Bitmain’s Mining Pools Now Control Nearly 51 Percent of the Bitcoin Hashrate

An array of ASIC Miners

Bitcoin mining pools controlled by China-based industry giant Bitmain now account for more than 40 percent of the total Bitcoin hashrate, raising new concerns about miner centralization.

Bitmain Hashrate Inches Toward 51 Percent

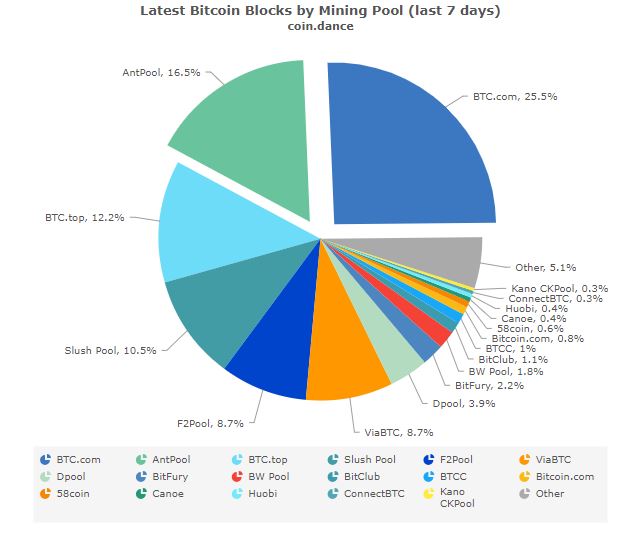

According to data from CoinDance , bitcoin mining pools BTC.com and Antpool have mined 25.5 percent and 16.5 percent, respectively, of all bitcoin blocks over the past seven days.

Both of these mining pools are owned by Bitmain — the world’s largest producer of application-specific integrated circuit (ASIC) miners — meaning that the firm now has influence over at least 42 percent of the Bitcoin hashrate. The two pools also control a combined 21.3 percent of the Bitcoin Cash hashrate, which operates on the same algorithm (SHA-256) as Bitcoin.

At this level, Bitmain is dangerously close to controlling 51 percent of the Bitcoin hashrate, a mark that would theoretically allow it to attempt a 51 percent attack against the network. Such attacks have recently been successfully deployed against a number of smaller altcoins, including Litecoin Cash, Bitcoin Gold, Verge, Litecoin Cash, and Monacoin.

There is far less financial incentive to attack Bitcoin, but some in the community nevertheless worry that — given CEO Jihan Wu’s support for bitcoin cash and controversial scaling proposal SegWit2x — Bitmain might launch a malicious attack against the network anyway. That’s a very unlikely scenario, but critics argue that the fact that it is a discussion at all means that bitcoin mining is too centralized.

It’s not clear what percentage of the hashrate belongs to devices physically-operated by Bitmain, but that point is somewhat moot since pool operators control the block templates for the entire pool. This means that, as long as those devices are pointed at Antpool or BTC.com, Bitmain can decide what transactions the pool will process (and which, if any, it won’t).

We’ve been here before. In 2014, now-defunct mining pool Ghash briefly crossed the 51 percent threshold but in response to community concern encouraged users to move some of their hashpower to other pools. However, it does not appear that Bitmain intends to take a similar tack.

In fact, Antpool recently began a zero-fee promotion that will continue through mid-September in a bid to attract even more miners to its platform. While the pool supports a variety of cryptocurrency mining algorithms, the promotion explicitly lists bitcoin as one of the coins that will be exempt from fees.

Bitmain did not immediately respond to a request for comment.

‘BetterHash’ Aims to Decentralize Bitcoin Mining

Nevertheless, a solution to the threat of miner centralization may be on the horizon.

As CCN.com reported, concerns over hashrate centralization inspired Bitcoin Core developer Matt Corallo to develop “BetterHash,” a draft proposal designed to decentralize bitcoin mining.

In short, he advocates replacing Stratum, the current bitcoin mining protocol, with two new protocols. This will allow individual miners to construct their own block templates (or select one from a third party) rather than being forced to use the one chosen by the operator of the mining pool at which they direct their hashrate.

In addition to providing miners with more autonomy, the implementation of these new protocols should reduce the ability of a malicious mining pool operator to use their position to attack the network.

Featured Image from Shutterstock