Dow Swings Wildly as Wall Street Recoils from 800-Point Bloodbath

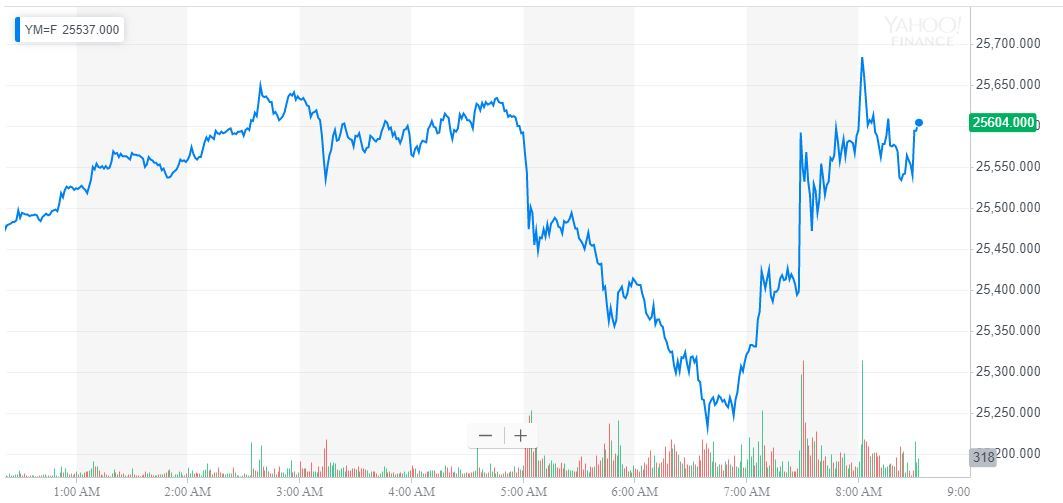

The Dow swung wildly on Thursday, as Wall Street digested new trade war developments - all while recoiling from an 800-point DJIA bloodbath. | Source: AP Photo / Richard Drew

By CCN.com: A volatile Dow Jones swung wildly on Thursday, as the US-China trade war once again took center stage in the wake of the bond market’s first main yield curve inversion in more than a decade.

Dow Zips Higher Despite Ugly Futures Session

Wall Street’s major indices recovered from steep losses in the futures market to post bullish advances. The Dow Jones Industrial Average took the first step in recovering from Wednesday’s devastating 800-point plunge, rising 111.13 points or 0.44% to 25,590.55.

The S&P 500 edged 10.92 points or 0.38% higher to 2,851.52. Consumer staples led the recovery with a 1.09% advance.

The Nasdaq rounded out a positive morning session with a gain of 25.19 points or 0.32% to 7,799.13.

China to Trump: Meet Us ‘Half-Way’

Dow Jones futures had pointed to another ugly loss, but the market jerked higher at approximately 7 am ET.

One primary driver was a positive development in US-China trade relations , which had quickly grown frosty following their resumption late last month.

On Thursday, Chinese foreign ministry spokesperson Hua Chunying said that Beijing is eager to meet the United States “half-way” on longstanding sticking points so that the world’s two largest economies can arrive at “mutually acceptable solutions” rather than engage in a market-rattling trade war tit-for-tat.

“We hope the U.S. side will meet China half-way, and implement the consensus reached by the two leaders during their meeting in Osaka, and look for mutually acceptable solutions through dialogue on the basis of equality and mutual respect,” Hua said. “On the basis of equality and mutual respect, we will find mutually acceptable solutions through dialogue and consultation.”

Bullish earnings reports from Alibaba and Walmart added to the optimistic mood, as both retail giants recorded substantial increases in sales.

Finally, excellent economic data bolstered the recovery. The Labor Department revealed that US productivity rose 2.3% for the second quarter, well above the expected 1.5% rate . Nevertheless, this was muddled a bit by a greater-than-expected increase in jobless claims .

Stock Market Bears Double Down on Tariff Spat, Historic Bond Yield Plunge

Of course, Wall Street bears also had plenty of ammunition to bolster their doom-and-gloom outlooks.

Bloomberg reports that, prior to the foreign ministry’s conciliatory remarks, China’s State Council Tariff Committee warned the White House that its recent tariff delay is insufficient to prevent Beijing from retaliating for the provocation, which Chinese officials say violated the agreement Donald Trump and Xi Jinping struck at the G20 summit.

According to a State Council Tariff Committee statement, China “has no choice but to take necessary measures to retaliate” against the new tariffs, some of which will still kick in as soon as September 1.

Adding to the bearish outlook, the South China Morning Post reports that Chinese companies aren’t counting on a swift end to the trade war , with firms reliant on US exports hunkering down for “the instability and tension to continue for at least a decade.”

Moreover, the yield on the 30-year US Treasury bond dropped to a historic low , briefly sliding beneath 2% for the first time ever. Yields decline as prices rise, indicating that investors continue to flee to the perceived safety of bonds as the outlook for equities grows darker.

Click here for a real-time Dow Jones Industrial Average chart.