Bond King Gundlach Bearish on Stock Market, But Jim Cramer Stays Bullish

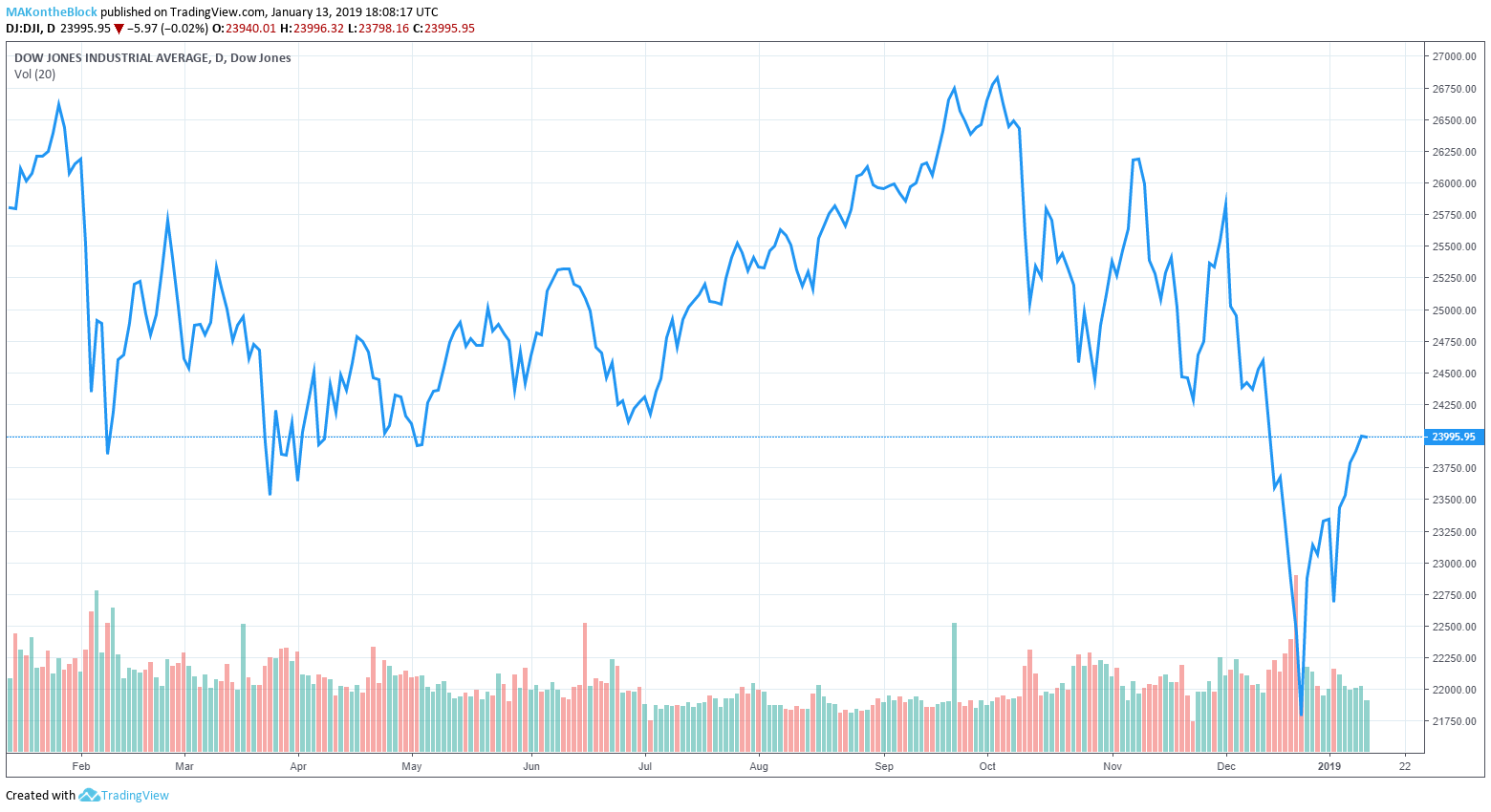

After calling a bear market in December, “bond king” Jeffrey Gundlach has criticized US debt levels. Despite last week’s stock market gains, he’s reiterated his bearish stance.

Jeffrey Gundlach, Jim Cramer Spar over Stock Market’s Future

The investor and former head of the $9.3 billion TCW Bond Fund has a reputation for being right. His current Total Return Bond Fund outperformed the competition to return 1.8% in 2018.

Speaking on Friday at a round-table of expert investors for Barron’s he called out reasons for current US debt highs and said he expects the markets to continue to fall, even though the Dow Jones, S&P 500, and Nasdaq, have seen the best start to a year since 2006.

In December 2018 after stocks struggled across the board, Gundlach said he was “pretty sure” stocks were entering a bear market. At the time, CNBC’s Jim Cramer said Gundlach should “stick to bonds.” Gundlach tweeted:

But Gundlach was right, the S&P subsequently fell 7%, and Cramer apologized.

Now he’s predicting a weak performance early in 2019, with recovery later in the year.

So now we are in a bear market, which isn’t defined by me as stocks being down 20 percent. A bear market is determined by the way stocks are acting.

Trump Claims Economy is Strong, But Gundlach Says Growth is Debt-Based

US debt is now over $21 trillion with a sustained annual government deficit of $1 trillion adding to this balance each year. Federal Reserve chairman Jerome Powell is also “very worried” about growing debt.

Gundlach believes the growth of corporate debt for investment, “junk” bond sales, and the exit from quantitative easing have created an “ocean of debt.” The US economy is “artificially” on “due to stimulus spending.” And:

We have floated incremental debt when we should be doing the opposite if the economy is so strong.

He’s now forecasting GDP growth for 2019 of 0.5%. Annualized GDP grew 3.4% in the third quarter of 2018, falling from forecasts of 3.5% and from the previous quarter at 4.2%.

Jim Cramer Says Stocks are in a Rolling Bull Market

Cramer still doesn’t agree, questioning on January 10 if stocks are now in a rolling bull market . Cramer said:

Are we now in a rolling bull market? Is that possible? Is that what’s propelling the market since the bottom.

Adding:

We’ve been able to bounce back from adversity, rally on days we should have gone down.

This in response to that day’s news of plunges in shares of giants like Macy’s and American Airlines. Cramer says pressure from the US Federal Reserve of further interest rate hikes has lifted:

That’s why, even with no real trade deal yet, with no real sense of how all of these weak corporate numbers will pan out, the bulls can run free even on a day that should have been destroyed by retail and airlines.

Cramer believes a rolling bear market has quickly moved to a rolling bull market.

Earlier last week, Gundlach predicted “easy 25 percent” gains for bitcoin, which he said could rise to $5,000.

Jim Cramer Image from Wikimedia Commons