bank bailouts end now.

We’ll resolve bank failures through organized bankruptcies, saving the companies for employees, while booting executives and paying obligations out of shareholder value since shareholders sucked up all income for years to pay themselves.

Since the Fed is already creating trillions of dollars out of thin air again, use that to save depositors at failed banks by creating money in new accounts in the remaining solvent banks to make good banks even better. Do it in smaller banks to keep from making banks that are “too big to fail” even bigger.

Never been done before? Neel Kashkari & Kompany have been doing things never done before for a decade. Kashkari headed up the department of Things that Are Rarely Proposed (i.e., TARP).

There won’t be any inflation because this adds nothing to money supply. It just replaces money that evaporates in one institution with new money in another — trading places — while flushing the failed bankers who thought they’d rely patriotically on tax payers.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.