Crypto Market Capitulation: Phenomenon Explained

Crypto Market Capitulation | Credit: Shutterstock

What Is Crypto Market Capitulation?

Key Takeaways

- Crypto market capitulation involves mass selling, often fear-driven resulting in rapid price declines.

- Market sentiment influences asset prices with bullish (optimistic) or bearish (pessimistic) outlooks.

- Coping with capitulation may be achieved by avoiding emotional decisions, having well thought out diversification, a long-term perspective, and dollar-cost averaging.

- Opportunities arise during capitulation events for experienced and contrarian investors.

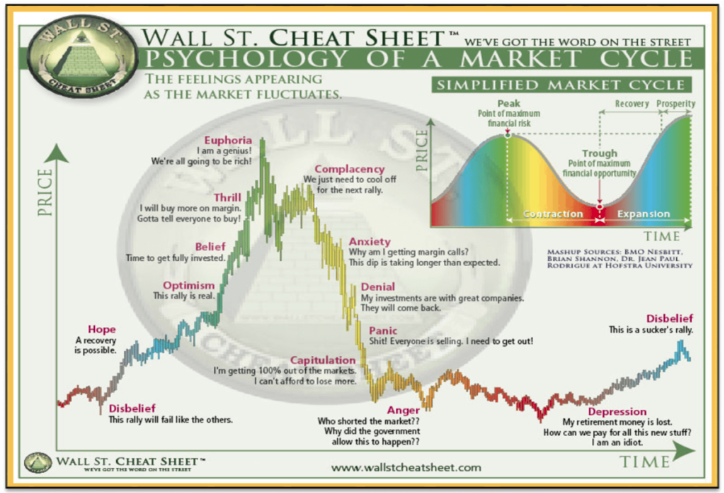

Crypto market capitulation refers to a period of intense panic selling and declining prices in the cryptocurrency market. The Wall Street Cheat Sheet is a simplified visual representation of market emotions, with “Euphoria” at the top and “Depression” at the bottom, of every market cycle. When a market cycle is overwhelmed by fear, it leads to a mass selling of assets at low prices. Capitulation is the time in a market when investors tend to sell their investments, causing prices to plummet rapidly.

This mass selling activity is often triggered by various factors, such as negative news, regulatory uncertainties, negative technical analysis indicators, and significant market corrections stemming from margin calls and overleveraged trades.

During this period, investors and traders, overwhelmed by fear and panic, are either forced to exit their positions because of said margin calls or liquidate their holdings rapidly because of their loss in faith in the asset. This environment normally results in a final capitulation in price and a bottom in price for that specific asset.

Amidst the chaos of selling, Baron Rothschild, a British banker and politician from the wealthy international Rothschild family, once said that the best time to buy is “when there is blood in the streets.” In simple terms, when everyone else is selling, is a great time to purchase to asset on discount.

Understanding Market Sentiment

Market sentiment refers to the overall attitude of the market towards a particular financial market or asset.

Bullish Sentiment

A bull is the animal symbolizing a positive trend and outlook on market prices because like price starts pushing upwards a bull fights upwards with its horns. This sentiment is often driven by positive technical analysis, positive news, strong fundamentals, and an overall optimistic view of the future.

Bearish Sentiment

Bearish sentiment, symbolized by bears who fight with their claws downwards, is referred to when investors and traders hold a negative outlook, expecting prices to decline, and are perceiving higher risks and potential losses. This sentiment can be triggered by negative technical analysis, negative news, concerns about market fundamentals, and a general sense of pessimism.

The Role Of Market Psychology In Crypto Trading

In crypto trading, understanding market psychology is key to determining a trader’s success. Just like in traditional markets, investors in the crypto world can tilt the odds in their favor by understanding market psychology. Strategies may then be developed by thinking in probabilities and using market psychology as a tool to make contrarian predictions.

Fear And Greed Index In Cryptocurrency

The Fear and Greed Index is a sentiment analysis tool for the cryptocurrency market, measuring the level of fear or greed among investors and traders. When the market is overly fearful, it may present a good buying opportunity, while extreme greed could indicate an overvalued market and a good time to sell. The index is color-coded on a scale of 0 to 100, with red indicating extreme fear and green indicating extreme greed.

Causes And Triggers Of Capitulation

Attempting to predict a capitulation event is challenging. This means making portfolio changes with a longer-term horizon can result in optimal decision-making.

Impact of Influential Investors – “Whales”

To navigate the market effectively, adopting a long-term investment strategy and being mindful of the market cycle becomes crucial. One significant factor to consider is the presence of influential investors, often referred to as “whales,” who possess substantial capital and can sway the market in various directions.

These seasoned investors are known to influence market movements, especially during capitulation periods, through strategic buying or selling of positions. As an investor or trader, it’s essential to have a well-thought-out trading plan that takes into account these significant market fluctuations.

Negative News And Events

The influence of negative news and events on market sentiment is undeniable, often causing short-term volatility. Emotional reactions among market participants can lead to swift sell-offs and increased uncertainty. Nevertheless, for long-term investors, it becomes crucial to judge between short-term disturbances and the lasting value of the underlying assets.

Additionally, it’s worth noting that at times, bad news might not necessarily have an immediate impact on asset prices, as it could have been anticipated and already factored into the market over time. Also, volatility is always healthy for a trader to take advantage of carefully.

Overleveraging and Liquidations

Capitulation events are a significant concern when it comes to overleveraging, which refers to the act of taking on excessive debt in pursuit of higher profits. Although it can enhance gains in favorable market conditions, it equally amplifies losses during downturns, making investors vulnerable to liquidations and margin calls. Unfortunately, by adopting leverage, individuals place themselves at a disadvantage, exposing themselves to higher risks of self-sabotage and the potential to wipe out their accounts. There are moments when the market turns against leveraged traders in price which can push numerous traders out of business, triggering mass selling and ultimately leading to a possible capitulation event.

Historical Examples Of Crypto Market Capitulation

FTX Exchange Collapse

In November 2022, the FTX cryptocurrency exchange, the world’s third-largest exchange by trading volume, experienced a significant liquidity crunch, leading to a cascade of events that had a major impact on the crypto market, including the capitulation of Bitcoin’s price down to $15,650.

The liquidity crunch was triggered by customers rushing to withdraw billions of dollars worth of assets due to fears surrounding FTX’s digital token FTT. The uncertainty and potential insolvency of such a prominent player had a spillover effect on the entire market, causing widespread concern among investors and traders.

Mt.Gox

Mt. Gox was the go-to service for handling transactions and dominated the Bitcoin exchange market in 2013. However, in 2014, it halted transactions due to a massive $473 million crypto-hack, the biggest at the time.

The event led to price discrepancies and increased volatility across exchanges, and after receiving extensive media coverage and amplifying fear and uncertainty in the market the Bitcoin price, in January 2015, saw a capitulation to $153 from its high in December 2013 of $1,141.

Miner Capitulation

Throughout Bitcoin’s history, there have been cycles of miner capitulation, where Bitcoin miners, faced with declining profits, sell their holdings to cover operational expenses or address over-leveraged positions. These capitulation phases usually occur during bear markets when the price of Bitcoin is low and mining becomes less profitable.

Impact Of Market Capitulation On Crypto Prices And Market

Market capitulation spirals out of control in the following manner.

First a significant news event shakes the whole macro environment or cryptocurrency space, impacting prices and the overall market. This event results in price volatility and extreme swings in price become apparent, as investors react to these sudden and sharp declines.

The chaos and fear of further losses further triggers investor panic, leading to a mass exodus of funds from the market. The fall in prices stops leveraged traders further pushing the price downwards. This loss of confidence in the market’s stability becomes a self-fulfilling prophecy, as more investors sell, further pushing prices lower until finally a bottom is found. This environment becomes excellent opportunities for experienced investors and traders to invest at a discount.

Recognizing And Coping With Capitulation

In the crypto and traditional financial markets recognizing capitulation usually begins by identifying moments of extreme uncertainty, fear, and complete lack of confidence among market participants.

Identifying Signs Of Market Capitulation

- Rapid price decline: Capitulation is often characterized by a sharp and sudden drop in asset prices, driven by intense selling pressure from investors.

- High trading volumes: During capitulation, there is an increase in trading volumes as investors rush to sell their holdings, leading to higher than usual transaction activity.

- Market volatility: Volatility spikes during capitulation as uncertainty and fear drive wild price swings and erratic market behavior.

- Oversold conditions: Technical indicators, such as the Relative Strength Index (RSI), may signal oversold market conditions, indicating that the asset’s price has dropped excessively.

- Negative sentiment: Investors’ sentiment turns overwhelmingly pessimistic, with a lack of confidence in the market’s future prospects.

Strategies For Coping With Capitulation

- Avoid emotional decision-making: Investors should strive to avoid making impulsive decisions driven by fear and panic. Emotional decision-making can lead to selling assets at a low point and missing potential buying opportunities.

- Stick to an investment plan: Having a well-defined investment plan that aligns with your long-term goals can help you stay focused during market downturns. Stay committed to your strategy and avoid deviating due to short-term market fluctuations.

- Diversification: A well-diversified investment portfolio can help mitigate the impact of capitulation on your overall holdings. Allocating investments across different asset classes can provide a hedge against market volatility.

- Long-term perspective: Remember that capitulation is often a temporary phase in the market cycle. Maintaining a long-term perspective can help you ride out the downturn and potentially benefit from market recovery.

- Dollar-cost averaging: If you are looking to invest during capitulation, consider dollar-cost averaging. This strategy involves investing a fixed amount at regular intervals, regardless of market conditions, which can help you buy assets at different price points and reduce the impact of market timing.

The Role Of Hodling In Times Of Capitulation

“Hodling” refers to the strategy of holding onto assets, typically cryptocurrencies, during periods of market volatility and uncertainty. Hodling can be an effective approach during capitulation, as it allows investors to avoid emotional decision-making and gives the asset a chance to recover once market sentiment improves.

Catching A Falling Knife In Times Of Capitulation

“Catching a falling knife” is a metaphor commonly used in financial markets, including cryptocurrency trading, to describe the risky practice of attempting to buy an asset at the moment it is experiencing a steep decline in price. Just like trying to catch a falling knife in the physical world is dangerous, this action can be highly risky in investing. It involves trying to time the bottom of a price drop, which is challenging and unpredictable.

Investors who attempt to catch a falling knife often face significant losses, as the asset’s decline may continue or worsen. It is a strategy that requires expert timing, extensive research, and a high tolerance for risk, making it unsuitable for most investors. Instead, a more prudent approach is to wait for the asset’s price to stabilize or show signs of a reversal before considering a purchase.

Opportunities In Capitulation

Contrarian Investing And Buying Opportunities

Capitulation can present unique opportunities for contrarian investors who are willing to go against the prevailing market sentiment. Buying assets when they are oversold and undervalued can lead to significant gains once the market recovers. However, contrarian investing requires careful analysis and risk management, as there is always the possibility of further price declines.

Bottom And Potential Reversal Points

Following capitulation, there is a possibility of prices rebounding from crucial support levels, suggesting a potential market bottom when the price revisits that pivotal point. To enhance our analysis at these levels, the Relative Strength Index proves to be a valuable technical indicator, alongside a thorough examination of past capitulation events.

Learning From Past Capitulation For Future Decisions

Studying past capitulation events and their outcomes can provide valuable insights for future investment decisions. By analyzing historical data and market patterns, investors can better understand the behavior of different assets during capitulation and devise more informed strategies to cope with similar situations in the future.

Conclusion

Price capitulation is bred from the emotional change in the markets. Fear can lead investors to sell their positions, causing swift declines in asset values. However, in these moments of despair, opportunities often lurk for the experienced contrarian investor. Whilst price capitulation may be brutal for many, those with conviction and patience get a chance to embrace undervalued assets and navigate toward future gains.

Remember, fortune favors those who stay steadfast when others falter, for the cycle of capitulation and resurgence is a constant dance within the realms of investing.

FAQs

What is crypto market capitulation?

Crypto market capitulation refers to a period in the market cycle when investors overwhelmingly sell their assets, causing prices to plummet rapidly.

What role does market sentiment play in crypto trading?

Market sentiment plays an unavoidable role in crypto trading as it determines the overall attitude of the market towards a particular asset.

How do influential investors and overleveraging impact capitulation events?

Influential investors (“whales”), can sway the market in various directions, impacting capitulation periods. Overleveraging, by taking on excessive debt for higher profits further amplifies losses during downturns, as it leads to liquidations and margin calls. Both factors can contribute to the intensity of capitulation events.

What are some strategies for coping with a capitulation in the crypto market?

To cope with capitulation, investors should avoid emotional decision-making, stick to a well-defined investment plan, diversify their portfolio, maintain a long-term perspective, and consider dollar-cost averaging. Hodling, or holding onto assets during volatility, can also be an effective strategy during capitulation. However, attempting to “catch a falling knife” by buying assets during steep declines is risky and requires expert timing and risk tolerance.