Bitcoin Vs. Gold: Race To Market Supremacy

Bitcoin Vs. Gold: Race To Market Supremacy

Key Takeaways

- Bitcoin’s performance outshines gold since 2009, highlighting a trend in Bitcoin investment appeal.

- Gold ETFs face outflows, challenged by physical asset constraints inherent to gold.

- Bitcoin ETFs simplify investing in digital currency and are attracting significant global interest in the process.

- Bitcoin ETFs are clearly becoming a new-age safe haven for investors with a price target of $757K per coin to equal gold market cap.

Over the last 15 years Bitcoin has become a formidable opponent to traditional assets like gold. While gold has long served humanity as a store of value and a hedge against economic uncertainty, Bitcoin’s rise as a modern day store of value has sparked debates about Bitcoin potentially surpassing the precious metal.

With Bitcoin’s market cap currently at $1.4 trillion, representing approximately 10% of gold’s market cap, the question arises: how high does Bitcoin’s price need to climb to overtake gold? can Bitcoin surpass gold in market cap?

Market Capitalization Comparison: The Current State of Bitcoin and Gold’s Market Cap

At the time of writing, Bitcoin is trading at approximately $73,000 per coin. Meanwhile, gold boasts a market cap of $14 trillion, making it the largest asset by market cap globally. Gold is bigger in market cap compared to any one company and despite Bitcoin’s exponential growth in recent years, it still lags behind gold in terms of market capitalization. However, the traditional world is changing and Bitcoin’s potential to challenge gold’s dominance cannot be underestimated.

Bitcoin-to-Gold Ratio: A Comparative Metric

To understand how and why Bitcoin can surpass gold in market capitalization we can look at key metrics to understand the relationship between these two assets better to identify the trend.

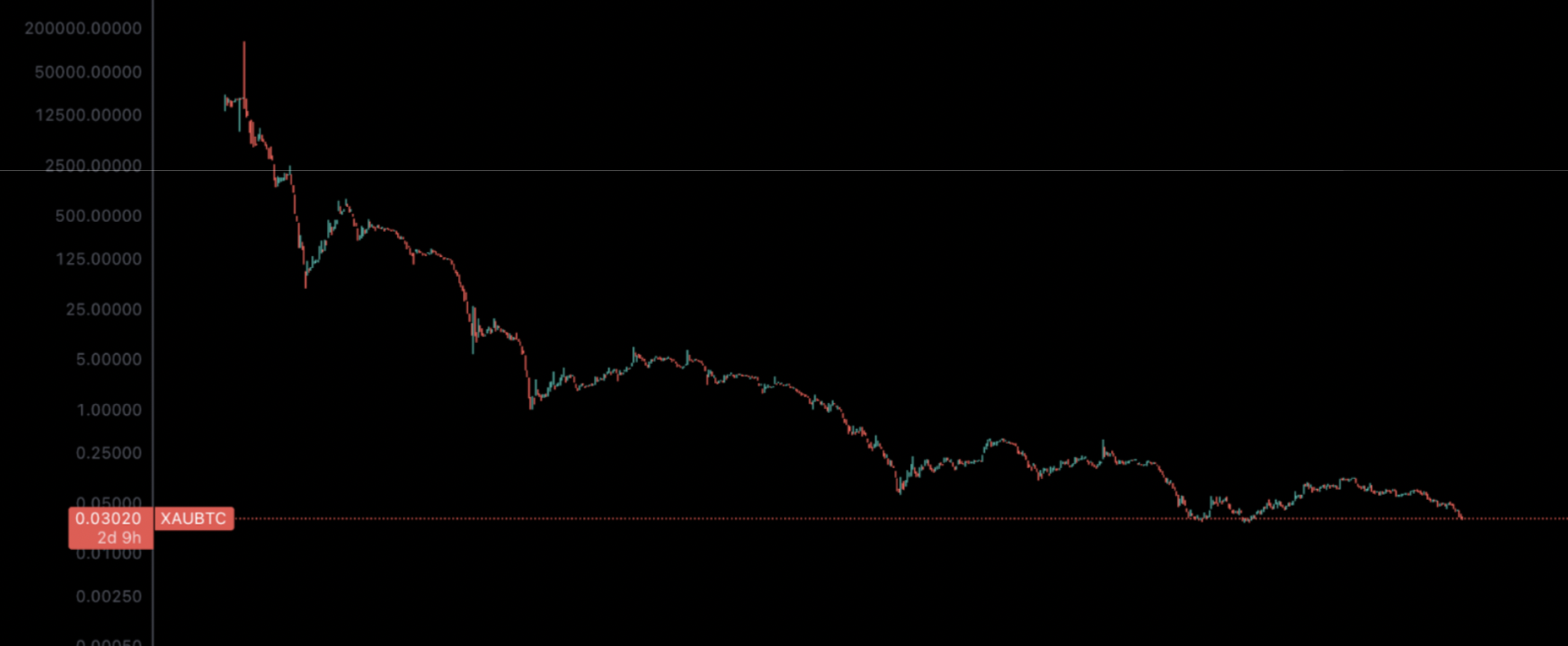

Bitcoin To Gold Ratio

One such metric is the Bitcoin-to-gold ratio, which measures the value of one Bitcoin in terms of ounces of gold. Currently, 1 Bitcoin is equivalent to approximately 33 ounces of gold .

As the ratio on the above Bitcoin-to-Gold chart illustrates, BTC has been on an upward trend that has consistently been outperforming gold. Starting from a value of 0.0002 in 2009 and escalating to 271.94 in 2024, the persistent strength of this trend suggests it is likely to proceed.

Market Liquidity And Trading Volume

Market liquidity and trading volume are another metric that signal the interest in an asset. For example Bitcoin’s 24/7 and high trading volumes on cryptocurrency exchanges indicate a strong market with significant investor interest and participation.

In contrast to gold’s appeal, the precious metal has inherent physical limitations, such as the challenges of liquidity influenced by market conditions, alongside logistical barriers of storage and transportation. The hurdles involved in using gold as a store of value stand in stark contrast to the ease of holding Bitcoin, which markets can speculate on through exchange traded funds (ETFs). This positions Bitcoin as a more attractive digital alternative to traditional tangible gold investments.

However, although Bitcoin offers the modern advantages of divisibility, portability, and transparent transactions, gold still holds the upper hand as a time-tested store of value that offers tangible stability.

Gold’s long history and tangible form offer a unique kind of security. Independent of technology, gold serves as a stable inflation hedge, accessible without electricity or internet. During economic or technological instability, gold’s inherent worth may outshine Bitcoin.

Adoption Rate And Network Growth

The adoption rate of Bitcoin and the growth of its network is much higher than gold. Illustrated below is the increasing number of Bitcoin wallets, growing transactions on the BTC blockchain and active users, and the expansion of Bitcoin’s use cases beyond speculative investment to include remittances, payments, and as a reserve asset by companies and institutions.

—–

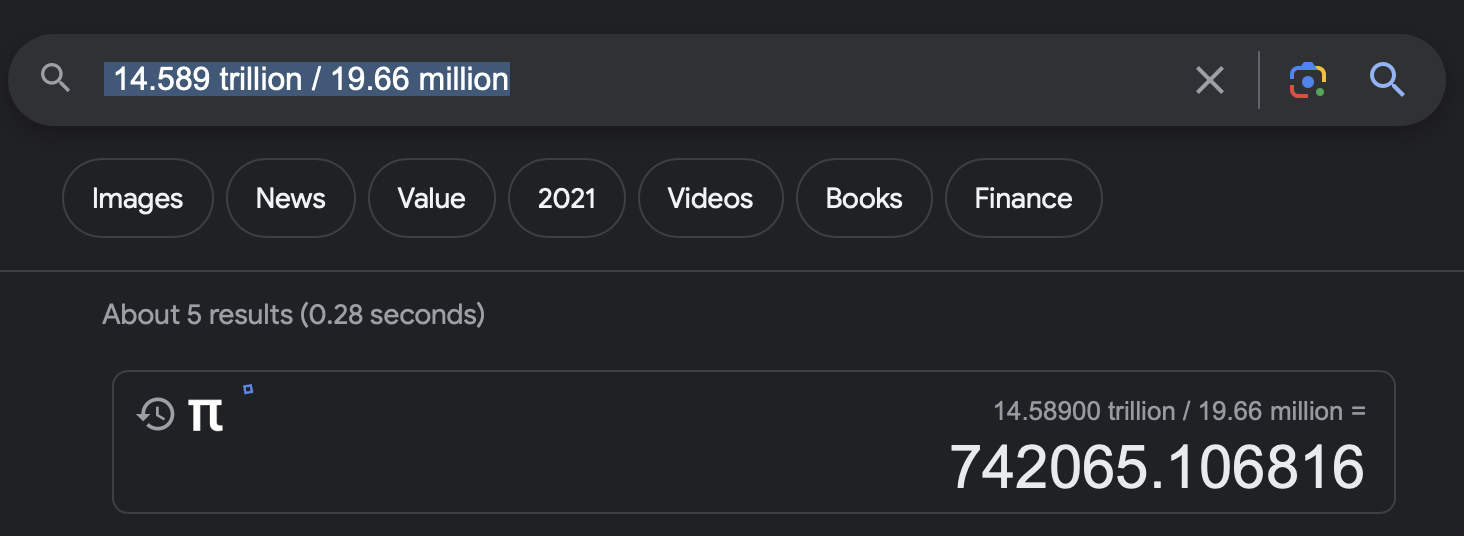

Finally, taking the:

- Market cap of gold today = $14.5 trillion

- Total supply of Bitcoin today = 19.7 million Bitcoin

To calculate the price per Bitcoin to achieve a market cap of $14.7 trillion we take the:

Market cap of gold / Total supply of Bitcoin ≈ $0.7M (+/- 20%=0.9M/$0.6M) = Price per Bitcoin.

If Bitcoin surpasses the market cap of gold, each Bitcoin would need to be worth approximately $742K. This figure is speculative and can fluctuate based on changing market conditions.

Any estimate regarding Bitcoin surpassing gold should be approached with caution, considering gold’s extensive history and the inherent uncertainties and potential unforeseen developments that could affect the valuation of both assets.

Factors Influencing The Bitcoin-to-Gold Ratio

It is important to recognize that the Bitcoin-to-gold ratio is not static and can vary over time due to various factors, including market demand, supply dynamics, and macroeconomic conditions. As Bitcoin adoption continues to grow and institutional investors show increasing interest in the cryptocurrency, the ratio could shift in favor of Bitcoin.

Since the launch of the spot Bitcoin ETFs on January 11, the landscape of investment preferences has subtly and significantly shifted. The ETF new entrants have not only intrigued the market’s attention but have unlocked and amassed nearly $10 billion in assets under management (AUM) in just over a month, a testament to the interest in cryptocurrency globally as a viable investment vehicle.

Gold ETFs, traditionally seen as the hardest commodity of value for the last five thousand years, have experienced notable outflows, with the two largest funds being the SPDR Gold Shares and iShares Gold Trust, seeing a combined withdrawal of over $3 billion in the same timeframe.

The timing of these shifts, coinciding with the introduction of Bitcoin ETFs, paints a compelling narrative of changing investor sentiment. While gold has long been cherished for its stability and historical significance, the allure of Bitcoin, often heralded as ‘digital gold,’ seems to be resonating more profoundly with modern investors as humanity enters the information age.

While it’s premature to declare a definitive shift in preference from gold to Bitcoin, the current investment patterns and performance indicators hint that Bitcoin has a very real chance to surpass gold. In this context, the enthusiasm for Bitcoin leaves an investor with a question to be answered. Isn’t it becoming increasingly obvious where the future of value preservation and growth might lie?

Bitcoin’s Edge Over Gold

Moreover, Bitcoin’s scarcity is a fundamental aspect that distinguishes it from traditional assets like gold. Unlike gold, which has a finite but continuously increasing supply due to mining, Bitcoin has a fixed supply cap of 21 million coins. The inherent scarcity inbuilt into the Bitcoin protocol was designed to mimic the properties of precious metals like gold.

Bitcoin As ‘Digital Gold’

Another factor that could influence Bitcoin’s price relative to gold is market sentiment and investor behavior. While gold has a long-standing reputation as a safe-haven asset, Bitcoin’s narrative as ‘digital gold’ is gaining traction among investors, particularly younger generations and tech-savvy individuals.

The Growing Institutional Interest In Bitcoin And Its Impact

As more investors recognize Bitcoin’s potential as a hedge against fiat currency devaluation and geopolitical uncertainty, demand for the cryptocurrency will surge, driving its price higher.

Conversely, a decline in confidence in traditional financial systems or a macroeconomic crisis could lead to increased demand for both Bitcoin and gold, further fueling their prices.

Additionally, the growing institutional adoption of Bitcoin could play a significant role in driving its price higher. In recent years, several institutional investors, hedge funds, and publicly traded companies have allocated a percentage of capital to Bitcoin in institutional investors portfolios as a hedge against inflation and a potential store of value.

Concerns Over BTC Volatility

The entry of institutional players into the Bitcoin market not only increases demand but also lends credibility to the cryptocurrency as an investable asset class. As more institutions allocate capital to Bitcoin, it is likely to experience an increase in price, potentially narrowing the gap between its market cap and that of gold. However, it’s important to note that Bitcoin’s price volatility remains a concern for some investors.

While volatility has decreased over time as Bitcoin’s market matures, the cryptocurrency is still prone to significant price swings, which could sway risk-averse investors away from fully investing into Bitcoin as a store of value.

Conclusion

In conclusion, while Bitcoin’s current market cap represents only a fraction of gold’s, Bitcoin’s potential to surpass gold cannot be dismissed. With its scarcity, growing adoption, and increasing institutional interest, Bitcoin is likely to continue its ascent in the financial world.

While predicting the exact price at which Bitcoin will overtake gold is challenging, the journey towards that milestone promises to be an intriguing one, with profound implications for the future of finance.

Disclaimer

Estimates and projections regarding Bitcoin’s potential to surpass gold’s market cap are speculative and subject to change based on various factors, including market dynamics, regulatory developments, and investor sentiment. Any investment decisions should be made after careful consideration of individual circumstances and thorough research.

FAQs

Since launching in January, Bitcoin ETFs have seen significant inflows, indicating growing investor interest and confidence in cryptocurrency. Investors are withdrawing from Gold ETFs, possibly due to lower performance and the physical limitations of gold investments. Bitcoin ETFs are emerging as a modern safe haven, offering protection against inflation and government intervention, similar to gold.How have Bitcoin ETFs performed since their launch?

Why are investors pulling funds from Gold ETFs?

Can Bitcoin ETFs be considered a safe haven like gold?