Dow Climbs as Trump Officials Prep for Crucial Beijing Trip

The Dow climbed on Monday as Trump's top negotiators prepared to travel to Beijing to resume trade talks with China. | Source: Nicolas ASFOURI / AFP

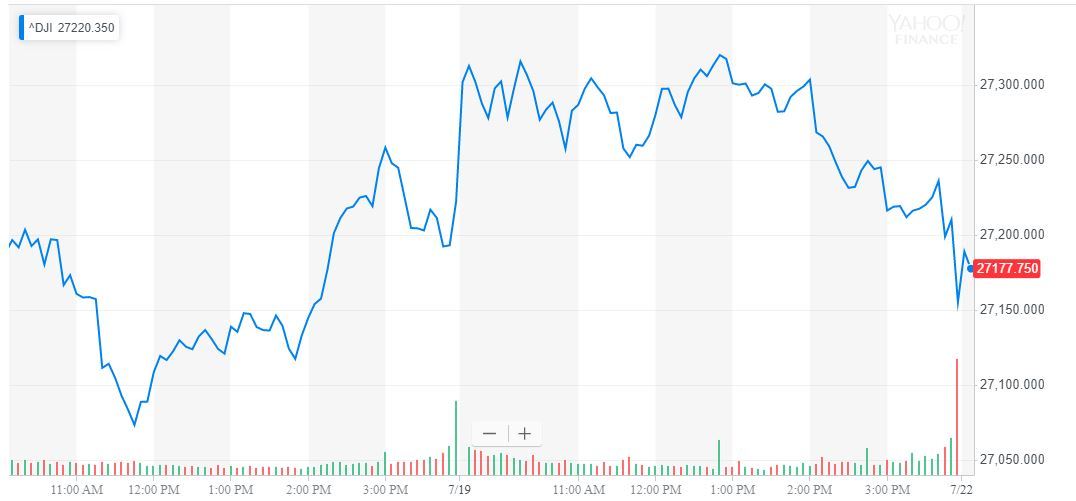

The Dow Jones began the week on a high note as the White House prepared to send its top negotiators to Beijing for their first face-to-face talks with Beijing since President Donald Trump met with Xi Jinping last month.

Dow, S&P 500, and Nasdaq All Rise

All of Wall Street’s major indices rose during the morning session, reversing the effects of Friday setbacks. The Dow Jones Industrial Average climbed 39.64 points or 0.15% to 27,193.84.

The S&P 500 added 6.91 points or 0.23% to climb to 2,983.52.

The Nasdaq outpaced its peers with a 29.57 point or 0.37% rise to 8,176.47.

US & China Prepare to Resume High-Stakes Trade Talks

The stock market rose amid reports that the United States and China will resume face-to-face negotiations following a two-month standoff.

According to the South China Morning Post , US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will fly to Beijing next week for the first in-person meeting since Presidents Donald Trump and Xi Jinping shook hands on a tariff truce at last month’s G20 summit meeting.

Lighthizer and Mnuchin will likely meet with Chinese Vice-Premier Liu He, Beijing’s top trade war negotiator, though neither government has confirmed the SCMP’s report.

Analysts fear that neither side plans to budge on longstanding disagreements that even trade war uber-optimist Steven Mnuchin has conceded are “complicated issues.”

However, both the US and China have made goodwill gestures ahead of next week’s rumored meeting. Bloomberg reports that Beijing plans to increase imports of US agricultural products, while the Trump administration announced tariff exemptions for more than 100 Chinese products.

Trump’s Fed Up with the US Central Bank

Elsewhere, President Trump continued his withering assault on the US Federal Reserve, which he blames for hampering economic growth even as the Dow, S&P 500, and Nasdaq all trade near record levels.

Writing on Twitter, Trump complained that the US is “needlessly being forced to pay a MUCH higher interest rate than other countries” due to “misguided” Fed policy.

“As good as we have done, it could have been soooo much better,” he said. “Such a waste of time & money. Also, very unfair that other countries manipulate their currencies and pump money in!”

The Fed, as CCN.com reported, will meet next week for its monthly FOMC policy meeting. The central bank is widely expected to reduce its interest rate target by at least 25 basis points, with the market pricing in a 23.5% chance of a 50 basis point cut.

Trump, however, does not intend to heap praise on the Fed for reversing its once-hawkish stance to initiate the rate reduction he has long demanded. Rather, he concluded his mini-tweetstorm with a warning.

“The Fed raised & tightened far too much & too fast. In other words, they missed it (Big!),” he thundered. “Don’t miss it again!”

Click here for a real-time Dow Jones Industrial Average price chart.