Dow Futures Whiplashes Upward On Trump Trade Claim but Questions Rage On

U.S. President Donald Trump has claimed China desperately wants to negotiate a trade deal again. Chinese state media says otherwise. | Source: REUTERS/Kevin Lamarque/File Photo

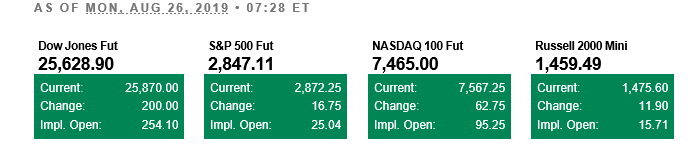

By CCN.com: Dow futures reversed sharply this morning after President Trump made positive comments about progress in the ongoing China-U.S. trade negotiations.

However, the president’s comments quickly came under fire, as Chinese players say no such talks happened.

Dow’s sharp reversal, despite questions

Prior to Trump’s comments, Dow Futures pointed to the market opening more than 300 points down. However, they quickly turned positive, up more than 300 points, after Trump delivered his comments from the G-7 Summit in France.

Trump said Chinese officials had reached out to start up trade talks again, not once, but twice. Hu Xijin, a Chinese journalist for the state-controlled newspaper in the People’s Republic of China, later tweeted:

Truce, cease-fire, or stunt?

The president reiterated that China is very eager to reach some kind of deal. When pressed for details, Trump would not give specifics.

The ‘he said, she said,’ banter led pundits to question who’s telling the truth, and at the very least, are Trump’s comments enough to hang your hat on? As the trade war has dragged on for weeks, investors and traders have been left with little clarity.

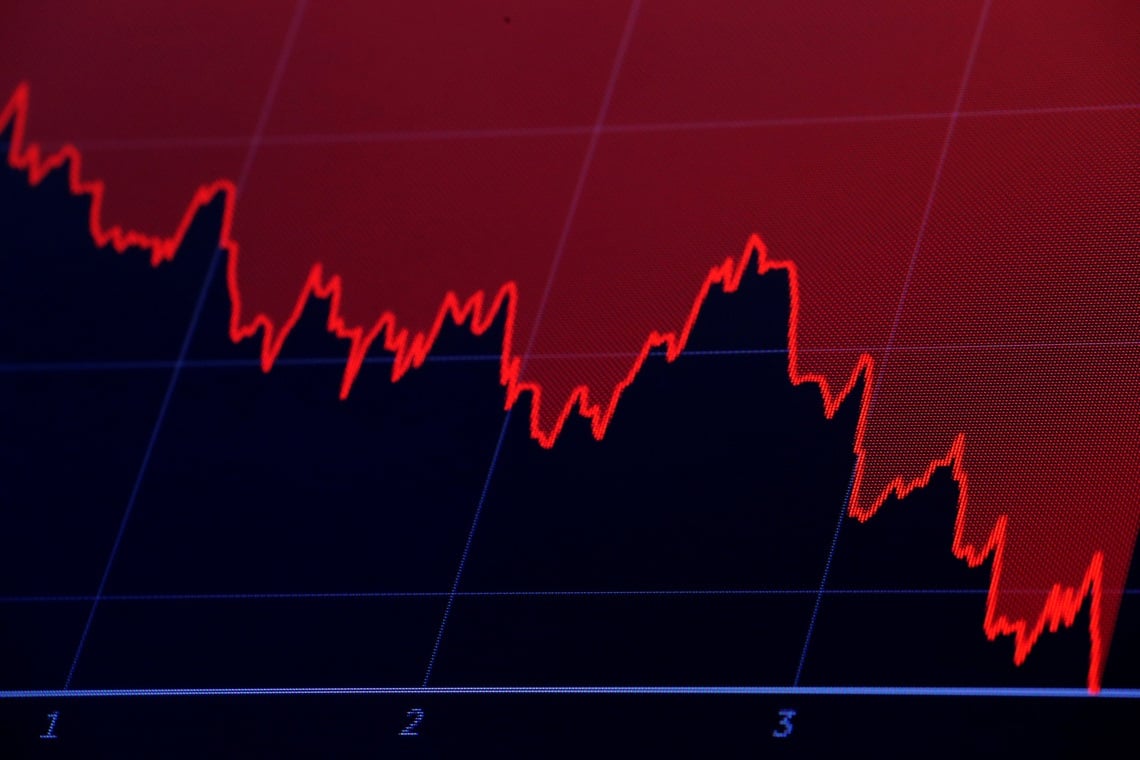

The Dow sold off mightily Friday, plummeting more than 600 points, as Trump indicated the U.S. would impose even more duties on Chinese imports. The administration was responding to China’s announcement early Friday that it would impose more tariffs on U.S. products.

The bloodletting was poised to continue Monday, and then voila, Trump says Chinese officials had rung him over the weekend.

Investment lesson

When it comes to the Dow, trade uncertainty is one of the most influential factors behind market volatility. Look no further than the Cboe Volatility Index , or VIX, the stock market’s ‘fear gauge.’ Last week it shot up 20%, largely because of investors’ jitters over this trade war.

Until a firm agreement is announced and acknowledged by both countries, buying and selling based on the intermittent comments can pave the way for long-term losses.