Dow Cringes as Wall Street Fears Painful Fed U-Turn

Fed Chair Powell's confusing commentary | Source: NICHOLAS KAMM / AFP

The Dow stumbled toward a third straight loss on Tuesday as Wall Street braced for Federal Reserve Chair Jerome Powell to initiate a painful U-turn on interest rate policy.

Dow Strings Together Another Loss

All of Wall Street’s major indices suffered another round of pullbacks. As of 9:31 am ET, the Dow Jones Industrial Average had dropped 127.31 points or 0.47% to 26,678.83.

The S&P 500 fell 11.72 points or 0.39% to 2,964.23. All 11 primary sectors recorded declines; Communications led the retreat with a 0.71% plunge.

The Nasdaq lost 36.28 points or 0.45% to settle at 8,0652.11.

Stock Market Sobers Up

The US stock market failed to recover from a frigid pre-bell session as Federal Reserve Chair Jerome Powell prepared to kick off three days of public commentary.

Beginning on Wednesday, Powell will testify for two days before Congress. The Fed chair also spoke at a conference this morning, and Wall Street will closely scrutinize his remarks for clues on what the central bank thinks about the health of the US economy.

In one of the market’s cynical ironies, investors are cursing last week’s bullish economic data, fearful that it will make the Fed hesitant to cut interest rates too aggressively.

Economists such as Mohamed El-Erian had already warned that Wall Street’s expectations for subsequent rate cuts have gotten out of hand, and investors are cringing because they believe cautious commentary from Powell could confirm El-Erian’s thesis.

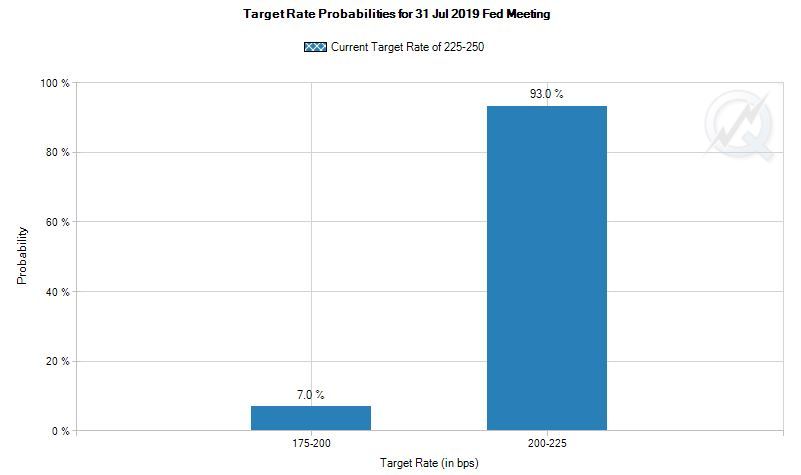

CME’s FedWatch Tool indicates that traders remain 100% certain that the Federal Reserve will cut its target interest rate in July.

However, some analysts believe that the multiple rates cuts the market had already priced in might not materialize.

Wall Street Wants to ‘Have Its Cake and Eat It Too’

Others warn that Wall Street is attempting to walk a dangerous tightrope.

They need the economy to be good, but not too good. They want the Fed to be concerned about the health of the market, but not too concerned.

That’s because, in the words of John Vail, stock market players seem to want to have their cake and it eat too.

“The level of certainty [that the Fed will cut in July] is not justified,” John Vail, chief global strategist at Nikko Asset Management told MarketWatch . “At least in the short term, markets believe they can have its cake and eat it too.”

But all that junk food could leave behind a bitter taste, especially if the Fed continues to fire off its last rounds of fiscal ammunition prematurely.

So-called permabear David Rosenberg warned on Monday that the US economy’s recession risk has spiked to 32.9%. Not only is that a 12-year high, but Rosenberg – the chief economist at Gluskin Sheff – said that historical data “shows there is no turning back at this level.”

Click here for a live Dow Jones Industrial Average (DJIA) price chart.