Dow Futures Gains Higher as Trump Tariffs Finally Choke China

Donald Trump's tariffs against China is hurting the Asian nation. | Source: AP Photo/Jacquelyn Martin)

Dow Jones Industrial Average (DJIA) futures ticked higher on Monday, pointing to a positive start on Wall Street. It comes after Chinese exports fell harder than expected in August in a sign that Trump’s tariffs are finally beginning to choke the country’s output.

As Chinese exports to the US fall, Trump gains an upper hand in the ongoing trade war negotiations. Traders anticipate the US president will use the weak numbers to leverage China into a trade deal.

Bloomberg’s Lisa Ambromowicz explained :

“Tariffs are hurting China more than economists predicted. This helps explain the nation’s latest round of stimulus – it may be combatting a deeper downturn in China than some realize.”

Dow futures climb 65 points on Monday

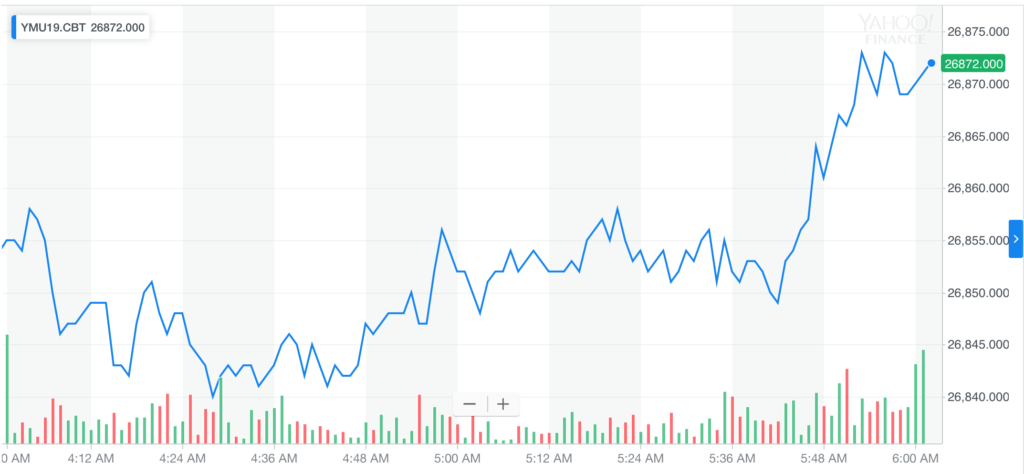

Dow Jones Industrial Average (DJIA) futures were cautiously higher at 6.14 am ET on Monday. The index futures contracts rose 63 points in early trading to 26,871.

S&P 500 futures followed the move higher, up 0.29%, while Nasdaq Composite futures were 0.28 percent higher.

China exports to US fall 16%

Chinese exports to the US fell 16% in August from the year previous. As the trade war ramps up, it seems the Trump administration’s tariffs have surpressed shipments.

The news buoyed Asian markets overnight as traders expect the People’s Bank of China to announce new economic stimulus. The optimism also spread to US stock market futures as the weakness in China gives Trump a strong hand in negotiations.

Declining recession fears sooth the Dow

Fears of a recession calmed over the weekend, as Federal Reserve chairman Jerome Powell said the central bank was not factoring in a significant downturn.

“[The Fed] is not forecasting or expecting a recession” – Jerome Powell.

Nobel prize-winning economist Robert Schiller also downplayed recession worries. Schiller is famous for predicting the dot-com collapse and the 2007 housing crisis. He pins the likelihood of a recession in 2020 at less than 50 percent, claiming he’s not seeing the same alarm bells he saw going into the dot-com recession .

“I’m not a gambler by instinct, but I felt more sure [in 2000] that something was wrong.”

He caveated the statement by saying that a recession will “eventually” come, and he wouldn’t be surprised if it happened in the next 18 months.