The Fed Is Likely to Succumb to Trump’s Tweets, Study Shows

Donald Trump's Twitter rants influence the market's perception about monetary policy, according to a new study. | Image: REUTERS/Carlos Barria/File Photo

U.S. President Donald Trump is grabbing headlines for all the wrong reasons.

Today, Trump is trending on social media as House Speaker Nancy Pelosi launched an impeachment inquiry against the president. Ironically, social media is one of Trump’s most powerful tools in influencing the masses as well as independent government bodies.

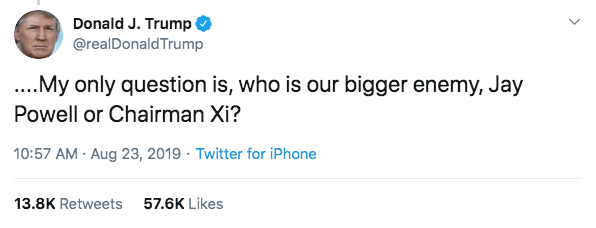

Recently, the U.S. president targeted the Federal Reserve and its chairman, Jay Powell, for not getting interest rates to zero or below. In a tweet, Trump wrote,

No “guts,” no sense, no vision!

Trump’s strategy seems to be working, according to a recent study.

Trump’s Tweets are Threats to Central Bank Independence

If you think Trump is using Twitter to rant just like an ordinary citizen, think again. A study published in the National Bureau of Economic Research revealed that the tweets of President Trump influence monetary policy.

Researchers relied on a high-frequency identification approach by collecting a massive sample of unique tweets from the U.S. president chastising the methods of the Fed in conducting monetary policy. They reviewed these tweets in conjunction with the market response over the course of two years.

The study discovered that the attacks on the central bank over interest rates have driven down the expected fed funds futures contract by 10 basis points (bps). On average, each tweet has an effect of -0.30 bps across all contracts.

In the end, researchers concluded that Trump’s criticisms have a significant and persistent impact on the Fed’s independence.

The Federal Reserve Should Not Be Constrained by Politics

Trump is not the first president to apply pressure on the Fed. President Lyndon B. Johnson was known to have physically threatened Fed Chairman William Martin to slash interest rates as the Vietnam War was having a significant impact on the budget.

In the 1920s, President Herbert Hoover wanted the Fed to raise interest rates to keep the economy from overheating. Unfortunately, the central bank decided to go the other way and slashed rates, which contributed to the stock market crash of 1929.

According to NBC , every president wishes to influence the Fed. However, the central bank must be free from political influence.

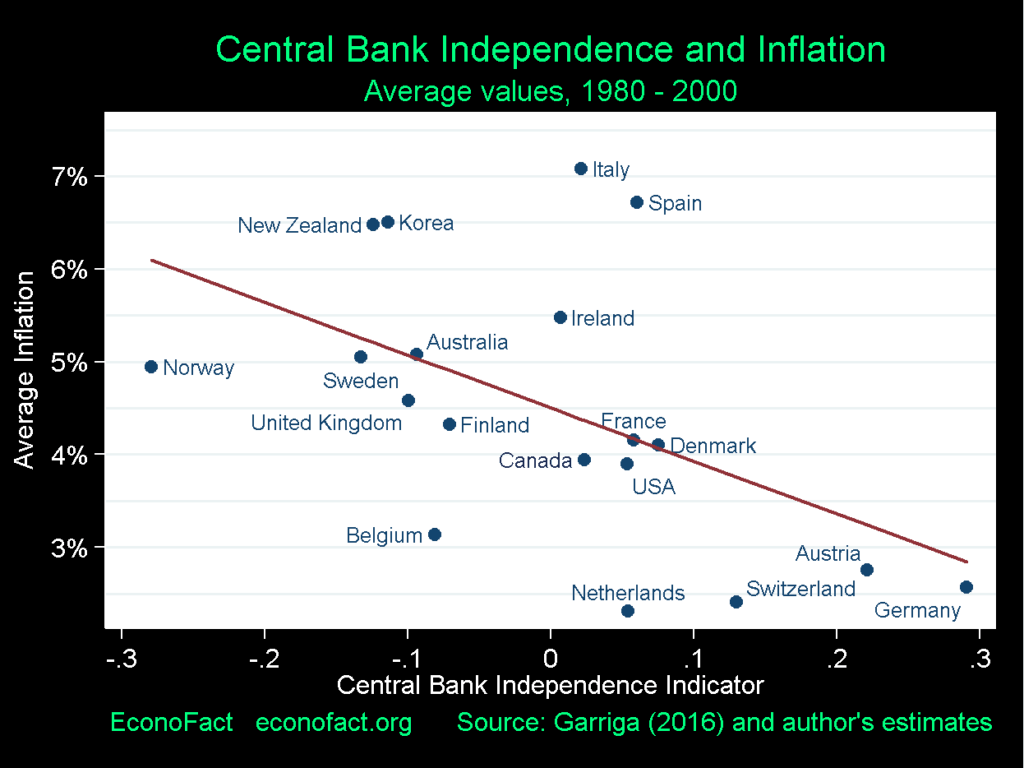

Studies have shown that economies tend to perform better when the central bank is independent. For instance, a PBS report showed the relationship between the average inflation for 19 countries and central bank independence from 1980 to 2000. Countries with more independent central banks enjoyed significantly lower inflation.

In addition, economist Alex Kruger explained why central banks should remain independent. He told CCN.com:

“It is important for central banks to remain independent because politicians optimize for short term votes, not for long term economic growth, while technocrats (economists) appointed on much longer terms are more likely to be insulated from short term politics and favor long term optimization. Fed governors are appointed for 14-year terms. Similarly, Supreme Court judges are appointed for life.”

Thus, it seems that presidents, including Trump, are not doing their country and constituents any favor by eroding the independence of the Federal Reserve.