Ethereum, Bitcoin Prices Dip as Cryptocurrency Markets Contract

The crypto markets contracted on Tuesday, pulling nearly every top 20 cryptocurrency into the red. Neither the ethereum nor bitcoin price was immune to the virus, and each dropped below significant thresholds.

The pullback occurred rapidly, causing more than $6 billion to evaporate from the cryptocurrency market cap in a matter of hours. After climbing to $141.4 billion at about 4:00 UTC on August 15, the total value of all cryptocurrencies dove as low as $133.8 billion before leveling out at its current mark of $135 billion.

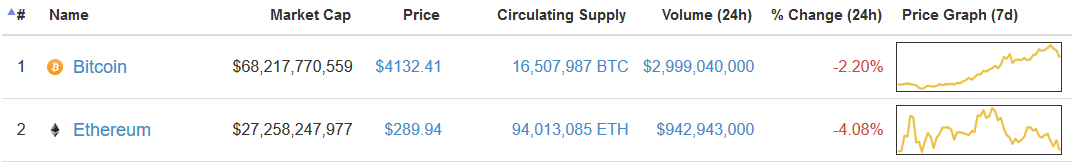

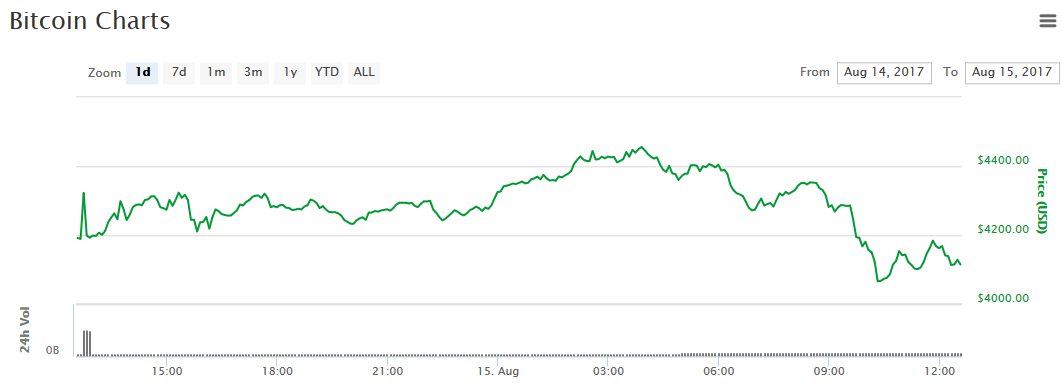

Bitcoin Price Slips Below $4,000

The crypto market’s recent bull run has led the bitcoin price to increase to unprecedented levels during the first half of August. On August 14, bitcoin market cap soared past $70 billion, surpassing PayPal’s total valuation in what might be the true “Flippening”. This morning, bitcoin soared as high as $4,456 to post yet another record. Shortly after hitting that mark, it began to fall at a rapid clip, briefly dipping below $4,000 on BitStamp due to a Korean sell-off. At present, CoinMarketCap lists the bitcoin price at $4,132, giving bitcoin a market cap of $68.2 billion.

Ethereum Price Falters as Transaction Volume Increases

Ethereum hit another impressive milestone on Tuesday when the network processed a record number of transactions. As Vitalik Buterin announced on Twitter, the blockchain recorded 410,061 transactions within a 24-hour period:

However, the ethereum price still fell prey to the market dip. Unlike bitcoin, which rose to a peak before stumbling later in the day, the ethereum price experienced a fairly steady decline. For the day, the ethereum price dropped 4% to $290. Ethereum now has a $27.3 billion market cap.

Ethereum Price Chart from CoinMarketCap

Ethereum Price Chart from CoinMarketCap

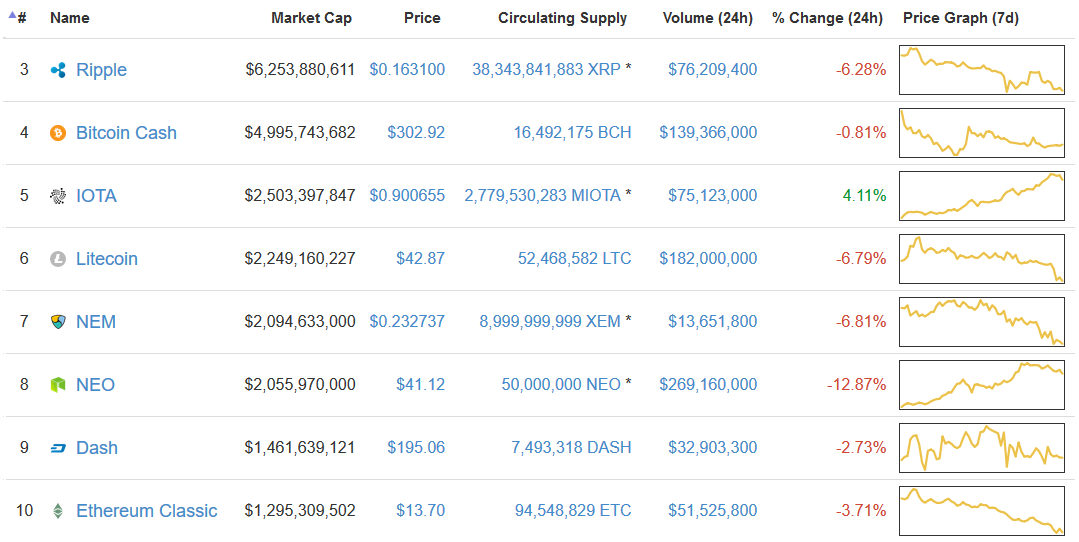

Altcoin Markets Bleed

The altcoin markets saw a predictable decline, with only one top 10 coin managing to post positive returns.

The Ripple price fell more than 6% to $0.163. Since August 8, Ripple has dropped more than $0.03 to reduce its market cap to about $6.3 billion.

With a decline of less than 1%, the bitcoin cash price fared better than most coins, although its 7-day chart is not pretty. Bitcoin cash now has a market cap that is just a hair under $5 billion. IOTA was the only top 10 coin to resist the day’s downward trend, increasing 4% to $0.90 and a $2.5 billion market cap. It now has a $250 million edge on litecoin, further cementing its place in the market cap top 5. The NEM and litecoin prices each fell about 7%, while Dash and ethereum classic fell 3% and $4%, respectively.

NEO was the worst performer in the top 10, which is not entirely surprising considering the rapidity of its recent climb. For the day, the NEO price declined 13% to $41. However, the NEO price still boasts a 7-day advance of 150%, and NEO continues to retain the 8th place ranking with a $2.1 billion market cap.

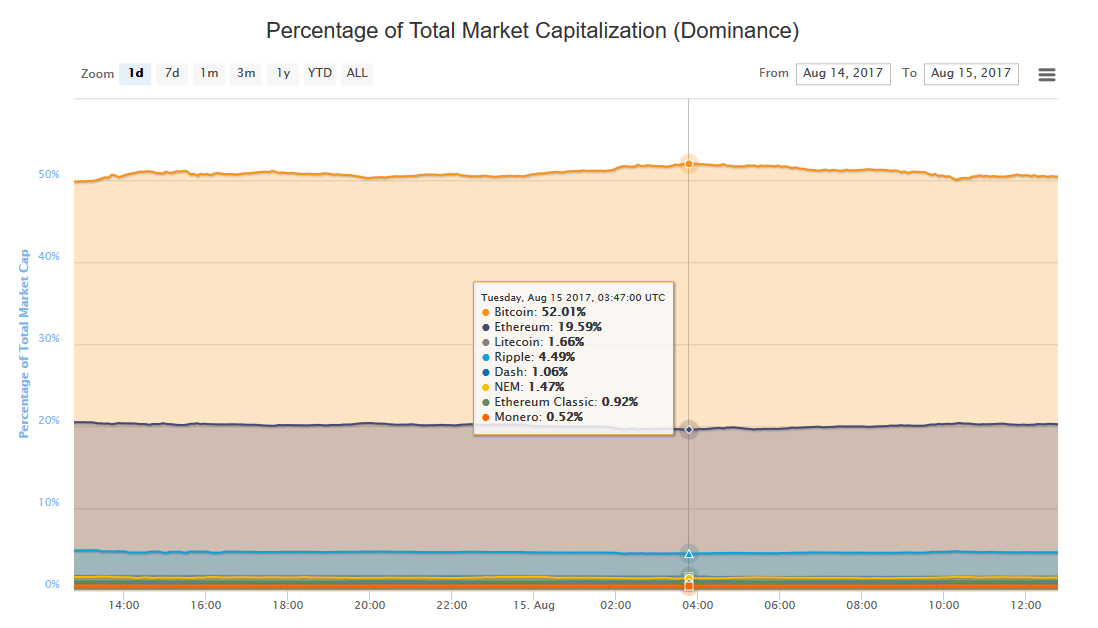

Bitcoin Dominance Holds Above 50%

Bitcoin dominance rose as far as 52% on Tuesday, its highest mark since July 29. This temporarily reduced ethereum’s market share below 20%. However, the bitcoin price contraction shuffled market cap shares a bit.

At present, bitcoin retains a dominant hold on the market with a 50.5% share. Ethereum accounts for 20.3% of the total crypto market cap, while Ripple’s share tumbled to 4.5% in what has become a prolonged decline.

Featured image from Shutterstock.