Bitcoin Price Eyes $4,000 as Markets Soar Past $130 Billion

Both the bitcoin price and the total value of all cryptocurrencies reached record highs on Saturday amid fears that the war of words between the United States and North Korea will escalate into a full-scale military conflict.

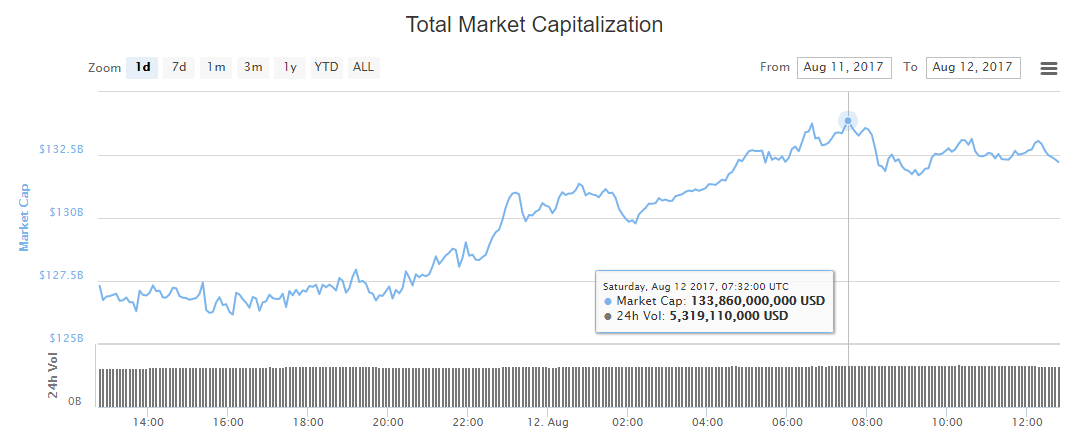

After rising to a new high of $133.9 billion, the total value of all cryptocurrencies has settled down to $132.5 billion. Since the beginning of August, the crypto market cap has added a staggering $40 billion. For reference, the total crypto market cap did not reach $40 billion until the beginning of May.

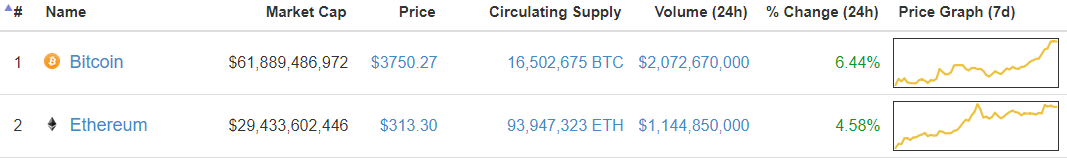

Additionally, bitcoin and ethereum now have a combined market cap of $91.3 billion, which is higher than the total cryptocurrency market cap was on July 31.

Bitcoin Price Eyes $4,000

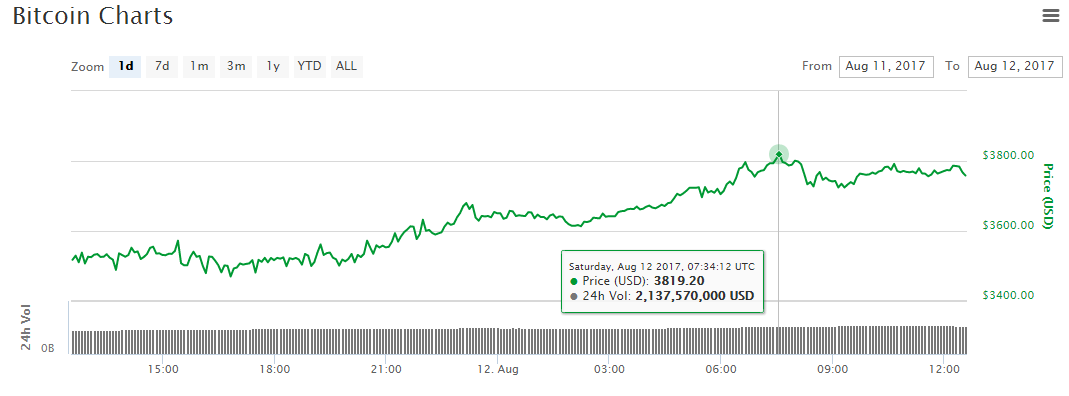

The bitcoin price continues to advance toward $4,000, confirming a June prediction by a Goldman Sachs analyst that it would near that mark during its current wave. On August 12, the bitcoin price extended past $3,800 for the first time. It peaked at $3,819 before receding to a present value of $3,750. This represents a daily gain of more than 6%, giving bitcoin a market cap of $61.9 billion.

Much has been written about the millennial generation’s fascination with crypto assets. Many younger investors view bitcoin as the digital equivalent of gold–a monetary safe haven during times of financial turbulence. As the South China Morning Post reported, part of the bitcoin price’s weekend boom could be due to uncertainty about whether the United States or North Korea will provoke an armed conflict. These fears have caused stock market indexes to drop in recent days, but the crypto markets continue to soar to record levels.

Ethereum Price Holds Above $300

The ethereum price crossed $300 this week and hovered at that level for several days. On August 12, it saw a 5% bump past $310. At present, the ethereum price is $313, which is just shy of its $316 August high. Ethereum now has a market cap of $29.4 billion.

Bitcoin Cash Sees Bump

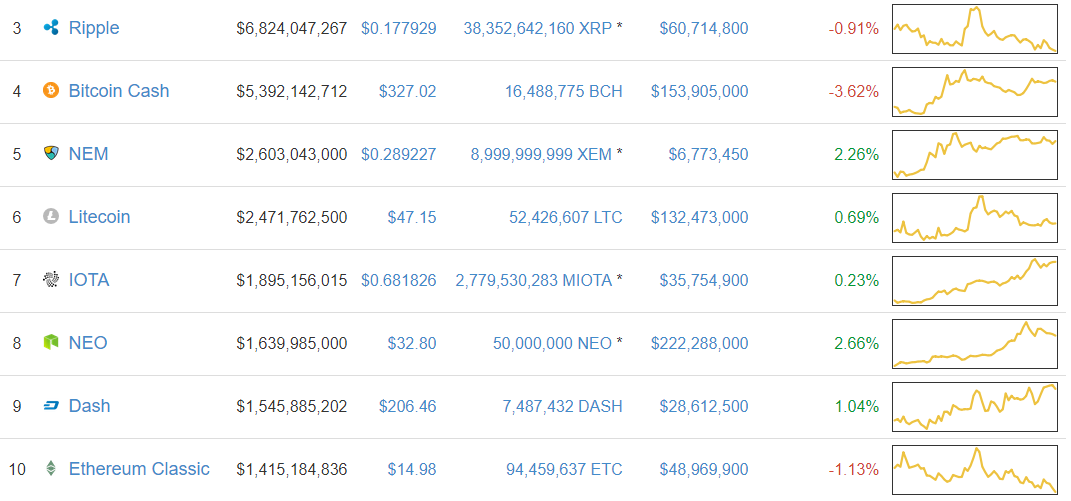

The bitcoin cash price has risen more than $100 since August 4 although it has fallen about 4% in the past 24 hours. At present, the bitcoin cash price is $327, resulting in a $5.4 billion market cap. The bitcoin cash outlook appears to be improving, at least for now. According to UK-based bitcoin derivatives broker Crypto Facilities, it is becoming more profitable to mine bitcoin cash. If mining profitability continues to increase, so will the network’s hashrate.

Altcoin Markets Stable

The altcoin markets were mostly stable on Saturday, with no top 10 altcoins showing significant movement. The Ripple price fell about 1% to $0.178, while the NEM price increased 2% to $0.289. Litecoin and IOTA saw minuscule gains, while Dash managed to move the needle 1% to $206. NEO–which rocketed into the top 10 earlier in the week–rose 3% to about $33. Aside from bitcoin cash, the worst performer in the top 10 was ethereum classic, whose price fell 1% to just under $15.

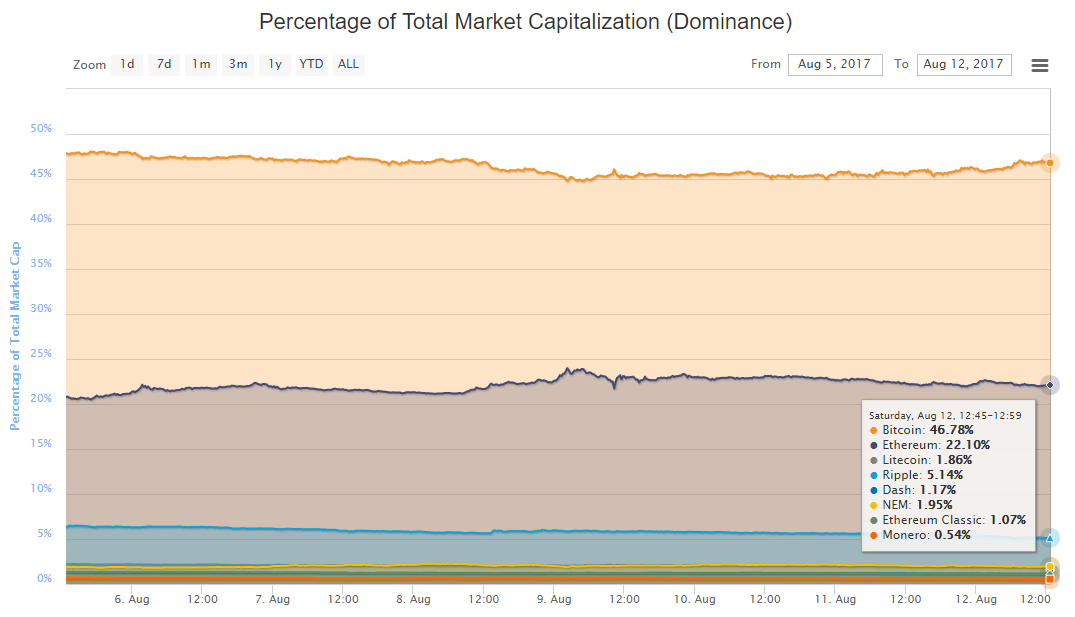

Bitcoin Dominance Heads North

Bitcoin dominance rose heading into the weekend and now rests at 46.8%. Ethereum’s market share declined to 22% after approaching 24% earlier in the week.

Ripple and litecoin also saw their shares of the market decrease, to 5.1% and 1.9%, respectively.

Featured image from Shutterstock.