Dow Quivers as Beijing Slams Trump for ‘Naked Economic Terrorism’

The Dow clawed higher on Monday, even as Donald Trump and China traded new jabs ahead of resuming already-fraught trade war negotiations. | Source: REUTERS / Jonathan Ernst (i), REUTERS / Florence Lo (ii). Image Edited by CCN.com.

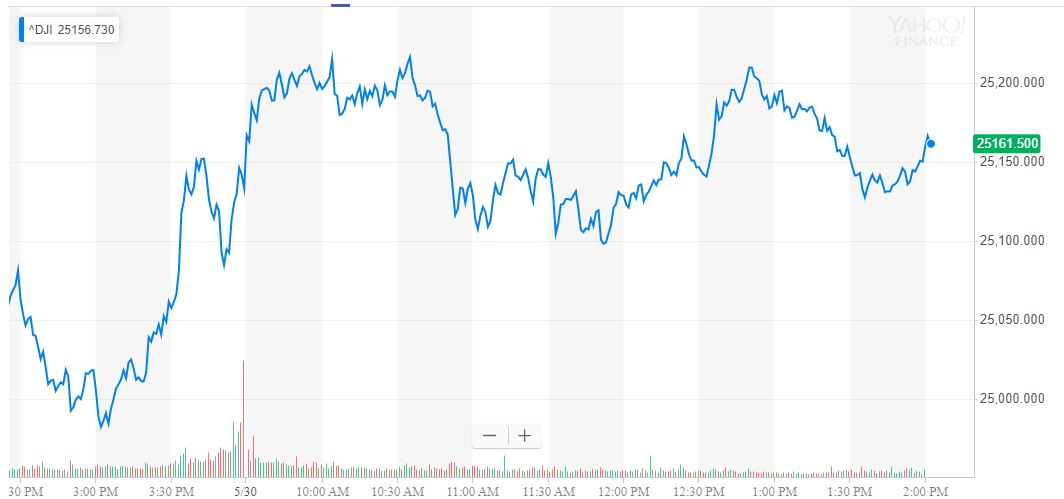

By CCN.com: A hesitant Dow crept toward a paltry recovery on Thursday following a two-day bloodbath that wiped nearly 500 points off the index. The trade war continues to command Wall Street’s undivided attention, and Beijing’s latest provocations should terrify investors.

Dow Creeps Toward Meager Recovery

Wall Street betrayed a lack of conviction during the Thursday trading session. As of 2:04 pm ET, the Dow Jones Industrial Average had inched up 31.77 points or 0.13% to 25,158.18. The S&P 500 climbed 3.61 points or 0.13% to 2,786.65, and the Nasdaq rose a disappointing 10.32 points or 0.14% to 7,557.63.

Beijing Intensifies the Ruthless Trade War Rhetoric

Stocks eyed a shaky recovery after bond yields rose, reducing concerns about a looming recession. However, that comeback will likely be hampered by yet another alarming escalation in trade war rhetoric by a senior Chinese diplomat.

Earlier today, Chinese vice-foreign minister Zhang Hanhui warned the United States that Beijing is “not afraid” of a trade war. He slammed President Trump’s administration from engaging in “naked economic terrorism” and “bullying.”

“We oppose a trade war but are not afraid of a trade war. This kind of deliberately provoking trade disputes is naked economic terrorism, economic homicide, economic bullying,” Zhang said, according to the South China Morning Post .

Just one day prior, an editorial in the Communist Party’s official newspaper savagely rebuked the Trump administration and called for China to weaponize its dominant position in the global rare earths market to cripple US manufacturing.

“Don’t say we didn’t warn you,” the editorial thundered, unleashing an ominous phrase that carries even more weight in Chinese than in English.

China Targets US Farmers With Soybean Standoff

Such rhetorical provocations could send a chill through Wall Street, particularly since they’re increasingly accompanied by concrete actions that are more difficult to unwind.

Bloomberg reports that China has suspended US soybean purchases , placing economic pressure on farmers – a Trump voting bloc – ahead of the 2020 presidential election.

China is the world’s largest importer of soybeans, and a sudden decline in demand would wreak havoc on the US agriculture industry.

China had previously promised to increase US soybean imports to help the US reduce its trade deficit. Beijing purchased 13 million metric tons of US soybeans following the December tariff truce and agreed in February to buy another 10 million tons.

While Beijing has not canceled its orders for the 7 million tons of soybeans it had already placed, the elimination of new purchases could make Trump sweat ahead of his planned meeting with Xi at the end of June.

Dow Edges Closer to Punishing Weekly Loss

Even if the Dow does manage to crawl its way toward a tepid gain on Thursday, the stock market bellwether remains on track to record a punishing sixth straight weekly loss.

On May 29, the Dow plunged 221.36 points or 0.87% to 25,126.41; altogether, the DJIA has lost 459.28 points during the holiday-shortened trading week.

The S&P 500 slid 19.37 points or 0.69% to settle at 2,783.02 on Wednesday, and the Nasdaq dropped 60.04 points or 0.79% to 7,547.31 as investors reduced exposure to riskier assets.