Dow Jones Dives 400 Points as US Cancels Trade Meeting with China

A booming US stock market is no match for a flailing Chinese economy. | Source: Shutterstock

By CCN.com: The Dow Jones Industrial Average plummeted 400 points by mid-day Tuesday. Markets are very responsive to crucial trade policy decisions. The ongoing tariff war with China has had a haphazard effect on various industries, both importing and exporting. Soybean growers have been hit particularly hard by retaliatory tariffs imposed by China.

US-China Trade Talks Canceled

A source told CNBC today that a planned meeting this week between Trade Rep. Robert Lighthizer and Chinese vice ministers of trade has been called off. Ongoing differences of opinion between the White House and Beijing contributed to the cancellation. The story is still developing, but erstwhile the president told China to “stop playing around.”

Donald Trump is committed to the idea of tariffs as a reasonable method for boosting the US economy. The effects of high tariffs between the US and China are hard to reconcile for the manufacturing and agricultural industries which rely on valuable exports to post reasonable profits.

The reports of the meeting cancellation follows news last week regarding China’s plan to go on a $1 trillion buying spree in the US.

Dow Drops 400 Points

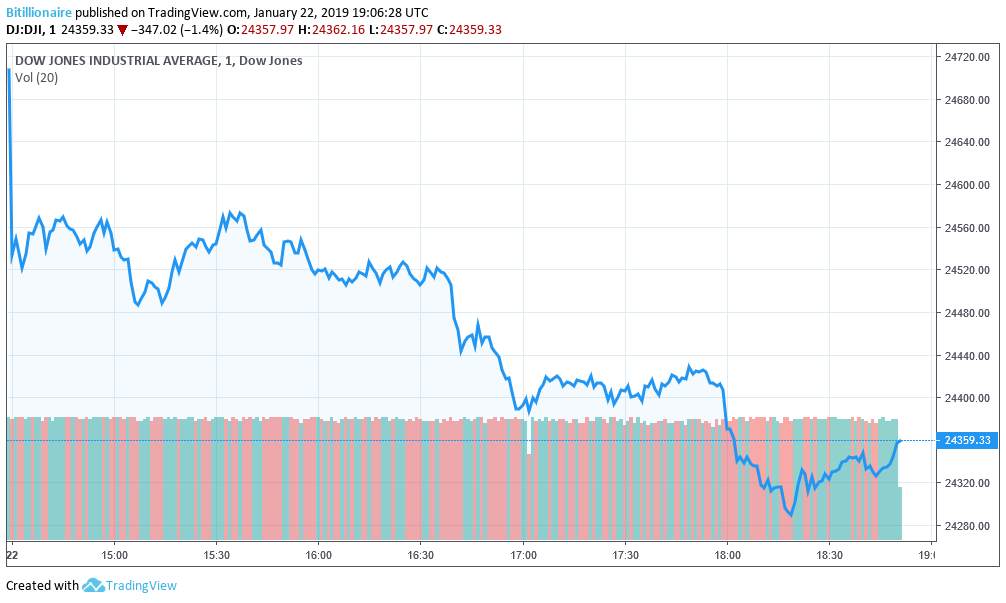

The Dow opened the day’s trading with steep losses, and by the time of writing (mid-day) the index had lost 400 points, bottoming out at one point around 24,290.

Top companies like Apple and Amazon are intimately affected by tariff wars, especially with China. Apple relies on importing its manufactured goods from China while a huge variety of products sold on Amazon are also made in China. Actual profitability of both firms can be impacted by even single-digit tariff increases on either side of the equation, which affects trader confidence in their stock valuation.

Stock Market Wrestles with Trade War

The US stock market has been in a state of chaos the past couple months as international trade policies are hammered out. In December, we saw the wildest two-day period in history, with a massive drop one day and a huge recovery the next. However, the recovery was not a complete reversal, and trading has been hit and miss since.

Some analysts have attributed wild trading to quantitative firms using algorithmic trading. Some algorithms include news feeds and calculate based on major announcements from government officials. The cancellation of the trade talks predicated a further 100-point slide today. It may have simply amplified an already down-trading day. Either way, the slippage and the trade situation, along with the government shutdown that affects most large companies who have contracts with the federal government, cannot be decoupled in a reasonable way.

Featured Image from Shutterstock. Price Charts from TradingView .