Dow Struggles as Trump Administration Eyes TikTok Ban

The U.S. stock market is awaiting Donald Trump's decision on Oracle's TikTok acquisition. | Image: Lionel BONAVENTURE and JIM WATSON / AFP

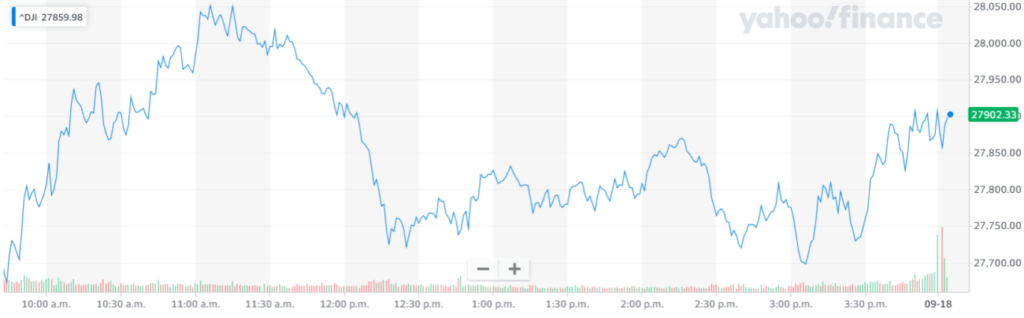

- The Dow Jones Industrial Average opened lower on Friday; the S&P 500 fluctuated after a positive start to the day.

- President Trump will announce Friday whether his administration would approve Oracle’s bid for TikTok’s U.S. operations.

- Despite Thursday’s sharp decline, U.S. equities are on track to snap a two-week losing streak.

The Dow and broader U.S. stock market fluctuated at Friday’s open, as investors awaited the Trump administration’s decision to approve Oracle’s minority stake in Chinese-owned TikTok.

Dow Declines; S&P 500 Flat-Lines

Wall Street’s major indexes were mixed at the open, reflecting a tepid pre-market for U.S. stock futures . The Dow Jones Industrial Average declined by as much as 73 points in early trading.

The broad S&P 500 Index was up by as much as 0.4% before quickly reversing course. The technology-focused Nasdaq Composite Index also pared gains and was last up 0.2%.

Most sectors traded mixed-to-lower at the open. The S&P 500’s consumer discretionary index plunged 1.6%. Energy stocks also fell sharply.

On the opposite side of the ledger, communication services rose.

Markets are still eyeing weekly gains thanks to a sharp rebound in technology stocks at the start of the week. Vaccine optimism and expectations of ultra-loose monetary policy also helped equities recover from back-to-back weekly declines.

Trump Decision on TikTok Expected

Shares of Oracle declined on Friday after the Commerce Department announced it would ban TikTok downloads and the use of WeChat on Sunday over national security concerns. Watch the video below:

Commerce Secretary Wilbur Ross told Fox Business Network that his office would implement a full ban on TikTok by Nov. 12 unless parent company ByteDance incorporates data safeguards in its pending deal with Oracle.

Oracle is the front-runner to become ByteDance’s technology partner in the United States , which would allow the company to continue offering its popular TikTok video-sharing platform.

According to The Wall Street Journal , Walmart and Oracle could together own a significant stake in TikTok’s U.S. operations. Walmart was previously involved in Microsoft’s bid for a minority stake in the platform.

According to CNBC, President Trump is expected to announce Friday whether his administration will approve Oracle’s bid.

The TikTok and WeChat bans are the latest in a series of escalations by the Trump administration to confront China’s so-called “civil-military fusion.”

The phrase, which appeared in the Commerce Department’s statement, refers to Chinese companies backed by the Communist Party. This fusion, the Trump administration alleges, allows Chinese-backed companies to collect intelligence and steal intellectual property from U.S. firms.