Dow Quivers as Wall Street Reckons With Fed Disunity

The Dow quivered on Wednesday as Wall Street reckoned with a disunified Federal Reserve whose FOMC decision will likely disappoint markets. | Source: REUTERS / Brendan McDermid

The Dow slid back into decline on Wednesday as Wall Street quivered ahead of what an increasing number of market analysts expect will be a less-than-satisfying Federal Reserve policy statement.

Dow Trades Down Ahead of FOMC Decision

The US stock market took a small step backward at Wednesday’s opening bell. The Dow Jones Industrial Average dropped 77.56 points or 0.29% to 27,033.24.

The S&P 500 declined 8.07 points or 0.27%. That forced the index below the 3,000 level to 2997.63. Eight of 11 primary sectors reported declines, with industrials and energy suffering the worst setbacks.

The Nasdaq slightly outperformed its peers, losing 16.51 points or 0.2% to settle at 8,169.50.

Stock Market on Pins & Needles as FOMC Decision Looms

The US market is on pins and needles ahead of today’s FOMC interest rate decision and policy statement release.

Wall Street bulls want the Federal Reserve and Chair Jerome Powell to adopt a more dovish tone. At the last Fed meeting in July, he described the bank’s first interest rate cut in a decade as a “mid-cycle adjustment.” The market, which craves confirmation that the Fed has embarked on a deliberate rate-cutting track, did not greet those remarks with enthusiasm.

There’s growing sentiment that, although the Fed is more likely to reduce its benchmark rate than not, Powell will not forecast future interest rate cuts. And the market is becoming increasingly worried that even today’s rate cut won’t materialize, either.

“He’ll underwhelm everyone and not overwhelm anyone,” Diane Swonk, chief economist at Grant Thornton, told CNBC .

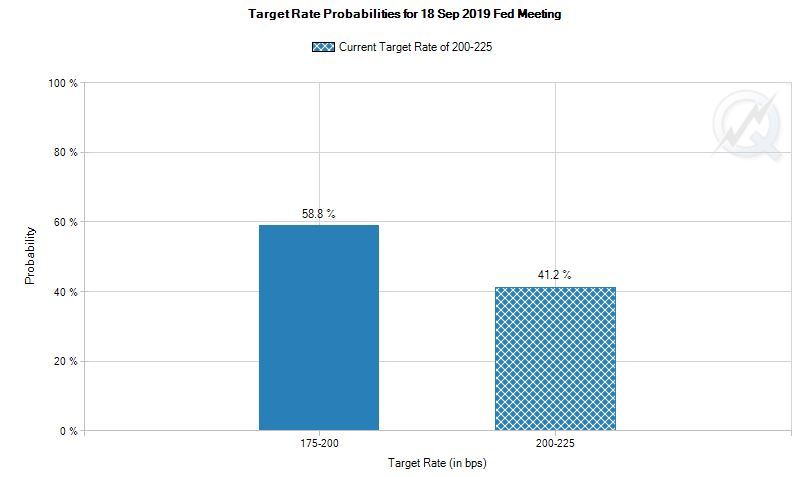

Earlier on Wednesday morning, CME’s FedWatch Tool implied a 58.8% probability of a 25-basis point interest rate cut following today’s FOMC meeting. That’s a remarkable swing from one month ago when the market implied a 100% probability of a rate reduction, and a one-fifth chance that the Fed would slash its target by 50-basis points.

While doves like St. Louis Fed President James Bullard have openly called for the bank to sharpen its cleaver and slash rates by 50-basis points, others – like Boston Fed President Eric Rosengren – have suggested that the Fed should maintain a neutral stance as long as inflation holds near 2%. Rosengren, along with Kansas City Fed President Esther George, voted against the first rate cut in July.

This stark disunity suggests that the Fed will maintain a measured stance in today’s FOMC policy statement.

“It is a very divided group,’’ Carl Tannenbaum, chief economist at Northern Trust, told Bloomberg . “If participants are not seeing a deterioration in growth, how far are they willing to push? It is not a sure thing they will do more.’’

The Fed will publish its interest rate decision and policy statement at 2 pm ET. Powell will hold a press conference at 2:30 pm ET.

Expect a Swift Rebuke from Trump

President Donald Trump has repeatedly called on Powell and the Fed to drive interest rates into negative territory, blaming the bank’s “incompetence” for wiping as much as 10,000 points in potential growth from the Dow.

With virtually no chance that the Fed acquiesces to his wishes this afternoon, it’s likely the FOMC policy statement will be met with a swift rebuke from Trump.

Click here for a real-time Dow Jones Industrial Average chart.